Finance Courses to Boost Your Career

Finance Courses to Boost Your Career

Introduction to Finance Courses to Boost Your Career

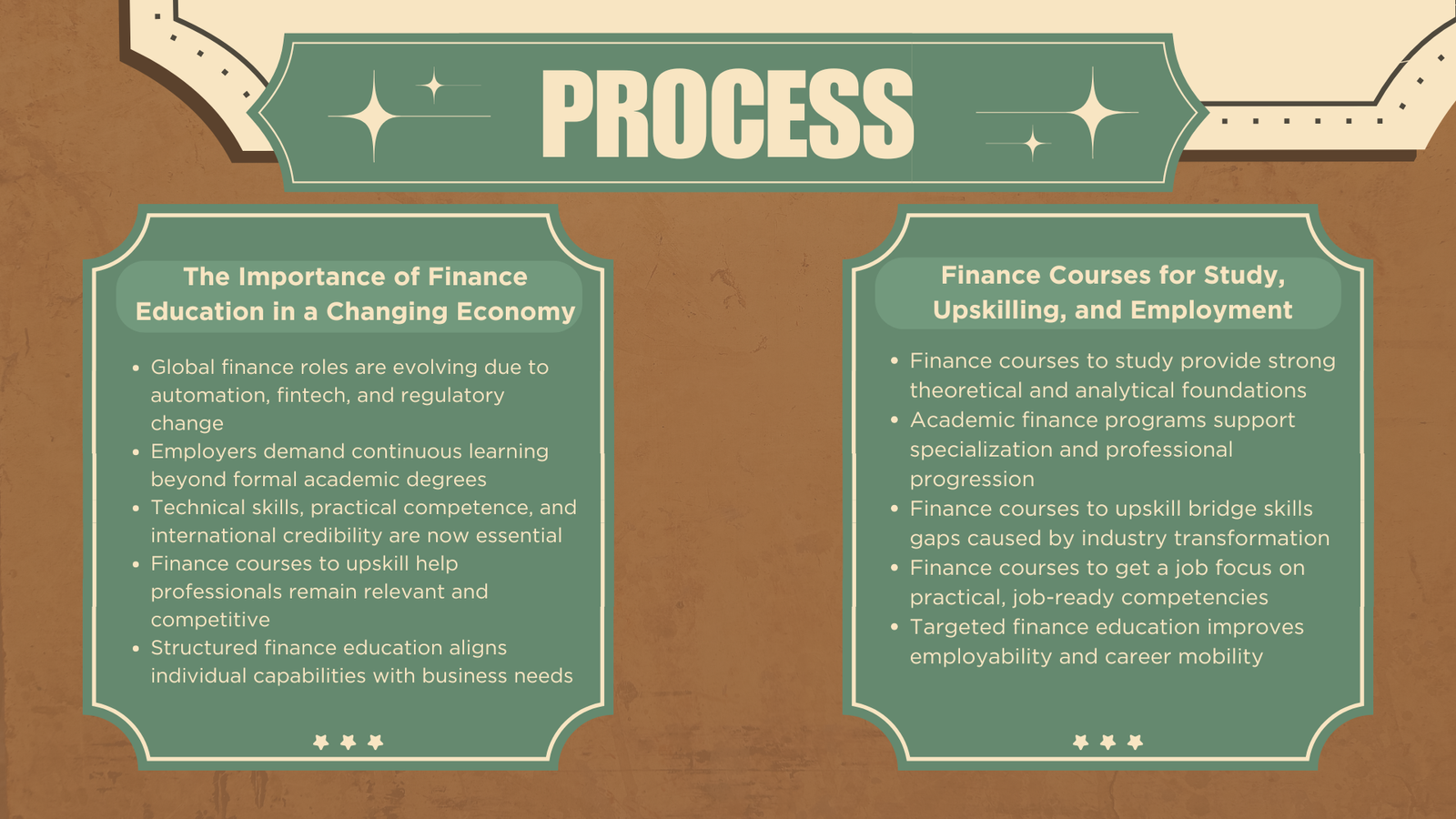

Upskilling in the form of finance courses has become a necessity to professionals who want to stay relevant, credible, and employable in a growing competitive and digitized global economy. Current trends in finance demand of professionals in the field increased expectations by employers that go way beyond the concerns of academic achievement, necessitating lifelong learning, practical competency, and international competencies.

The expectations of employers have changed; nowadays, it is the candidates who are flexible and have real-life expertise. In that regard, upskilling finance courses can help professionals as well as students to enhance their technical capacity, adapt to regulatory and technological change, and align their skills with the current business demands.

Strategic Importance of Finance Courses to Upskill in the Modern Economy

Over the past decade, the financial industry has undergone significant transformation. Traditional roles in banking, accounting, investment management, and corporate finance have been reshaped by automation, data analytics, fintech innovation, and increasingly stringent regulatory environments. As a result, finance courses to upskill have shifted from being optional to becoming a fundamental strategy for career sustainability.

These finance courses to upskill enable professionals to bridge gaps between legacy knowledge and emerging industry requirements. For instance, finance practitioners who once focused primarily on financial reporting are now expected to understand data visualization, regulatory compliance, and strategic decision-making. High-quality finance courses to upskill provide structured exposure to these competencies while reinforcing core financial principles such as valuation, risk management, and financial analysis.

