Finance Formula Toolkit Singapore: From Profit Calculations to Forecasts

Finance Formula Toolkit Singapore: From Profit Calculations to Forecasts

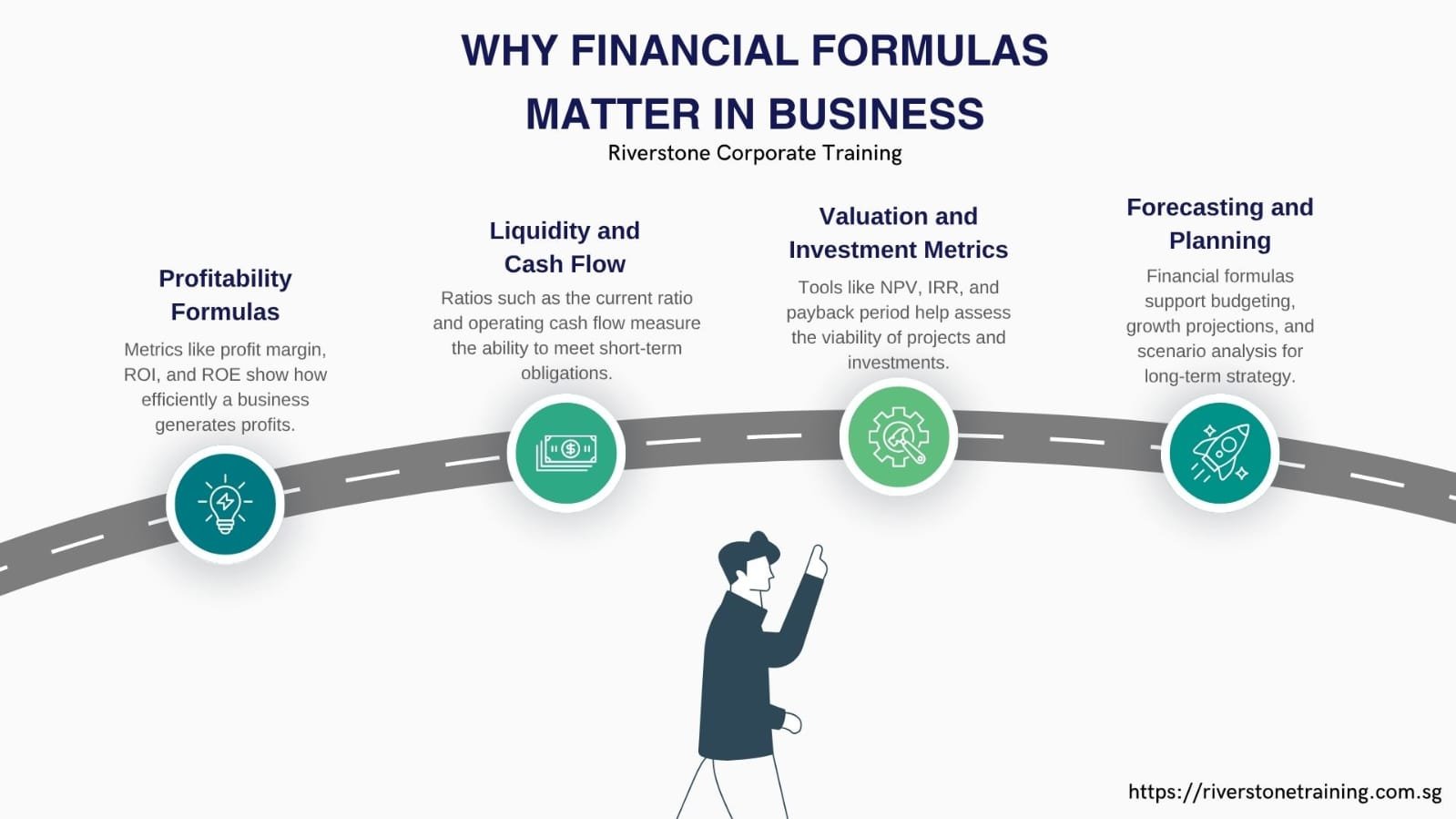

Introduction: Why Financial Formulas Matter in Business

Business is the art of finance and formulas give the roughness to that art. Since startup company valuation Singapore will be finding those willing to fund their enterprises, all the way up to large-scale corporations running budgets, the financial formula is necessary to transform data into a decision. They assist the leaders with the quantification of the results, the risk evaluation, and growth design.

