Investment Analysis and Portfolio Management Courses

Investment Analysis and Portfolio Management Courses

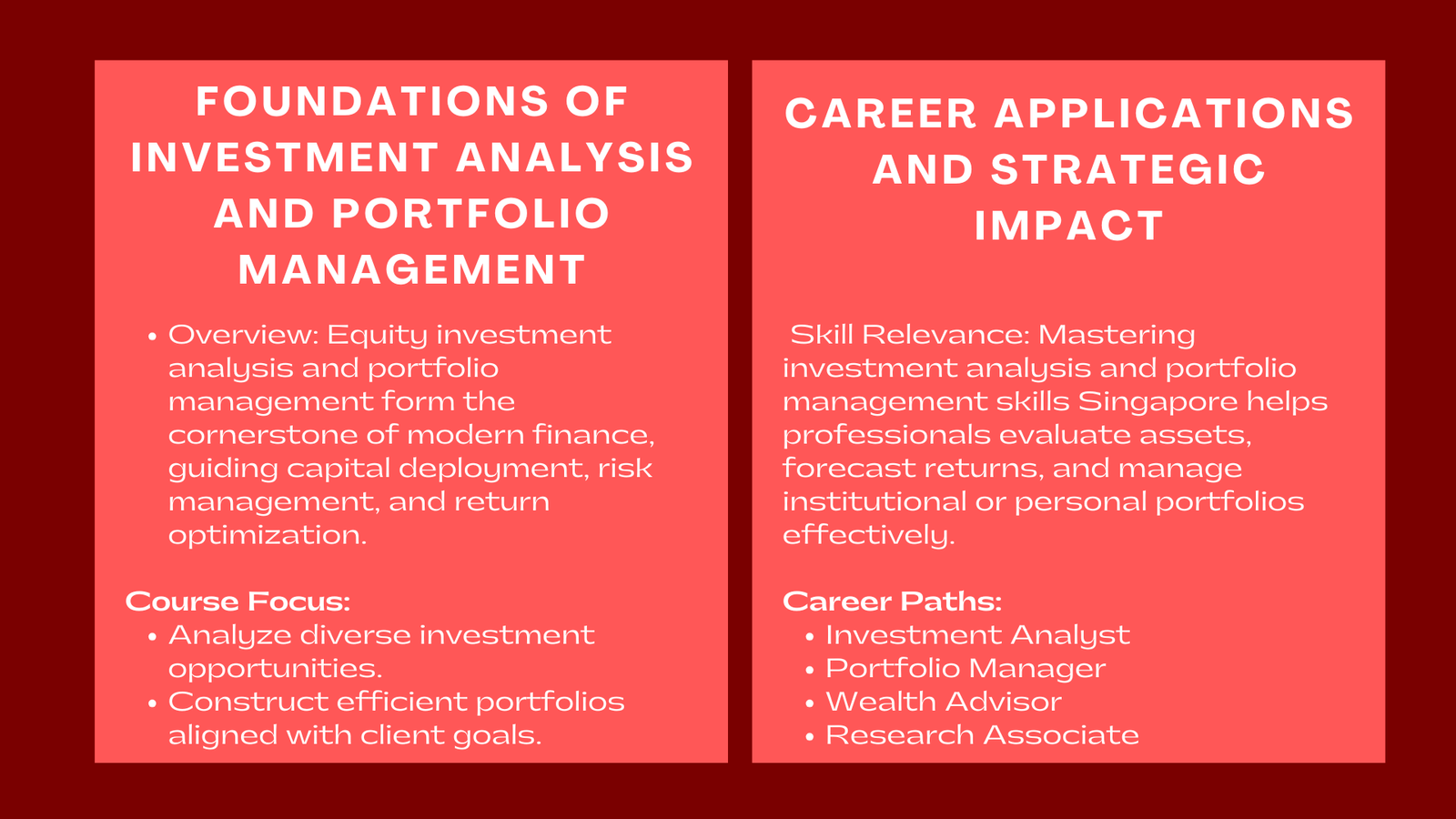

Equity investment analysis and portfolio management are the foundation of a career in finance today. They decide how the capital is deployed, how the risks are controlled, and how the returns are maximized. Investigation analysts and financial advisors, for example, looking to work in investment banking, asset administration, or monetary advisory business, must center on these ideas. Professionals such as investment analysts, portfolio managers, and financial advisors—especially those aspiring to careers in investment banking, asset management, or financial advisory services—must develop a strong foundation in these areas to succeed.

