Derivatives and Hedging Courses for Advanced Finance Learning Focus on Currency Hedging Strategies in Corporate Finance

Derivatives and Hedging Courses for Advanced Finance Learning: Focus on Currency Hedging Strategies in Corporate Finance

Introduction to Derivatives and Hedging Courses for Advanced Finance Learning Focus on Currency Hedging Strategies in Corporate Finance

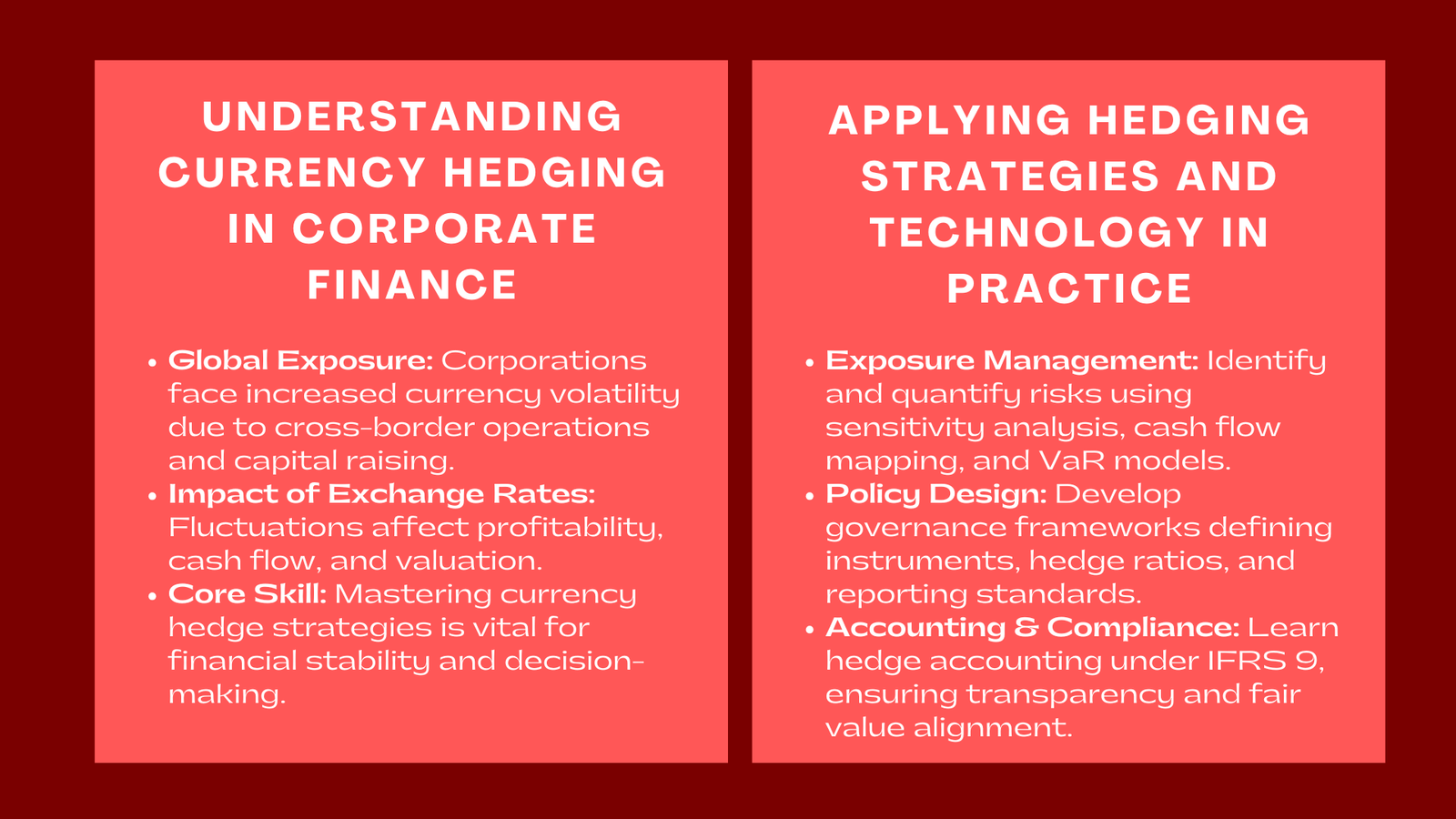

In the present globalized economy interconnected world, corporations are more exposed to currency volatility with the growth of its operations, cross-border transactions, and raising capital in various markets. The changes in the exchange rates may have an enormous impact on profitability, cash flow, and even valuation of companies. This has made knowledge and practice of efficient currency hedge strategies to be an important skill among finance professionals.

Advanced derivatives and hedging classes are no longer purely theoretical as they provide their participants with practical knowledge of how to handle realistic exposures to forward contracts, options, swaps, and more complex hybrid instruments. The given article examines the role that superior finance courses, including derivatives and hedging training Singapore global finance risk, and especially those ones which focus on the currency hedging, can enhance the financial stability of corporations, enhance business decision-making processes, and equip the professionals with the challenges of managing risks in a global scope.

1. The Tactical Significance of Currency Hedging Corporate Finance.

1.1 Managing Exchange Rate Risk

In the case of multinational corporations, the currency fluctuations have direct effect on revenues, costs and financial reporting. A high U.S dollar say will lower foreign earnings when converted back to the domestic currency and the opposite could happen to a weak currency, which would inflate the cost of imports. Through structured foreign exchange risk management courses, finance teams learn to quantify exposures, model potential outcomes, and implement effective hedging policies that protect margins and stabilize performance.

