Accessible Finance Education Pathways

Accessible Finance Education Pathways

Introduction toAccessible Finance Education Pathways

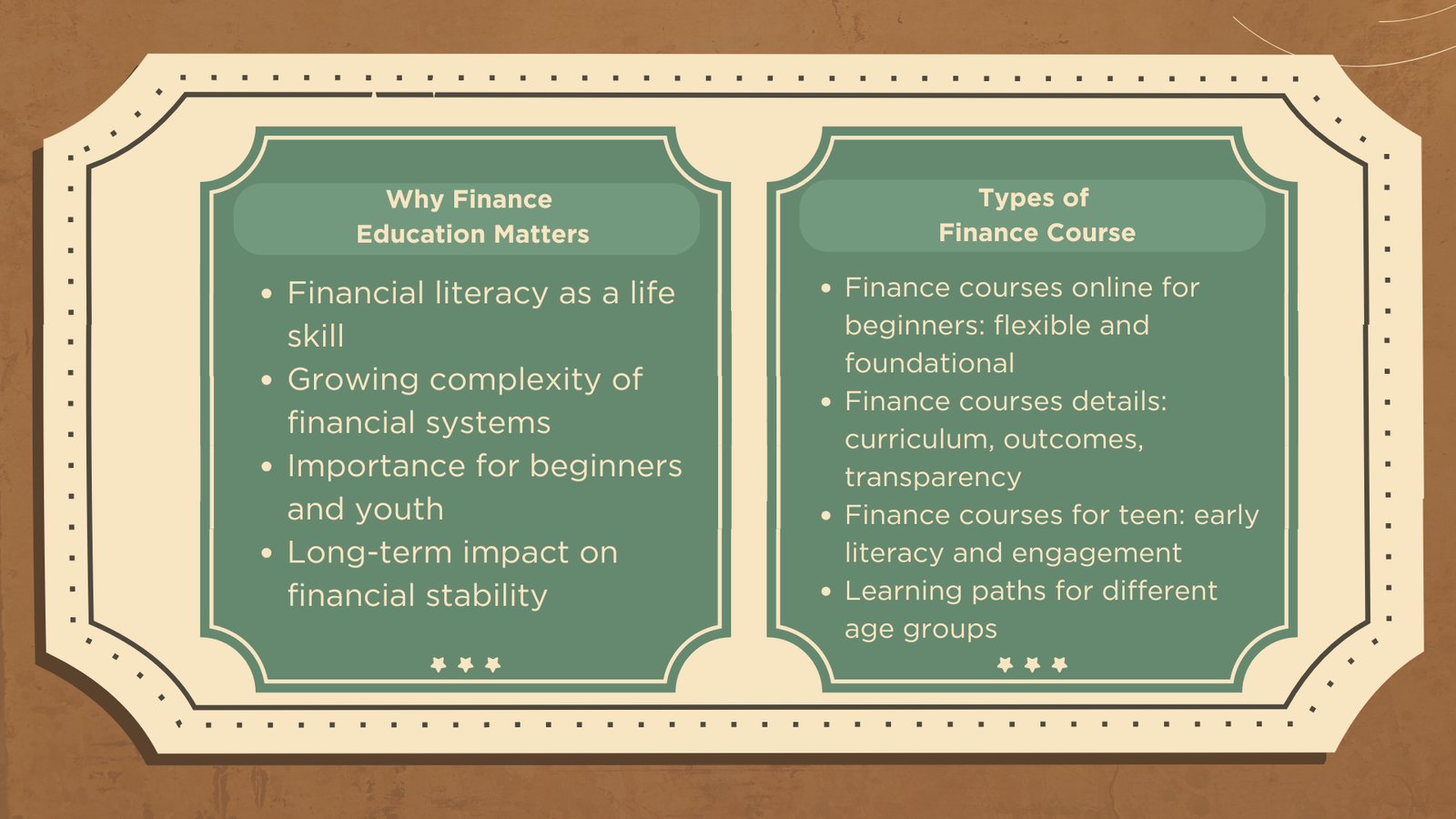

Financial literacy has evolved into a fundamental life skill in today’s increasingly complex financial environment. No longer considered a specialized competency, financial knowledge is now essential for individuals of all ages. Beginners entering the financial system and younger learners alike must understand how money is managed, how risks are evaluated, and how informed financial decisions are made. Consequently, global demand for finance courses online for beginners, transparent finance courses details, and structured finance courses for teen continues to grow.

Digital learning has significantly transformed access to finance education, enabling learners to study at their own pace while gaining practical knowledge applicable to real-world situations. Well-designed finance programs support informed decision-making, promote responsible financial behavior, and contribute to long-term financial stability. This article explores the strategic importance of finance education, examines various course formats and content structures, and highlights the role of finance learning across different age groups.

Strategic Implications of Financial Education

Finance education plays a critical role in strengthening personal capability and financial sustainability. Individuals with financial literacy are better equipped to manage income, control spending, and plan long-term financial objectives. For newcomers, structured learning through finance courses online for beginners provides a reliable introduction to fundamental financial concepts.