The absence of a clear understanding of financial formula would mean that the decisions businesses make are not directed by assumptions but actual knowledge. This paper discusses important formulas, starting with simple profit formulas through the most powerful predictive analysis products, which are the cornerstones of everyday operational processes and the planning process.

Profit Calculations: The Foundation of Finance Formula Toolkit Singapore

The first measure of financial health is profits. It agrees on whether or not a business is value-generating or falling behind.

Gross profit shows the dollar amount of revenue less the cost of goods sold which emphasizes on production efficiency. Operating profit (EBIT) goes even further and includes the operating costs and reveals how the management is able to control the cost. Lastly, taxes and interest are subtracted on the net profit, showing the final result to the owners and investors.

All these measures build a multifaceted image of performance. They assist with tracking profit x where profitability is being created/or killed as a part of the business model.

Profitability Ratios: Measuring Efficiency

Raw numbers of profits are descriptive, but ratios put numbers into perspective.

Gross margin indicates the proportion of the total amount of revenues remaining after the cost of production. Operating margin shows the amount that is left after operating expenses. Net margin demonstrates what will be real bottom-line profits. Return on equity (ROE) is used to determine the quality of shares fund usage.

These ratios can be compared by industries and companies. They emphasize efficiency, expose weaknesses, and monitor changes over time to provide a more competitive insight to the managers and investors.

Liquidity and Solvency: Can You Pay the Bills?

Profitability will not guarantee survival. A firm should also uphold liquidity- being in a position to fulfill the immediate liabilities and solvency which shows long term sustainability.

The measures of liquidity will be used to determine whether assets such as cash or receivables will finance instant liabilities or not. Solvency analyses the amount of debt against equity, that is, whether the business will be able to maintain its level of capital structure.

Even a good company whose profits are good can fall out of financial health because of inability to meet the bills or due to over-encumbers between it and the debtor. Through keeping track of these indicators, entities gain the trust of the lenders and investors besides protecting continuity.

Growth and Forecasting Formulas

Enterprises need to look into the future and also look backward. Forecasting makes predictions based on previous activities and plays a strategic direction.

The growth rate of the revenue measures whether the growth of sales is rising or declining. The compound annual growth rate (CAGR) averages the results in a number of years in such a way that it depicts sustainable trends. Break-even analysis demonstrates the quantity sales have to be made to meet expenses and the future revenue model is calculated on the increased assumptions.

These equations enable businesses to make achievable goals, review investments and plan the risks. Forecasting does not make strategy a guess work but rather based on quantifiable expectations.

