Simple Integrating Financial Intuition for better Business Leadership Decisions

Simple Integrating Financial Intuition for better Business Leadership Decisions

Introduction: Balancing Data with Intuition in Leadership

The rapidly developed business world of today, in many ways, is full of data and analytics. Nevertheless, the most successful leaders are also able to merge hard numbers and financial intuition, or the sense of underlying risks and opportunities as well as future implications that can not be directly observed on spreadsheets.Financial Modeling in business leadership does not mean making some guesses, but it actually means that we base our financial models with respect to experience, contextual sensitivity, and strategic wisdom.

The balanced approach of inclusion of financial intuition in the decisions of the leaders brings in a balancing weight between quantitative precision and quality judgment, leading to more resistant and futuristic approaches.

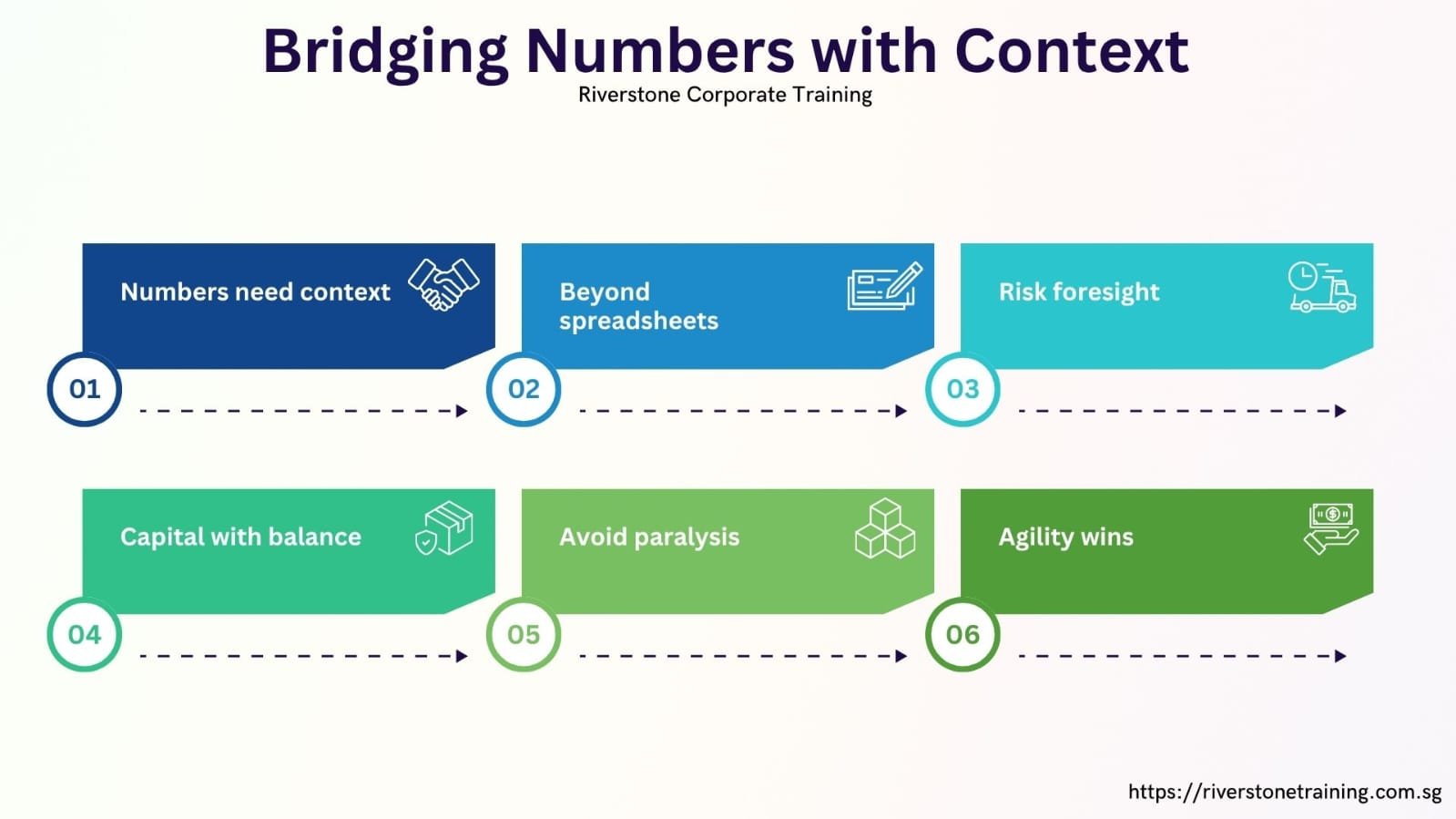

Bridging Numbers with Context Financial Intuition for better business leadership decisions

The financial reports are an excellent summary of business performance in structured form but a backward looking view. They narrate what has happened, but not necessarily what is going to transpire. As a matter of fact, markets can be volatile, consumers change, demand is transformed by the newer cultural tendencies, and technologies bring some disruption to a whole sector well before the financial statements provide an indication of such shifts.

Strongly financially intuitive leaders are wise readers who understand how to read between the lines. They analyze numbers in terms of bigger market indicators, or even competition and social development. This approach guarantees that financial decision-making is not only reactionary to previous outcomes but also proactive whereby the company is set to be before its time.

Enhancing Risk Awareness

Most conventional financial models presuppose the constant conditions, yet the business reality can hardly be said to be constant. New competitive entrants may also disrupt the market rapidly and supply chains may collapse in the face of global shocks and regulatory tightening. These emerging threats may not necessarily be instilled by pure data analysis on time.

Financial intuition helps leaders become better aware of risks that cannot be identified by numbers. They are able to pre-determine weaknesses, stress-test contingency plans, and develop more robust contingency plans by combining both data and foresight. This increase of awareness on risk is critical to organizational resiliency where business can survive and prosper even during turbulent times.

