Professional Finance Skills Development Course

Finance Courses 2025 and Career-Ready Learning: How Finance Related Training Topics Are Powering the Next Generation of Global Finance Professionals

Introduction to Professional Finance Skills Development Course

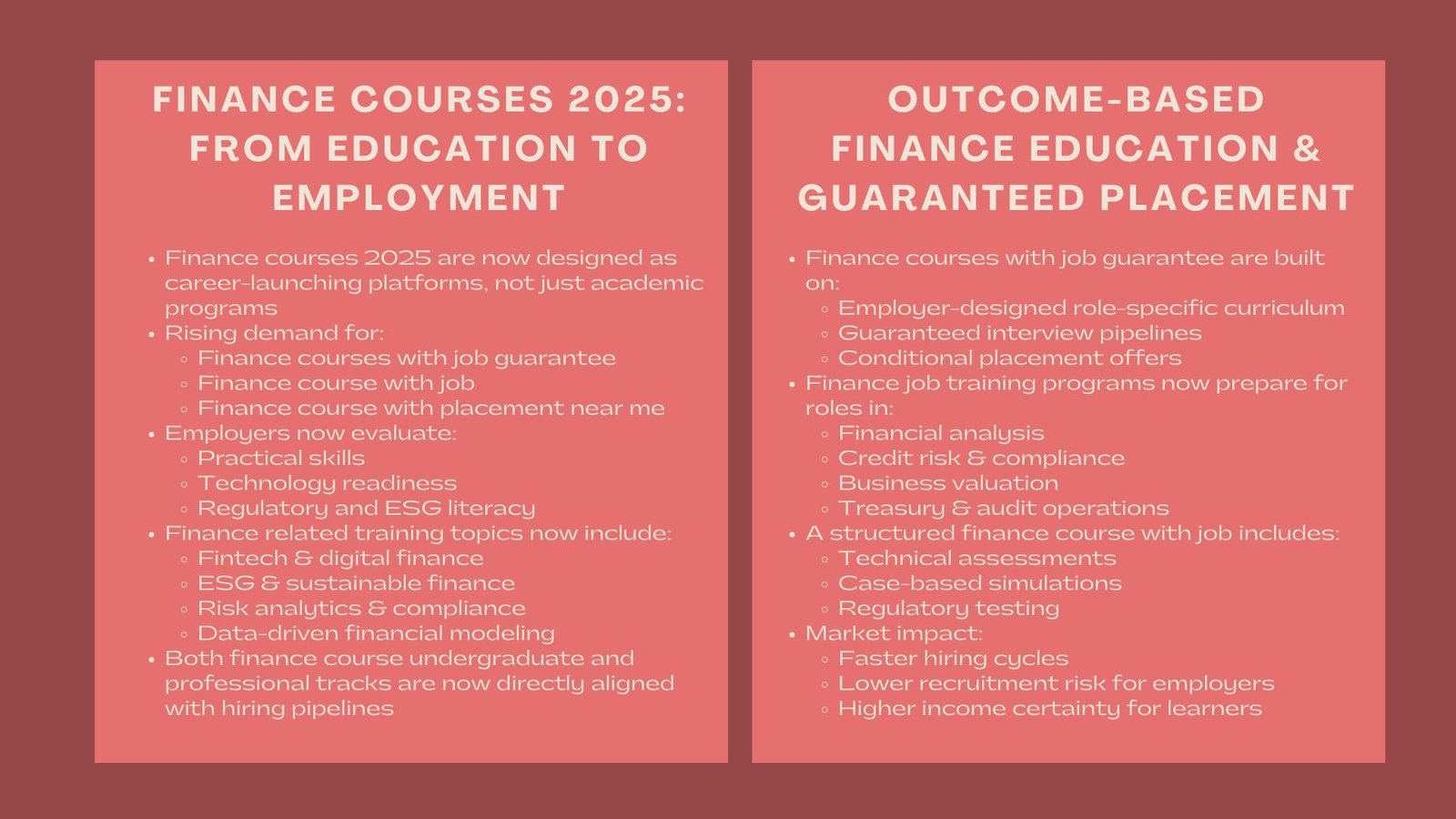

With the increase in financial markets becoming data-oriented, regulated and technologically advanced, the need to have talented people in the field of finance is growing at an unprecedented rate. Finance courses 2025 no longer merely represent the academic degree that opens highly educated access to a career; it is an employment-oriented platform structured around job outcomes. Modern learners seek finance courses with job guarantee, finance courses with jobs, and even localized demand for finance courses with placement near me as education becomes inseparable from employment.

