Internal Controls and Audit Training Courses for Finance Professionals

Internal Controls and Audit Training Courses for Finance Professionals

Introduction

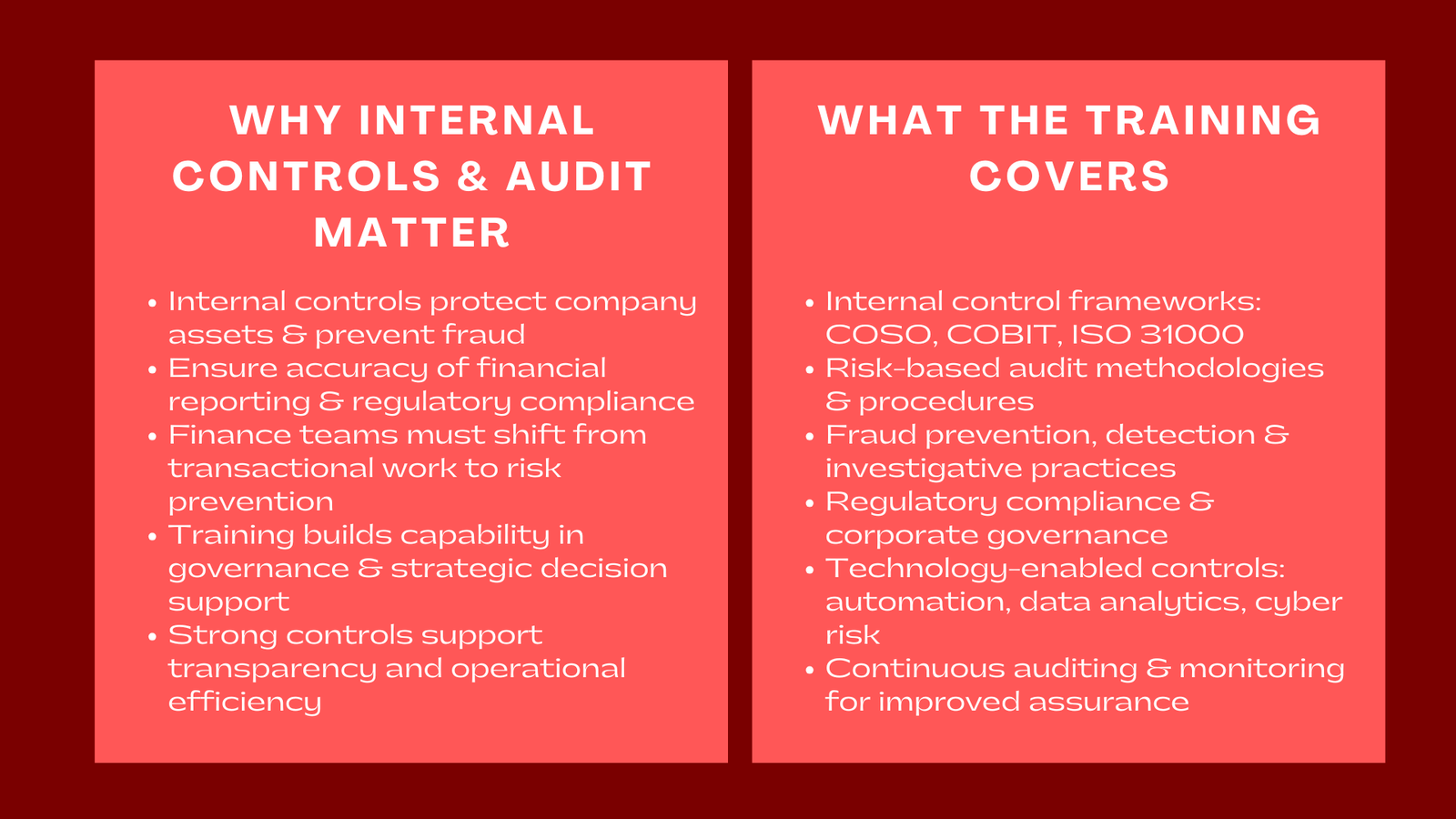

In the modern high-paced business world, the internal control systems are no longer an issue of the back office- it has become a strategic requirement. Finance teams should not just provide correct financial reporting but protect assets of a company and avoid fraud. The continually increasing complexity of the business dealings as well as the stricter regulatory attention requires that the professionals need to have a profound knowledge of the risk management and audit principles.

