FinTech and Digital Finance Courses for Modern Finance Professionals

FinTech and Digital Finance Courses for Modern Finance Professionals

Introduction to FinTech and Digital Finance Courses for Modern Finance Professionals

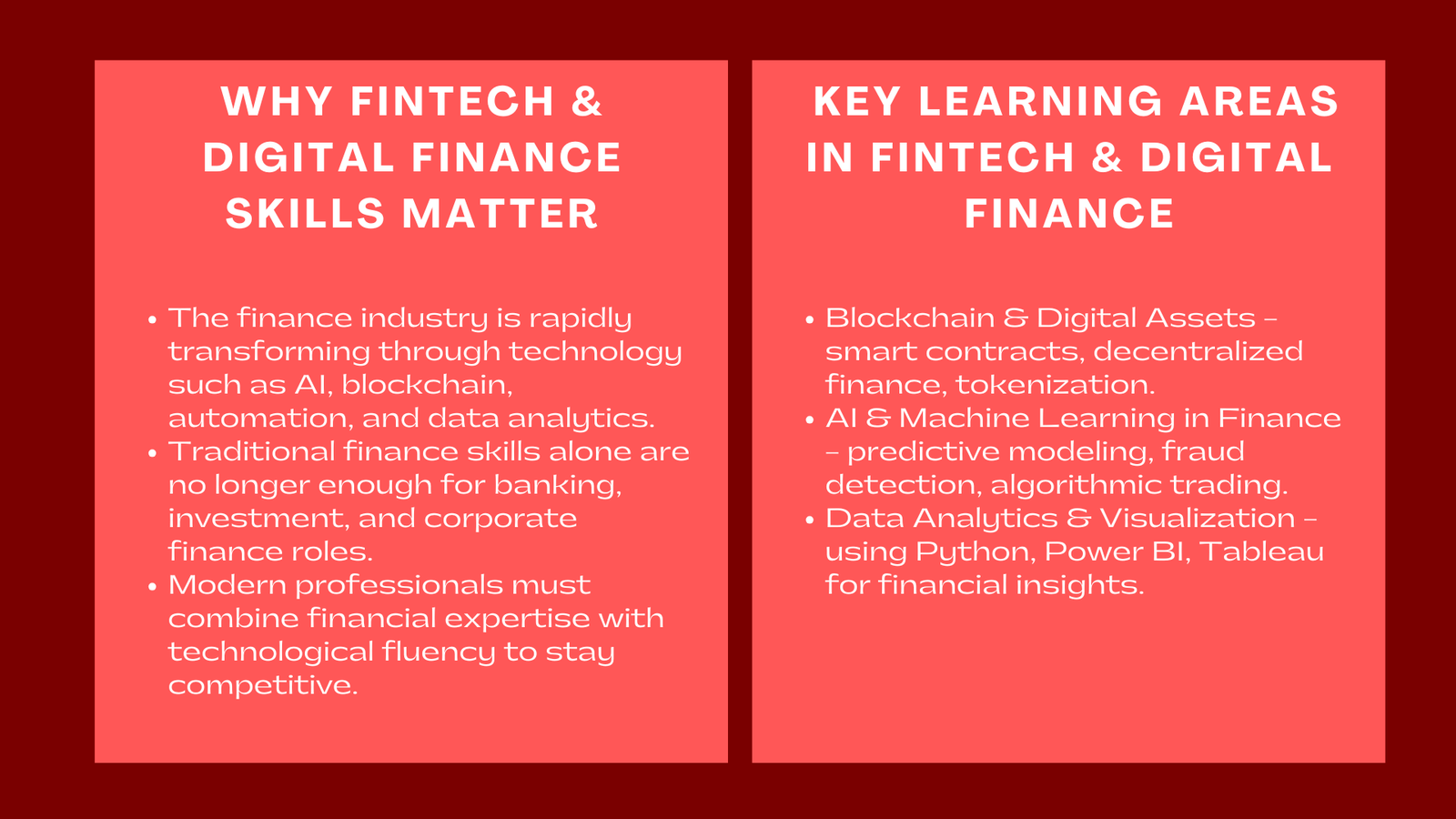

The financial industry is undergoing a profound transformation driven by technology. FinTech and digital finance courses for professionals Singapore — short for financial technology — has redefined how businesses manage payments, investments, lending, and financial analysis. As artificial intelligence, blockchain, data analytics, and automation continue to reshape financial operations, professionals in banking, investment, and corporate finance are under growing pressure to adapt. The traditional finance skill set, while still essential, is no longer sufficient to remain competitive in this rapidly evolving digital landscape.

Modern finance professionals must now combine financial acumen with technological fluency. Understanding FinTech innovation, digital finance tools, and data-driven decision-making is becoming a prerequisite for leadership roles. Enrolling in specialized FinTech and digital finance courses allows professionals to bridge the gap between conventional financial theory and cutting-edge technology — transforming them into hybrid experts capable of driving financial innovation and strategic growth.