At the same time, institutions offering finance job training programs and finance courses great learning ecosystems are reshaping how professionals build credibility and enter competitive finance careers. Whether learners pursue a finance course undergraduate pathway or transition through industry reskilling, finance education is now directly structured around employability, specialization, and measurable career outcomes.

1. The Strategic Importance of Finance Related Training Topics in 2025

1.1 Why Finance Training Is Now a Core Economic Infrastructure

Finance, in a capital intensified global economy can no longer be seen to be a support entry but as a business engine of sustainability. Finance related training topics now extend far beyond accounting fundamentals to include financial technology, ESG investing, forensic finance, international taxation, quantitative risk management, and valuing digital assets. The areas of knowledge are crucial because the enterprises are exposed to the increased regulatory intensity, digitalization, and international capital flows.

Consequently, the finance courses 2025 are purposefully adjusted to the changing structure of the present-day financial systems. Governments, multinational companies, banks and technology companies are more and more relying on employees who have been trained in integrated finance disciplines as opposed to the narrow bookkeeping skills. This is fundamentally redesigning the structure of the finance course undergraduate programs and postgraduate professional qualifications.

1.2 Why Learners Demand Direct Career Outcomes

Students do not gauge learning in terms of the certificates. They gauge it in terms of employability. This is why there is such an explosive demand of finance course with job guarantee, finance course with job and structured finance job training programs coupled with real world hiring pipelines. The students have come to measure the value of investing in education using the factors of placement rates, employer relationships and speed of getting into paying jobs.

2. Finance Courses 2025: How the Curriculum Has Transformed

2.1 The Technical Shift in Modern Finance Courses

The common finance course 2025 is very much technological based. Artificial intelligence-assisted forecasting is introduced into financial modeling. Risk analytics are machine learning-based and part of the portfolio management. Along with digital treasury management systems, corporate finance is taught. This change makes graduates of either undergraduate and executive levels in the finance courses to be relevant in the automated financial systems.

Some of the training topics previously covered in modern finance have been modified to include data proficiency, API-based financial systems, cybersecurity in banking operations, and digital compliance infrastructure. These technical layers support the reason why the old theory of finance is no longer sufficient.

2.2 Alignment with Global Hiring Needs

The multinational employers are increasingly seeking finance professionals that are knowledgeable in cross-border capital regulation, international tax standards, and ESG compliance framework. Consequently, finance courses and great learning platforms have become more globalized in coursework and simulations of the markets live and in case studies that are co-designed by industries have become part of the coursework to reflect the international hiring standards.

3. Finance Courses With Job Guarantee and the Rise of Outcome-Based Education

3.1 How Job Guarantees Are Structuring Modern Finance Education

Another significant change in the education-to-employment contract is the emergence of finance courses with job guarantee. In this paradigm, the training facilities collaborate with employers to develop role-oriented curricula. The financial analysis, credit risk, investment operations, compliance reporting or treasury functions are trained with guaranteed interview pipelines or conditional placement offers.

This model reduces uncertainty in the employment aspect of the students and promotes performance responsibility in the finance job training programs. The schools that provide a course in finance with a job are getting more and more revealing with the help of the placement rates, salary rates, and even the employers.

3.2 Market Impact of Guaranteed Placement Finance Education

Regarding the labor market, understaffed fields including risk analytics, AML compliance, business valuation, and financial data operations stabilize entry-level supply with finance courses with job guarantee. The employers enjoy ready trained talent whereas the learners enjoy formatted professional insertion.

4. Finance Course With Placement Near Me: Localization of Global Finance Training

4.1 Why Localized Placement Has Become Essential

Finance course with placement near me and indicates great preference to regional employability. Although finance is global in its application, employment is frequently locally controlled and license based. Students are increasingly demanding programs that will make them connected to local banks, audit companies, fintech startups, and investment companies.

The current training programs of modern finance have integrated regional standards of taxation, local financial regulations, banking regulations and domestic capital market structures. Such localization strengthens the instant employability and preserves the global career mobility.