Beyond individual benefits, finance education contributes to broader economic resilience. With access to clear and comprehensive finance courses details, learners can select programs aligned with their goals, ensuring efficient and targeted skill development. Transparency in curriculum design and learning outcomes enhances both credibility and educational effectiveness.

Early exposure to finance is equally important. The increasing popularity of finance courses for teen reflects a growing recognition that financial literacy should begin at a young age. Introducing financial concepts during adolescence helps establish responsible habits and informed financial perspectives that carry into adulthood.

Finance Courses Online for Beginners

Programs designed for beginners focus on building foundational financial knowledge in an accessible and structured manner. Finance courses online for beginners are particularly effective because they eliminate traditional barriers related to time, location, and prior experience.

Common topics covered include budgeting, saving, basic investing, and understanding financial products. Learners gain confidence in managing personal finances and interpreting simple financial information. The flexibility of finance courses online for beginners allows participants to progress at their own pace while applying concepts directly to everyday financial decisions.

In addition, many beginner programs integrate practical examples and interactive exercises. This applied learning approach ensures that participants develop not only theoretical understanding but also essential money management skills.

Understanding Finance Courses Details

Clear and comprehensive finance courses details are essential for evaluating the relevance and quality of finance programs. These details typically outline learning objectives, curriculum scope, delivery methods, and expected outcomes.

Most finance programs begin with core topics such as financial literacy, personal finance management, and introductory financial analysis. Well-presented finance courses details also describe assessment methods, learning duration, and certification opportunities, enabling learners to make informed enrollment decisions.

Advanced course descriptions may include specialization areas such as investment planning or risk management. By reviewing accurate finance courses details, learners can ensure alignment between course content, experience level, and long-term goals.

Finance Education and Personal Decision-Making

Sound financial decisions are grounded in knowledge and understanding. Individuals who participate in finance courses online for beginners develop the ability to evaluate financial choices objectively rather than relying solely on assumptions or external advice.

Finance education supports effective budgeting, debt management, and long-term planning. Through transparent finance courses details, learners understand how financial principles apply in real-life contexts, increasing confidence and accountability.

Financial literacy also enhances adaptability in uncertain economic conditions. Learners with foundational knowledge are better prepared to respond to financial challenges, reinforcing the value of structured finance education.

Finance Courses for Teen Learners

The introduction of finance courses for teen represents a proactive approach to building financial literacy among younger populations. These programs are designed to present financial concepts in an engaging and age-appropriate manner.

Typical topics include managing allowances, understanding income and expenses, saving strategies, and basic investing principles. Through finance courses for teen, young learners develop early awareness of financial responsibility and long-term planning.

Some programs also incorporate introductory entrepreneurial concepts, encouraging creativity, problem-solving, and financial awareness. As a result, finance courses for teen support both personal development and early career readiness.

Comparing Finance Courses Across Learner Groups

Finance education varies according to learner objectives and experience levels. Finance courses online for beginners emphasize foundational knowledge and accessibility, while finance courses for teen focus on engagement and basic financial literacy.

Course depth and delivery methods also differ. Beginner courses often rely on practical digital applications, whereas teen-oriented programs use interactive and relatable examples. Reviewing detailed finance courses details enables learners, parents, and educators to select programs best suited to specific learning needs.

Despite these differences, all finance courses share a common goal: empowering individuals to make informed financial decisions throughout their lives.

Learning Formats and Accessibility

Digital learning has significantly expanded access to finance education. Online platforms make finance courses online for beginners widely available, offering flexibility and convenience without compromising educational quality.

These platforms typically provide transparent finance courses details, including course structure, content coverage, and assessment methods. Digital tools such as simulations and quizzes further enhance learning effectiveness.

Similarly, online delivery has improved access to finance courses for teen, enabling young learners to engage with financial education in a structured yet flexible environment. Accessibility remains a key driver of increased participation in finance learning.

Long-Term Benefits of Finance Education

Structured finance education delivers lasting benefits across age groups. Finance courses online for beginners help individuals build confidence, improve financial decision-making, and establish responsible financial habits.

Clear finance courses details support informed course selection aligned with personal or educational objectives. For younger learners, finance courses for teen foster independence, responsibility, and early financial awareness.

Collectively, finance education strengthens individual stability, enhances decision-making capabilities, and promotes sustainable financial behavior.

Choosing the Right Finance Course

Selecting the appropriate finance program requires careful consideration of learning objectives, experience level, and delivery format. Prospective learners should review finance courses details to assess curriculum relevance, instructional quality, and expected outcomes.

Beginners benefit most from finance courses online for beginners that emphasize clarity, flexibility, and practical application. For adolescents, finance courses for teen should balance engagement with structured learning.

Purpose-driven course selection ensures that finance education delivers meaningful and long-term value.

Conclusion

In conclusion, finance education is a vital foundation for informed decision-making and sustainable financial well-being. Finance courses online for beginners, transparent finance courses details, and structured finance courses for teen provide accessible learning pathways for individuals at different stages of life.

As financial systems continue to evolve, the ability to understand and apply financial knowledge becomes increasingly important. By selecting appropriate finance programs and applying acquired insights, learners can strengthen personal financial capability, support sustainable economic participation, and contribute to a more financially literate society.