This article explores the landscape of FinTech and digital finance education, examining how courses in areas such as blockchain, AI, data analytics, and digital banking empower professionals to thrive in the future of finance.

The Rise of FinTech and Digital Transformation in Finance

Technology as the New Financial Infrastructure

The emergence of FinTech training for finance career advancement represents one of the most disruptive shifts in the history of financial services. Technology has become the new financial infrastructure, underpinning payment systems, investment platforms, credit assessment models, and even compliance frameworks. Digitalization has not merely enhanced efficiency — it has fundamentally altered how value is created and delivered.

From mobile banking and peer-to-peer lending to robo-advisory and decentralized finance (DeFi), technology now drives financial inclusion, transparency, and scalability. For professionals, understanding how these systems operate is crucial to navigating the modern financial ecosystem. Traditional finance knowledge must now coexist with technical understanding of APIs, machine learning algorithms, and distributed ledger systems.

This digital convergence has expanded the definition of finance itself — integrating data science, cybersecurity, and behavioral analytics into the professional toolkit.

The New Skill Set for Financial Professionals

Finance professionals today must operate at the intersection of technology and strategy. While financial modeling, valuation, and accounting remain core competencies, the ability to interpret data, automate workflows, and evaluate FinTech solutions has become equally important. Employers increasingly seek professionals who can bridge business and technology — individuals who understand both the economic rationale and the technological mechanics of financial innovation.

FinTech and digital finance courses are designed to build this interdisciplinary expertise. They equip learners with practical skills in digital transformation, algorithmic finance, and data-driven strategy. As the industry continues to evolve, those with a command of both finance and technology will lead the next generation of financial innovation.

Core Areas of FinTech and Digital Finance Learning

Blockchain and Digital Assets

Blockchain technology has revolutionized the concepts of trust, transparency, and transaction efficiency in finance. Courses in blockchain and digital assets teach professionals how decentralized systems operate, how cryptocurrencies are created and valued, and how smart contracts automate complex financial agreements, making it an essential foundation for anyone taking a fintech and digital finance course Singapore for modern professionals.

Beyond cryptocurrencies, blockchain applications extend to trade finance, supply chain management, and digital identity verification. Understanding these mechanisms enables professionals to evaluate how distributed ledger technology (DLT) can enhance existing financial operations or create entirely new business models.

For finance leaders, literacy in blockchain is becoming essential — not necessarily to develop code, but to strategically assess risks, opportunities, and regulatory implications of tokenization and digital assets in global finance.

Artificial Intelligence and Machine Learning in Finance

AI and machine learning have become the analytical engines of modern finance. Courses in this domain focus on how algorithms can improve forecasting, detect fraud, optimize trading strategies, and personalize financial products.

Students learn how to build predictive models that analyze large datasets, extract patterns, and support real-time decision-making. For example, machine learning models can predict credit risk more accurately than traditional scoring systems, while natural language processing (NLP) algorithms enable sentiment analysis in financial markets.

Professionals trained in AI applications can bridge the gap between quantitative finance and data science — turning massive amounts of financial data into actionable insights.

Data Analytics and Visualization

Data is the lifeblood of digital finance. As organizations collect unprecedented volumes of financial information, the ability to extract value from data has become a competitive differentiator. Courses in data analytics teach professionals how to use tools such as Python, R, Power BI, and Tableau to analyze trends, forecast outcomes, and visualize results for strategic communication.

Beyond technical proficiency, these courses emphasize storytelling with data — transforming complex financial metrics into clear narratives for decision-makers. For finance professionals, mastering data visualization fosters transparency, credibility, and more persuasive communication of financial performance and forecasts.

Digital Banking and Financial Innovation

Digital banking represents one of the most visible outcomes of FinTech evolution. Courses in this area explore the transformation of banking models, from branch-based operations to mobile-first ecosystems. Participants learn about neobanks, open banking frameworks, and application programming interfaces (APIs) that enable third-party financial innovation.

Understanding digital banking architecture allows professionals to evaluate competitive positioning, regulatory requirements, and customer experience strategies. As financial institutions embrace digital transformation, professionals with expertise in digital banking operations and innovation management are highly valued.

RegTech and Cybersecurity in Finance

As financial systems become more digitized, compliance and security take center stage. RegTech (Regulatory Technology) and cybersecurity courses equip professionals with tools to manage digital risks, automate compliance processes, and ensure data integrity.

These courses cover topics such as anti-money laundering (AML) monitoring, know-your-customer (KYC) automation, and data privacy frameworks like GDPR. Finance professionals learn how to integrate secure systems and assess regulatory implications of technological adoption.

The ability to navigate cybersecurity risks and regulatory challenges has become indispensable in an era where data breaches and compliance failures can have significant reputational and financial consequences.

Global Learning Pathways and Certification Options

University-Based FinTech Programs

Leading universities around the world now offer specialized degrees and certificates in FinTech and digital finance. Institutions such as Oxford, MIT, Imperial College London, and the National University of Singapore provide executive programs that blend finance, data analytics, and technology strategy.