1.2 Aligning Hedging with Corporate Objectives

The trick to hedging is not to get rid of any risk but to match the risk tolerance with strategic objectives. Any sophisticated training will assist the professionals to analyze when to hedge, what amounts to hedge and incorporating hedging decisions with wider treasury and financing policies. To illustrate, an exporter may decide to make partial hedging so as to be competitive on price but still to counter down-side risk.

2. The Essentials in Currency Hedging.

2.1 Forwards and Futures

The most typical and the simplest tool of hedging is forward contracts. They fix an exchange rate at which they will conduct their transactions in future making them predictable in terms of cost. Futures are used to accomplish a similar purpose but they are standardized and traded on an exchange and provide liquidity and daily settlement. In high-level courses, the participants simulate the influence of both instruments on the cash flow projections and accounting results under the IFRS 9.

2.2 Options and Swaps

Currency options have flexibility- this enables companies to enjoy positive rate changes whilst cushioning them against the negative changes. Swaps, however, tend to be applied to longer term exposures or financing arrangements, e.g. the exchange of fixed interest payments on one currency to floating payments on another. The training programs in corporate currency hedging include learning how to organize, appreciate, and trade such derivatives.

3. Incorporation of Hedging in Company Treasury activities.

3.1 Exposure: Identification and Measurement.

The underlying exposure has to be quantified in order to have an effective hedge. The sensitivity analyses, cash flow mapping, and Value-at-Risk (VaR) models are the tools used by treasury teams in determining the nature and magnitude of currency risk. Training programs focus on the development of data-driven exposure structures that are in line with operational and financial planning.

3.2 The design and governance of the policies.

The setting up of a hedging policy renders uniformity and transparency. It determines the instruments that are permitted, the ratio of hedge, the amount of counterparty, and reporting. High level classes can involve workshops in which participants are tasked with setting up simulation of corporate hedging policies, requiring them to understand how to balance financial control and flexibility.

4. Accounting and Compliance Issues.

4.1 Hedge Accounting under IFRS 9

Compliance with accounting standards is one of the most difficult issues of hedging. Under the IFRS 9, hedge accounting enables firms to represent the economic impacts of hedging in their books. Imbalance between exposures and hedging instruments, however, may lead to reported earnings volatility.

Those in on higher education financial courses learn how to record the effectiveness of hedges, quantify changes in fair value and how to make disclosures that are compliant.

4.2 Regulatory and Risk Reporting.

Regulatory compliance and investor communication are two additional areas of currency hedging overlap. The finance practitioners should also make sure that they report the hedging positions and risk management results in a transparent manner. Teachers usually combine examples of case studies on how companies report their hedging outcomes in the annual reports and investor briefings.

5. Measuring Hedging Effectiveness and Performance.

5.1 Quantitative Assessment

Hedge performance analytics must be strong to assess hedge performance. Dollar- offset ratios, regression analysis and correlation testing are some of the methods taught in courses to ensure the adequacy of the hedge in offsetting the exposure. Another area of research by the participants involves more complicated measures including cost of carry and credit valuation adjustment (CVA) that determine the overall performance of hedges.

5.2 Post Hedging Review and Optimization.

Ongoing evaluation is vital. Treasury teams should examine the alignment of hedging strategies according to the business objectives as the market changes. High level training focuses on developing loop feed back- reviews of outcomes and refining of policies to establish continuous improvement.

6. Hedging Operations in Technology and Automation.

6.1 Treasury Management Systems (TMS) 6.1.

Hedging strategies today are more dependent on digital applications which combine market data, exposure surveillance and execution of the trade. An effective Treasury Management System is used to simplify the whole hedging process process, including the identification of risks to accounting entries, making it more accurate and effective.

Training sessions make the participants acquainted with the best TMS platforms, which involve how automation lowers risk of operations.

6.2 Data Analytics and AI

The artificially intelligent technology is revolutionizing the way businesses predict the fluctuations of the exchange rates and plan the hedge timing of their businesses. With the integration of predictive analytics, finance professionals can make a decision based on data that would help in improving hedge ratios, and also cut on unneeded expenses. State of the art learning modules can recreate AI-based scenario analysis on the global FX portfolios.

7. Real-World Case Studies in Currency Hedging

7.1 Corporate Example: Exporter with USD Exposure

Consider a European manufacturer with substantial U.S. dollar sales. A 5% appreciation in the euro could erode profit margins. Using forward contracts, the company hedges 70% of its forecasted exposure, securing predictable earnings. Participants in corporate currency hedging training programs study similar real-life models to understand the risk-return trade-offs of different instruments.

7.2 Financial Institution Example

Currency risk also occurs in banks and investment companies as a result of international portfolios. In foreign exchange risk management courses, case discussions tend to point to the approach of liquidity, cost, and exposure duration balancing that is commonly applied to forwards, options, and swaps by institutions.

Conclusion

Due to the increasing globalization and instability of the financial markets, currency hedging is something that the contemporary financial expert must master. Derivatives and hedging courses devoted to foreign exchange risk prepare the participants to act strategically in exposures, to harmonize financial policy with business objectives and to conform to complicated regulatory structures.

By acquiring the professional skills and knowledge through structured learning that involves combining theory, analytics, and practical implementation; they become equipped with the technical prowess and strategic views of ensuring profitability and contributing to the global growth. Currency hedging is not only a financial instrument but also a competitive edge that characterizes robust and progressive organizations in an environment where volatility is the order of the day.