4.2 Regional Employer Integration Models

The current institutions that provide a course in finance with placement near to my location have already been functioning on a regional basis through employer clusters where the students are exposed to client simulations, internship pipelines and live projects directly connected to the employment demand. Such an organized incorporation reduces the education-income transition time.

5. Finance Courses Great Learning Platforms and Digital Transformation

5.1 The Role of EdTech in Finance Upskilling

Finance courses great learning platforms have become the core infrastructure of contemporary professional finance training. These platforms have integrated instructional recordings and interactive laboratories, peer to peer modeling activities, mentorship connections, and employer evaluation role plays. Thousands of learners can be exposed to finance courses 2025 according to the changing standards in the industry through their scalability.

These platforms are dynamically updated with content changes unlike in traditional classrooms depending on the changes in regulations over time, cycle of interest rates and market volatility trend. This makes the finance professionals dynamic instead of being passive.

6. Finance Course Undergraduate Programs in a Career-First Economy

6.1 Evolution of Undergraduate Finance Education

The undergraduate program of the modern finance course has become a hybrid model of academic/professional one. Python-based modeling courses, real-time stock analytics laboratories, ESG valuation modeling courses, and studies of fintech legal compliance are all now standard undergraduate courses.

Such change assures correspondence between the areas of training that are in the domain of finance and the actual demand of hiring, as opposed to the conceptual success.

6.2 Employer Integration at the Undergraduate Level

Top employers currently liaise with universities that have undergraduate programs in finance courses. They consist of internship placement, the early career fast-track program, project-based evaluation pipelines that transform academic performance into a direct hiring outcomes.

7. Finance Job Training Programs as a Professional Re-Skilling Engine

7.1 Mid-Career Finance Transitions

Accountant and engineer, information technology and business operations professionals are turning to more and more finance job training programs to make the transition to finance careers. Such programs cram the basis theory of finance into faster modules with the addition of technical ability training in model building, automation of reporting, and analysis of regulatory compliance.

This mobility in the middle of career reinforces flexibility in the labor market and minimizes the risk of long-term unemployment in the restructuring processes of the economy.

7.2 Corporate-Sponsored Finance Training Pipelines

Numerous multinational companies have presently sponsored finance job training courses to internal talent redeployment in finance action, transaction consultant, and data-driven finance approach functions. This mobility model in the internal setting lowers the external recruitment expenses and maintains the institutional knowledge.

8. Finance Course With Job: From Certification to Income Generation

8.1 Structuring Guaranteed Employment Finance Learning

A job course in finance is no longer a marketing statement but a formal employer-supported career. These programs set specific skill objectives that are set against job descriptions e.g. financial analyst, credit risk officer, audit associate, valuation analyst or treasury controller.

Students who take a course in finance and work experience the evaluation measures that are employer-aligned such as the modeling tests, regulatory tests, and simulation of investment-related cases.

8.2 Income Outcomes and Career Stability

Graduates of approved finance courses with jobs can access employment into income generating positions faster hence less uncertainty after graduation. This consistency is especially important in unstable macro economic conditions where the hiring windows open and close at high speed.

9. The Future Outlook of Finance Courses 2025 and Beyond

9.1 Integration of AI and Predictive Finance Education

By the turn of the next decade, the models of finance courses 2025 will incorporate more and more AI risk prediction, automated valuation engines, and algorithmic portfolio construction as a teaching tool. Such tools will revolutionize the structure of finance related training subjects at any stages of the career.

9.2 Global Talent Competition Through Digital Finance Learning

With the internationalization of finance courses great learning platforms, competition among global financial talents will be heightened. The geographical separation will be reduced and the focus will be on the proven competence and not the institutional pedigree.

Conclusion

Financial education has been globalized and the career-oriented, employer-focused and technologically infused finance courses 2025 have become the first choice in education direction. From the initial undergraduate courses in finance through ordinary finance courses to high speed finance employment training courses, modern finance education can no longer be seen without employment results. The high demand for finance courses with job guarantees, finance courses with jobs and finance courses with placement near me indicates that the workforce places a top priority on economic security and professional development.

Simultaneously, platforms with a finance course that provide very good learning experiences are reinventing the process of developing financial expertise: data, simulation, mentorship and predictive market modeling. With the field of training on aspects of finance in AI, ESG, fintech, and global compliance continuing to grow, the most solid jobs in the future of global finance employment will be those who strategically invest in the structured education of finance.