Financial Statement Analysis Courses Learn to Interpret Financial Data

Financial Statement Analysis Courses: Learn to Interpret Financial Data

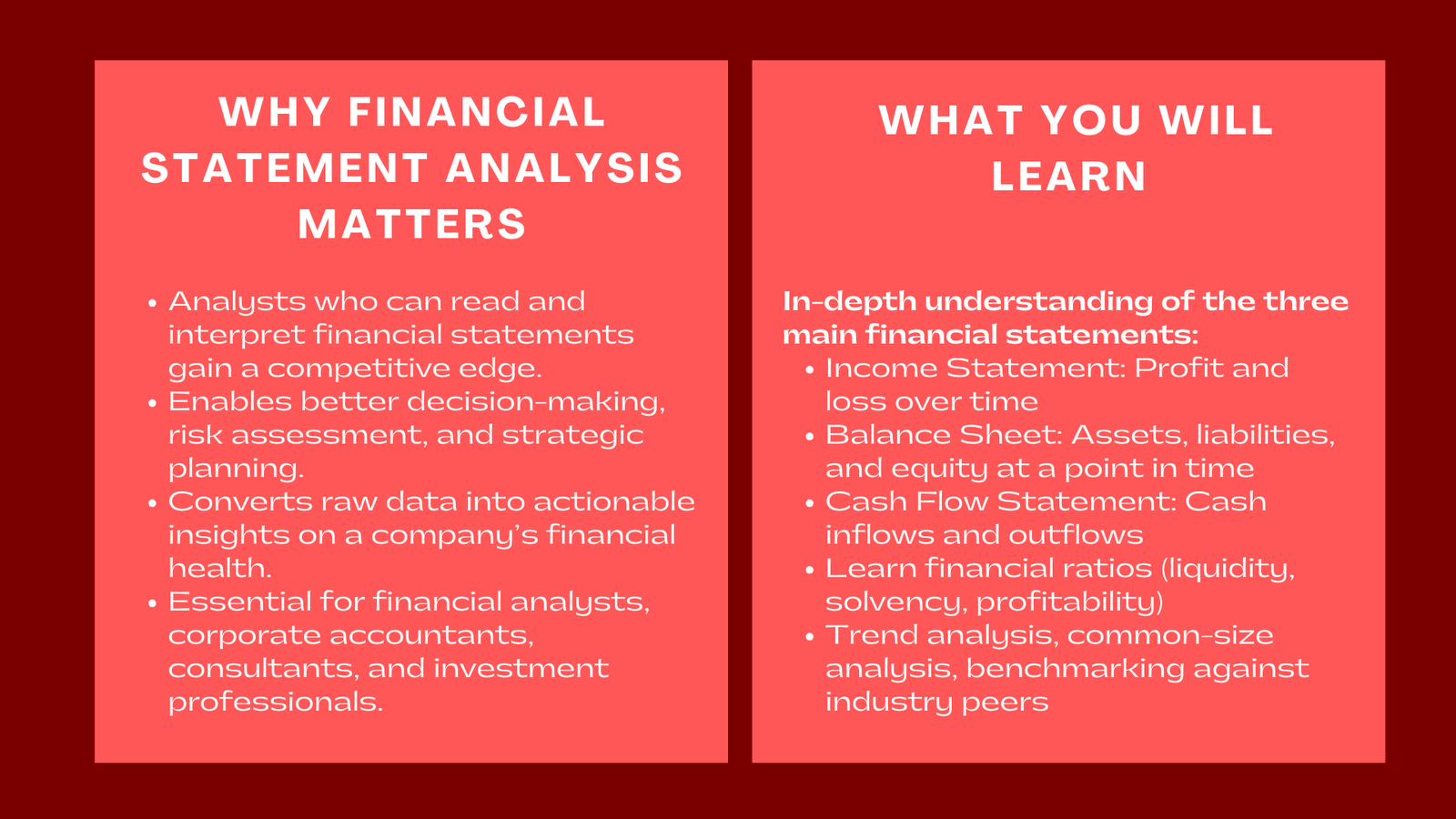

In these data-driven times of finance, analysts who successfully read financial statements and can interpret them have a significant edge. The ability to read financial data allows for better decision making, better risk assessment and strategic planning. This is a fundamental skill that courses in financial statement analysis have been created to develop, so that learners go beyond just the numbers to gain an insight into the realities behind financial health and performance of a company.

Financial statements are statements of facts pertaining to a business such as revenue produced, expenditures incurred and the use of assets to create value. However, this story can only be comprehended by people who are good at interpreting balance sheets, income statements, and cash flow statements. Such courses make participants capable of converting data into information and, therefore, a powerful asset when working as a financial analyst, corporate accountant, consultant, or investment professional. This is especially relevant in Financial Planning Courses Singapore, where mastering financial data interpretation is key to making informed planning and investment decisions.

What Financial Statement Analysis Teaches

Financial statement analysis courses aim to gain an in-depth understanding of the three main financial statements: income statement, showing profit and loss over a period of time; balance sheet, showing assets, liabilities and equity at a certain moment in time; and cash flow statement, showing cash flow into and out of a business. Together, these are the basis for the financial diagnosis and prognosis.

Shadow banking: Pi Cast Analytics The learner is instructed in the analysis of ratios that are frequently used to determine the financial status of a company, such as liquidity, solvency and profitability ratios. They also learn how to look at methods of trend analysis, common-size analysis and benchmarking with peers in the industry. These skills are not only critical for internal decision-making, but they are also critical for investors and lenders to use in assessing company performance.

Courses in advanced practice usually expose learners to tools such as Excel, Power BI and financial modelling software to assist them automate and visualize financial data. They also use real life case studies to simulate how real-world analysts use statements to spot red flags, make assumptions about growth and investment recommendations.

Why Financial Statement Analysis Matters for Your Career

Financial data is crucial for businesses, and employers of all kinds will appreciate an employee with the ability to do financial analysis accurately. Be it corporate finance, investment banking or management consulting, financial statement analysis forms the solid foundation for valid recommendations and perhaps nets out of the same, a strategic plan.

Considered from an analyst’s and a manager’s point of view, the statements should be able to answer key questions, such as: Is the company producing enough cash to continue growing? Is it manageable when it comes to its liabilities? Can the profitability improve with time? Those professionals who are able to answer these questions add tangible value to their organizations. On top of this, this competence is necessary for entrepreneurs and owners of the company looking for funding from the investor. Shareholders use financial statement analysis as a key resource in assessing the viability of companies, and understanding different types of business valuation multiples explained is an essentially required knowledge for entrepreneurial business.

Conclusion to Financial Statement Analysis Courses Learn to Interpret Financial Data

Financial statement analysis courses help in making sense of raw data and converting it to a more workable intelligence. Though by learning or understanding financial information with the ability of clarity with precision, professionals strengthen their analysis skills and career prospects.

Whether your career aspiration is to work in corporate finance, banking or investment management, if you don’t know financial statement analysis you will lack confidence to make data-driven decisions that matter. This is more than number-crunching but rather trying to understand the story behind the numbers and based on the story how you can create the financial success.