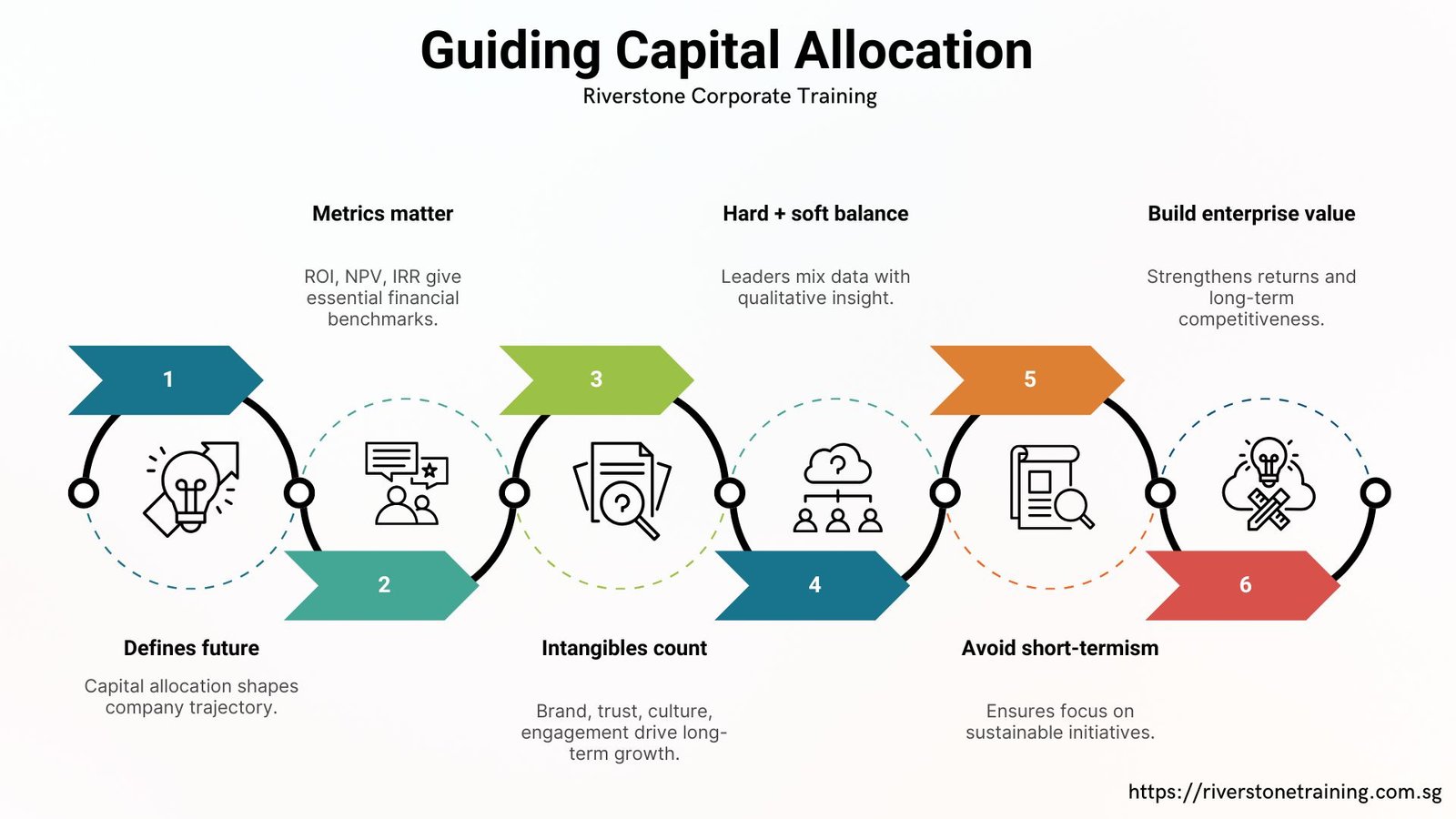

Guiding Capital Allocation

The important decisions formerly make the future of a company. Although such parameters as ROI, NPV and IRR are important, they merely mean a portion of the aspects of the value equation. Intangible data such as brand recognition, customer loyalty, organizational ethos or even employee action tend to yield a startling influence on growth in the medium term, yet is more challenging to comprehend.

Financial intuitive leaders comprehend that these soft assets will transform into decisive competitive advantages. They can make more balanced best investment opportunities Singapore by incorporating both hard information as well as qualitative features. This process will prevent the problem of short-termism where capital of the business is used in undertaking projects, which will principally enhance the business financial performance as well as the enterprise value.

Strengthening Strategic Agility

Markets that are swift in transformation will leave the slow moving companies behind. The excessive and unnecessary dependence on sophisticated data models may produce an analysis paralysis where decisions cannot be made until the search for ideal information. Leaders who are analytical and intuitive make comparatively assured action when some degree of uncertainty prevails. This is a capacity to fast track the decision-making financial intuition process and enhance strategic nimbleness. These kinds of leaders factories identify inflexion points sooner, redirect resources faster and exploit potentialities as their competitors continue to deliberate. Organizations remain flexible, robust, and agile in fast changing business environments by combining business precision and instinct boys intuition.

Conclusion: From Decision-Makers to Visionary Leaders

When excellence of financial intuition is integrated into leadership decisions, it is not a question of substituting the data but rather adding it with experience, foresight, and context to the information. Analytical rigor and intuitive judgment can help leaders more effectively navigate uncertainty and make more savvy resource uses; they can also formulate resilient and forward-looking strategies. The balance enables judgements that are not only based on numbers, but also they are in line with the market realities and long-term vision.