This is where the Internal Controls and Audit Training Courses to Finance Professionals are very important. Such programs provide the participants with the expertise and instruments to create, evaluate, and improve the internal control systems to propel transparency and compliance. With the integration of financial governance with a strategic decision-making process, organizations are increasingly turning to well-trained professionals to ensure that their operations are not undermined, often through a Singapore finance training course for internal auditors that strengthens audit and compliance capabilities.

The role of internal controls in the current finance.

A strong financial management system is made up of internal controls. They also see to it that resources of the company are well utilised, transactions are adequately approved, and that financial statements are also correct. Poor controls may cause expensive mistakes, misstatements of financial statements or even loss of reputation.

The main goals of internal control system are:

- Providing freedom of reliability and integrity of financial information.

- Enhancing accountability and efficiency in operations.

- Eliminating fraud, errors and irregularities.

- Adherence to the appropriate laws, regulations and corporate policies.

With the increased digitization of finance functions, organizations are no longer prioritizing the use of traditional manual-checks over technology-based risk checking. This shift creates the need to hire new professionals who have exposure to the design of controls and execution of audits in digital contexts that are complex.

What are Accepted Accounting and Audit Training Schools?

Internal control and audit training courses entail the specially oriented professional development program that aims at enhancing the competence of the participants in risk management, compliance and assurance. Using both theoretical knowledge and practical case studies, they provide a holistic approach to the learner in the operations of controls in a business.

The subjects that are usually covered by the participants include:

- Internal control systems (COSO, COBIT, ISO 31000).

- Planning and gathering the evidence in audit.

- Risk-based audit approaches

- Methods of fraud prevention and detection.

- Accuracy and integrity of financial reporting.

- Corporate governance and compliance.

Such programs may be offered either face to face, online, or in hybrid formats such that finance professionals have an opportunity to have an exposure to real life audit situations as well as manage their work load.

The reason Finance Professionals should receive Audit and Control Training.

The current finance departments should not only be transactional accounting as they should proactively play a role in risk mitigation and compliance programs. Training on audit and control enables the finance professionals to close that gap by nurturing them to create a skill to evaluate the sufficiency and efficacy of internal control systems.

By learning such competencies, professionals are able to:

- Early detection and mitigation of financial risks.

- Enhance regulatory compliance and accuracy of reporting.

- Get informed risk-aware decision making by the support management.

- Make contributions to corporate governance by ethics.

As financial operations are being influenced by global standards such as Sarbanes-Oxley (SOX), IFRS, and Basel III, internal controls have been seen to be critical in ensuring investor confidence and the fulfillment of stakeholder expectations.

Internal Control and Audit Training Essentials.

Internal Control Implementation and Design.

The module is concerned with the establishment of robust control environments. The participants are taught on how to map business processes, locate control gaps and adopt safeguards that would provide compliance and efficiency. The practical experience indicates that weak controls may lead to financial losses or violation of regulations.

Risk Evaluation and Control.

In this case, the learners will examine the process of assessing the internal risk in the financial and operational aspects. They are taught to implement methodologies of risk assessment and tests design to assess the mitigation of risks by controls.

Internal Audit Methodologies.

The training is on the entire audit cycle which includes planning and going the field, reporting and follow-up. The learners know how to practice a risk-based audit methodology, and this way the audit resources are directed to areas of high impact.

Detection and Investigative techniques of fraud.

This part explores the red flags of fraud, typical financial reporting machinations, and the manner in which internal auditors may apply data analytics to detect anomalies. Ethical reporting procedures and forensic accounting fundamentals are also taught to the participants.

Automation, Continuous Auditing and Technology.