These courses are often designed for mid-career professionals seeking to transition into digital leadership roles. They combine theoretical frameworks with case studies, industry projects, and exposure to emerging technologies. Graduates of such programs gain not only technical literacy but also strategic insight into how FinTech reshapes financial systems globally.

Professional and Online Certifications

For professionals seeking flexibility, online platforms such as Coursera, edX, and LinkedIn Learning offer certifications in digital finance, blockchain, and financial data analytics. Programs like the CFTE (Centre for Finance, Technology and Entrepreneurship), Wharton’s FinTech Specialization, and MIT’s Digital Transformation in Finance have gained global recognition.

These certifications typically focus on applied learning — emphasizing real-world tools, coding exercises, and project-based assessments. They enable professionals to upskill quickly while maintaining full-time employment. Employers increasingly recognize these credentials as valid indicators of practical expertise in digital finance.

Specialized FinTech Bootcamps

Bootcamps offer an intensive, hands-on alternative for professionals who want rapid immersion in FinTech topics. Programs often last several weeks and focus on practical applications such as Python for finance, algorithmic trading, and blockchain implementation.

Unlike academic degrees, bootcamps prioritize immediate employability and project-based outcomes. Participants leave with tangible skills and portfolios demonstrating their ability to apply technology to financial challenges. This model appeals particularly to professionals transitioning from traditional finance to tech-oriented roles.

Career Benefits of FinTech and Digital Finance Education

Expanding Career Horizons

FinTech education opens pathways across multiple sectors. Graduates of digital finance courses often pursue roles in investment analysis, digital banking, financial data analytics, or product innovation. The combination of financial and technological expertise makes them attractive to both traditional financial institutions seeking digital transformation and emerging FinTech startups disrupting legacy models.

Professionals equipped with digital finance skills can also transition into hybrid roles — such as FinTech strategy consultant, digital transformation manager, or chief data officer — where financial acumen meets technological innovation.

Enhancing Strategic and Analytical Capability

Courses in FinTech and digital finance strengthen analytical capabilities by integrating quantitative reasoning with data interpretation. Professionals learn how to apply algorithmic thinking to financial strategy — whether through automating valuation models, analyzing consumer behavior, or optimizing asset allocation.

This strategic and analytical agility empowers professionals to make faster, data-driven decisions. As financial environments become more complex, such skills translate into greater confidence, influence, and leadership potential within organizations.

Building Digital Leadership and Innovation Mindset

Beyond technical training, FinTech education cultivates a mindset of innovation and adaptability. Exposure to case studies on digital transformation and startup ecosystems encourages professionals to think entrepreneurially — identifying inefficiencies and creating solutions that leverage technology for financial impact.

This mindset is critical for future CFOs, financial strategists, and entrepreneurs who must lead in uncertain and rapidly evolving environments. The ability to envision and execute digital finance strategies positions professionals as catalysts of change within their organizations.

Integrating FinTech Learning into Career Development

Continuous Learning and Professional Relevance

FinTech is an ever-evolving field. Professionals who commit to continuous learning remain relevant as technologies and business models evolve. Ongoing education in digital finance not only expands knowledge but also signals adaptability and lifelong learning — traits that employers value highly.

Integrating FinTech courses into professional development plans ensures that financial expertise remains current. Whether through short certifications, workshops, or executive programs, sustained engagement with emerging technologies reinforces professional resilience.

Applying Learning in Real-World Contexts

The true value of FinTech education lies in application. Professionals should integrate what they learn into their daily work — experimenting with data analytics tools, automating reporting processes, or proposing technology-enabled solutions.

Demonstrating tangible results from FinTech learning strengthens credibility and career advancement prospects. It also contributes to organizational innovation, as finance teams increasingly play strategic roles in digital transformation initiatives.

Networking and Collaboration in the FinTech Ecosystem

FinTech courses often provide access to professional networks that span finance, technology, and entrepreneurship. Engaging in these communities fosters collaboration and exposes professionals to diverse perspectives and emerging trends.

Participation in FinTech associations, hackathons, or alumni networks extends career opportunities beyond traditional corporate structures. Networking within the FinTech ecosystem can lead to partnerships, startup ventures, or advisory opportunities that further enhance professional growth.

Conclusion

The convergence of finance and technology has reshaped what it means to be a finance professional. Mastery of spreadsheets and accounting principles, while still essential, must now be complemented by fluency in data analytics, automation, and digital innovation. FinTech and digital finance courses provide the bridge between traditional finance and the digital future — equipping professionals with the tools, mindset, and strategic vision to thrive in a technology-driven economy.

By embracing these learning pathways, finance professionals not only future-proof their careers but also position themselves as leaders in an era of financial transformation. The next generation of finance will belong to those who can think beyond the balance sheet — to those who can design, analyze, and lead within the digital frameworks shaping global finance.

Ultimately, FinTech education is more than professional training; it is an investment in adaptability, innovation, and long-term relevance. Those who seize the opportunity to learn today will define how finance operates tomorrow — merging technology with financial insight to build a more connected, intelligent, and inclusive financial world.