Continuous professional education is also widely interpreted by employers as a sign of commitment and adaptability. Candidates who consistently invest in finance courses to upskill are often perceived as lower-risk hires and stronger long-term assets. This perception directly influences promotion opportunities, leadership progression, and international career mobility.

Aligning Academic and Career Objectives When Choosing Finance Courses to Study

Clear purpose is essential when selecting finance courses to study. Not all programs serve the same objectives, and misalignment can lead to inefficient use of time and resources. Academic-oriented courses emphasize theoretical frameworks, research methodologies, and foundational knowledge, whereas professionally oriented programs focus on practical application, case-based learning, and industry standards.

For undergraduate and postgraduate students, finance courses to study often serve as a foundation for further specialization. Subjects such as financial markets, corporate finance, and investment analysis establish a strong conceptual base. When combined with applied learning, these finance courses to study prepare graduates both for immediate employment and for advanced professional certifications.

Working professionals, however, should approach finance courses to study from a skills-gap perspective. Identifying weaknesses in areas such as financial modeling, regulatory compliance, or strategic finance allows learners to select targeted programs with immediate workplace relevance. Well-chosen finance courses to study also facilitate career transitions, such as moving from accounting to financial planning or from operational roles to corporate finance.

The Role of Finance Courses to Get a Job in Employability and Hiring Decisions

In highly competitive labor markets, credentials often determine whether a candidate progresses beyond initial screening stages. Employers increasingly rely on certifications and structured training as indicators of job readiness. Consequently, finance courses to get a job are designed to align closely with employer expectations, regulatory requirements, and practical skill demands.

Unlike purely academic programs, finance courses to get a job emphasize applied competencies such as financial analysis, compliance reporting, budgeting, and decision support. Many incorporate assessments that simulate real-world scenarios, ensuring that graduates can perform effectively from their first day in the role. This practical orientation explains why candidates with relevant finance courses to get a job frequently outperform peers with broader but less targeted educational backgrounds.

Recruiters also place strong value on programs with international recognition or professional accreditation. Such credentials signal standardized quality and transferable competence. In this sense, finance courses to get a job function not only as learning mechanisms but also as professional signaling tools within global labor markets.

Integrating Finance Courses to Upskill, Finance Courses to Study, and Finance Courses to Get a Job

Although finance courses to upskill, finance courses to study, and finance courses to get a job may appear distinct, they are closely interconnected. Effective career planning integrates all three dimensions into a coherent and structured development strategy.

For example, an individual may begin with finance courses to study at an academic level to establish foundational knowledge. As their career progresses, they may pursue finance courses to upskill to remain competitive and adapt to evolving job requirements. Finally, when targeting a specific role or industry, they may enroll in finance courses to get a job that directly enhance employability.

This integrated approach ensures that learning investments produce measurable outcomes. Rather than accumulating unrelated qualifications, professionals develop a sequential and purposeful set of competencies aligned with long-term career goals.

Core Competencies Developed Through Quality Finance Education

Well-designed programs across finance courses to upskill emphasize advanced financial analysis, performance measurement, and strategic decision-making under uncertainty. These competencies are particularly valuable in leadership and advisory roles.

Meanwhile, finance courses to study focus more strongly on conceptual understanding, ethical frameworks, and theoretical foundations that support sound professional judgment. In contrast, finance courses to get a job prioritize execution, compliance, and operational efficiency aligned with employer needs.

Across all categories, communication skills remain essential. Finance professionals must translate complex data into actionable insights for non-financial stakeholders, making presentation and reporting capabilities critical outcomes of modern finance education.

Evaluating the Quality and Credibility of Finance Courses

Not all finance courses to upskill deliver equal value. Learners should assess curriculum relevance, instructor expertise, and industry recognition. Programs developed in collaboration with professional bodies or industry practitioners tend to offer stronger real-world alignment.

Similarly, finance courses to study should be evaluated based on academic rigor, accreditation, and progression pathways. For employment-focused learners, finance courses to get a job must demonstrate clear links to employment outcomes, employer partnerships, or role-specific competency mapping.

Transparency in learning outcomes and assessment methods remains a key indicator of program quality across all finance education pathways.

Long-Term Career Impact of Strategic Finance Learning

The benefits of targeted education through finance courses to upskill extend far beyond immediate job placement. Professionals who pursue continuous upskilling often experience faster career progression, greater job security, and higher earning potential.

For early-career professionals, finance courses to study establish a strong intellectual foundation that supports adaptability across roles and industries. Prioritizing finance courses to get a job reduces the transition gap between education and employment by aligning skills with professional standards from the outset.

Over time, strategic selection across these three learning pathways builds professional credibility and long-term career resilience.

Conclusion

In today’s dynamic financial environment, career success depends on informed and intentional learning decisions. Finance courses to upskill enable professionals to remain competitive and adaptable, finance courses to study provide the theoretical and analytical foundations for long-term growth, and finance courses to get a job translate knowledge into employability by aligning skills with market demand.

When integrated into a coherent professional development strategy, these courses become powerful tools for sustained career advancement. Viewing education as a continuous process rather than a one-time investment allows finance professionals to build resilient, ethical, and impactful careers in a rapidly evolving global economy.