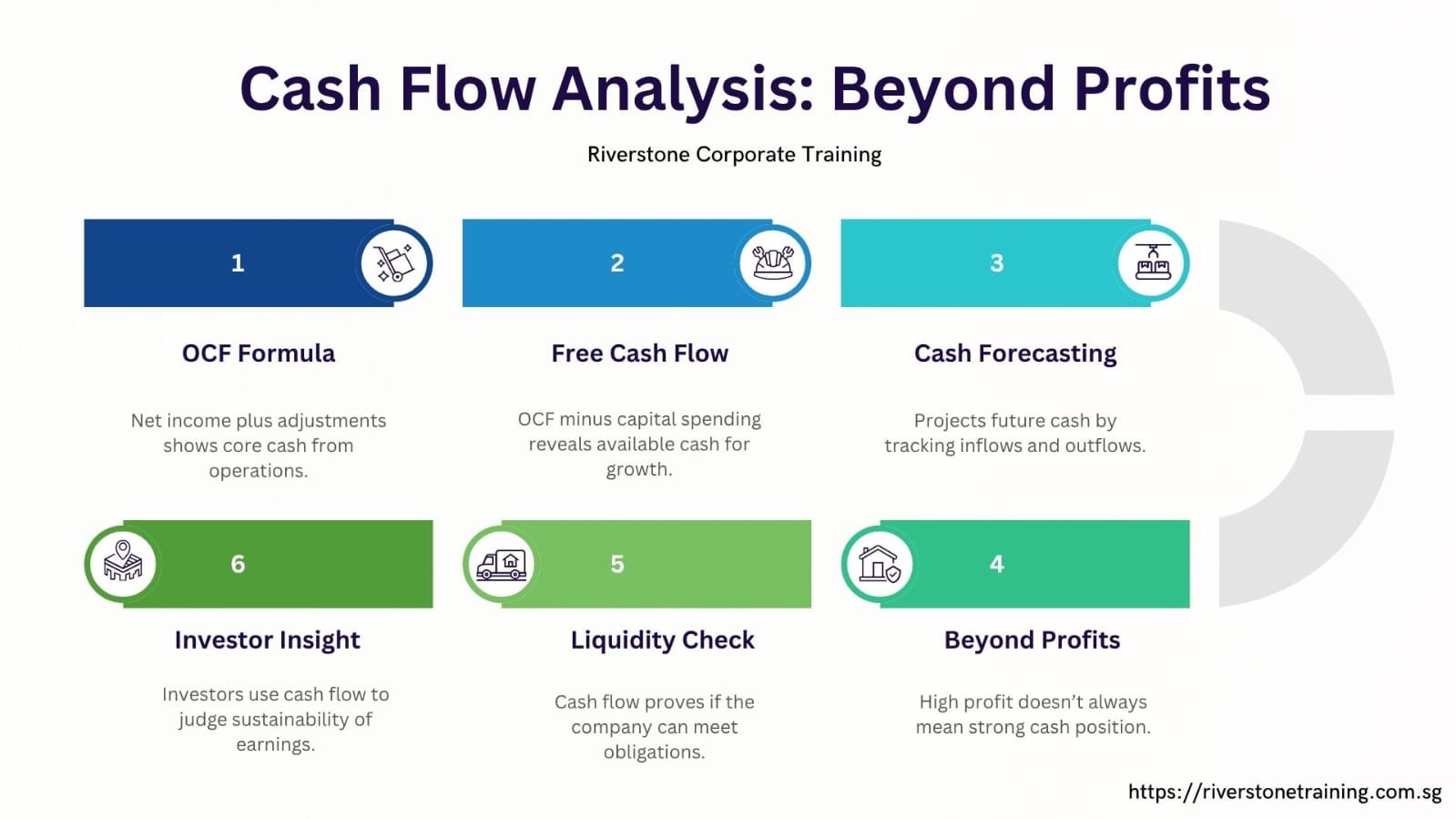

Cash Flow Analysis: Beyond Profits

On paper, a profit is not necessarily going to be cash in hand. It is the reason why the analysis of cash flow is essential.

Operating cash flow (OCF) is the amount of cash flow created by its specifics and free cash flow (FCF) is the amount that is left out as a result of capital expenditures. Cash forecasting predicts inbound as well as outbound cash flows hence enabling the company to predict shortfalls or surpluses.

On the contrary, cash flow does show the real financial strength of a business, as opposed to profits. It is relied upon by investors and managers to analyse the liquidity, sustainability and the capacity to finance future growth.

Conclusion: Turning Numbers into Strategy

Finance formula toolkit transforms raw data into strategic data. In profit calculations, forecasting models and many more, these formulas make it very easy to see the efficiency of their business valuation course singapore and the risk they are likely to face as time goes on.

The companies can get off the reacting level of work and be proactive by using the proper formula and at the right time. Formulas inspire confidence in the investor, enable smarter practical decision making techniques for finance professional as well as convert numbers to a sustainable growth plan.

In the modern competitive world, it is not a choice, but a necessity to practice best online finance course. They are the pillars of better management, more focused strategy and success in the long term.