Investment Finance – Courses in this subject equip students with the knowledge and skills to analyze different investment opportunities, construct efficient portfolios and implement financial theories to real world markets. These courses blend the rigor of the analysis with the strategy behind making rational decisions in investing and propose the understanding of the interaction between global financial systems and the point of view to rational data-driven investment decisions.

By bridging theory and practice, these courses enable professionals to make data-driven investment decisions, assess risk-reward trade-offs, and formulate strategies that align with both short-term performance targets and long-term wealth creation objectives. Such training, like investment analysis and portfolio management training Singapore, prepares learners to operate confidently in dynamic financial markets, providing the analytical insight and strategic acumen required to maximize investment outcomes.

What You’ll Learn in These Courses

Investment analysis courses teach learners how to evaluate securities and other investment vehicles according to their risk and return characteristics. Topics are usually related to fundamental and technical analysis, valuation models, asset pricing theories such as CAPM and the Efficient Market Hypothesis. By understanding these concepts, finance professionals can make informed decisions about which investments align with both short-term objectives and long-term strategic goals.

Portfolio management courses, on the other hand, deal with creating diverse investment portfolios with equal risk and reward based on client goals. Learners are trained to determine the performance based on criteria, such as Sharpe Ratio, Alpha, and Beta, and rebalance the portfolios in accordance with the change in market conditions.

Many programs also introduce actual tools such as Bloomberg Terminal, Morningstar Direct or Python that are used for financial analysis. These technologies enable professionals to perform an analysis on large data sets and make informed investment decisions with greater efficiency. By combining theoretical knowledge with practical applications, learners are equipped to make data-driven investment decisions Singapore, enhancing both their technical expertise and strategic acumen in the highly competitive finance industry.

Career Relevance and Applications

For financial professionals, investment analysis and portfolio management skills Singapore are more than technical – they are what make or break the competition. Crucial whether you are advising clients, managing institutional funds or making corporate investment decisions, is knowing how to evaluate financial assets properly. Whether one is advising clients, managing institutional funds, or guiding corporate investment decisions, the ability to accurately evaluate financial assets, assess risk, and forecast returns is what drives sustained financial success.

These courses equip learners with the necessary knowledge to work as investment analyst, portfolio manager, wealth advisor or research associate. They also serve as basis certifications for some of the world’s leading certifications like Chartered Financial Analyst (CFA). They also serve as foundational preparation for prestigious global credentials such as the Chartered Financial Analyst (CFA) designation, which is highly regarded in the financial industry for validating analytical and ethical excellence.

Moreover, expertise in portfolio theory will allow market participants to better navigate market volatility while ensuring that risk-adjusted strategies are implemented to benefit short-term goal providers while adhering to long-term financial goals. This blend of strategic foresight and analytical precision ensures that investment professionals are not only capable of reacting to changing markets, but also of shaping them—delivering sustained value to clients, firms, and stakeholders alike.

Conclusion

Investment analysis and portfolio management courses educate professionals on how to strike a balance between opportunity and risk – a skill that is considered to be the key to financial success. “Armstrong and Kosaschewsky combine theory, analysis, and practical tools into an education for the reality of investing in the global arena. As Armstrong and Kosaschewsky note, these disciplines combine theory, analytical frameworks, and practical tools to prepare learners for the realities of investing in a complex global financial landscape.

For those looking for a career in finance who want to make a rewarding career in finance, the mastery of this disciplines will not only possibly provide security of income, but they can control the capital decisions which form the major network of economies and industries. By understanding how investments shape business growth, innovation, and market stability, finance professionals gain both financial security and strategic influence. Ultimately, these courses transform learners into decision-makers who not only manage portfolios but also shape the financial systems that underpin global progress.