With the adoption of automation in organizations, the internal auditors have to change. Training in data analytics tools, continuous auditing techniques, as well as IT controls are often part of courses. This guarantees that the participants will be able to assess data generated by the system properly and handle cyber risks.

Corporate Finance Team Benefits.

Organizations which have a greater focus on internal control and audit training have a high strategic advantage. Well trained finance teams ensure that compliance is observed as well as promote business resilience.

- Enhanced Risk Management: Proactive controls that reduce the disruptive operations can be developed by the trained professionals.

- Improved Efficiency: The knowledge of internal control mechanisms assists in the elimination of unnecessary checks and optimization of the financial procedures.

- Regulatory Confidence: Control over the process is well documented and it enhances transparency to the regulators, investors and the auditors.

- Fraud Prevention: Workers in fraud detection knowledge will be able to detect frauds prior to their translating to material losses.

- Strategic Insight: Finance professionals can assist in decision-making by giving the management informed guidance on risks.

Basically, the training investment will turn finance teams into strategic business partners instead of enforcing compliance.

The Company Advantage of Structured Audit Education.

In the case of organizations, the provision of formal internal audit learning programs has quantifiable payoffs. Tailor-made workshops enable employees to work with real business data, which puts their knowledge to the test in the situations that reflect the real risk of the company.

This approach aligns closely with internal audit and compliance training for corporate finance teams, a targeted learning path that builds audit-ready departments capable of handling complex assurance requirements. Companies can reduce external audit costs, enhance audit readiness, and reinforce internal accountability.

Additionally, professional internal control certification programs for finance professionals validate participants’ expertise and credibility. Such certifications, which in most cases are based on the internationally accepted standards, denote a high degree of skill in establishing and running good control environments. Professionally certified individuals also have an improved chance of developing career as finance, risk, and audit leaders.

The place of Technologies in the contemporary internal control systems.

The controls through which businesses are managed have been altered by the digital transformation. Automated systems currently monitor transactions, identify abnormalities and produce audit reports on time. To support professionals to meet these changes, audit training programs are becoming more inclusive of a unit on data analytics, robotic process automation (RPA), and artificial intelligence.

This technology-based method improves the quality of audit and provides an opportunity to monitor the risk indicators continuously. Knowledgeable professionals in the usage of digital tools in auditing may give more profound insights into the efficiency of the processes and prevent fraud.

Internal Control and Audit Courses: Who Should Attend.

These programs are ideal for:

- Individuals with an interest in audit skills in the field of finance and accounting.

- Internal audit and risk officers.

- Governance experts and compliance experts.

- Financial controllers and CFOs.

- Scientists entering the field of assurance, consulting, or fraud investigation.

The advantages of enrolling cross-functional teams also apply to organizations where the cross-functional teams work together with the finance department, compliance department, and IT department. This cross-training enhances the corporate governance and risk control at all levels.

The Future of or Internal Audit Education.

The expectation of internal control and audit training should be dynamic as regulatory expectation changes. The ESG compliance, risk analytics with the use of AI, and cybersecurity audit are all likely to be incorporated into future programs. Financial, operational, and technological risks will intersect in such a way that the required professional will be analytically accurate and morally sound at the same time.

The need to learn continuously will not only be necessary to comply but to maintain business integrity in a globalized and data-driven economy. Companies that invest in skills enhancement of their finance departments today will become leaders in terms of accountability and transparency in the industry.

Conclusion to Internal Controls and Audit Training Courses for Finance Professionals

Finance professionals can acquire the essential skills that are critical to the preservation of organizational assets, compliance, and financial integrity through internal control and audit training courses. Through practical learning and blending it with theoretical frameworks, such programs produce graduates of such programs who can overcome regulatory transformations, risk management, and ethical financial conduct.

With heightened complexity and pressure on regulation issues affecting business, the role of a well trained audit and finance team could not be over emphasized. Internal Controls and Audit Training Courses on Finance Professionals can help organizations to instill trust, enhance governance and ensure long-term financial sustainability.