Sustainable Finance and ESG Courses for Corporate Responsibility

Sustainable Finance and ESG Courses for Corporate Responsibility

Introduction to Sustainable Finance and ESG Courses for Corporate Responsibility

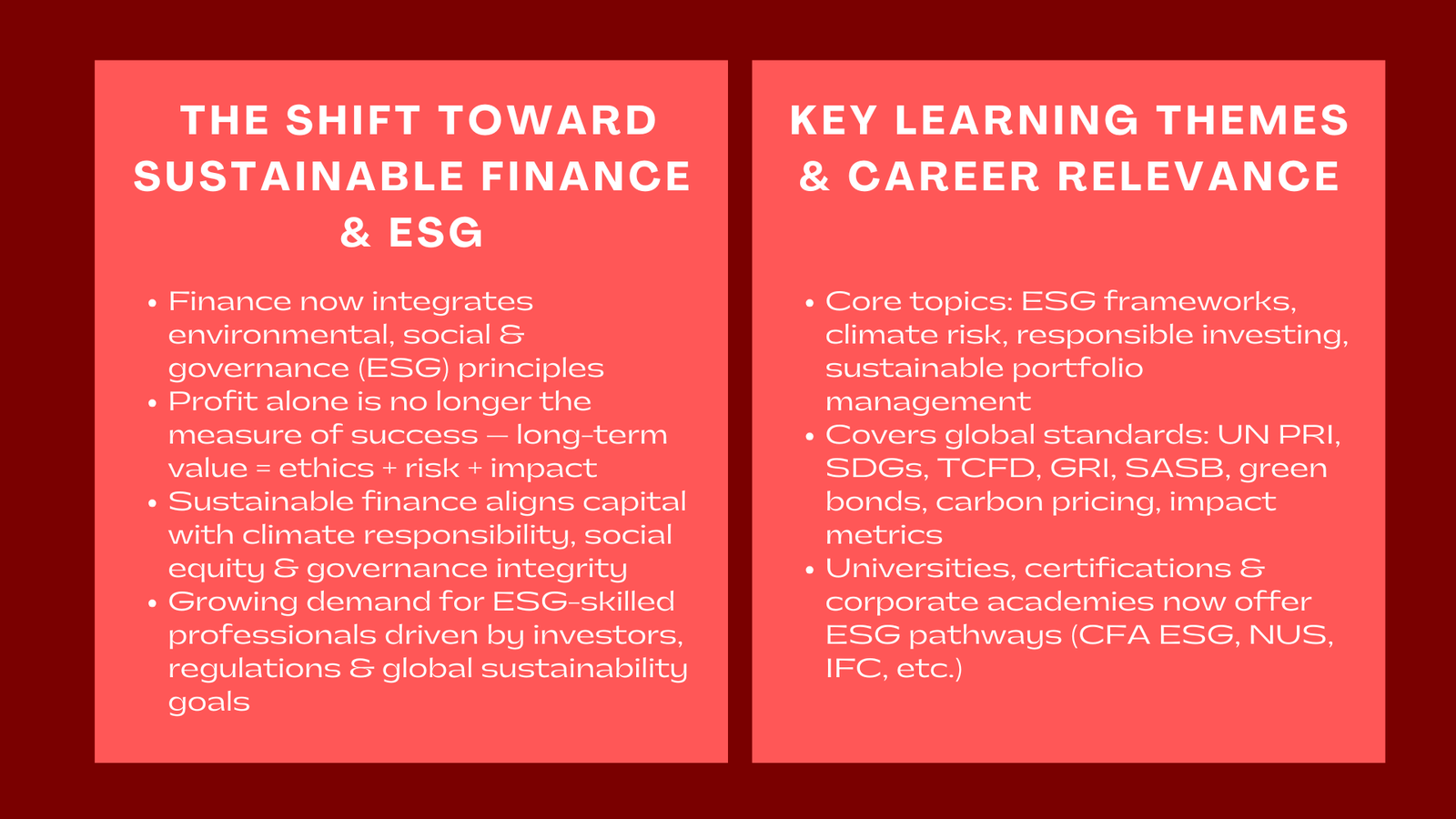

As the global economy transitions toward sustainability, finance professionals are increasingly called upon to integrate environmental, social, and governance (ESG) principles into business strategy. The era when profitability alone defined corporate success has ended. Today, long-term value creation depends on a company’s ability to manage sustainability risks, promote ethical governance, and contribute positively to society and the environment.

Sustainable finance — the practice of aligning financial decision-making with ESG objectives — has emerged as both a strategic imperative and a professional discipline. For corporations, it supports capital allocation that promotes environmental responsibility and social equity. For finance professionals, it represents a transformative skill set that bridges financial performance and corporate accountability.

Educational institutions and professional training organizations have responded by developing specialized Sustainable Finance and ESG courses professionals Singapore designed to equip professionals with the knowledge, analytical tools, and frameworks needed to navigate this new paradigm. This article explores the importance of such courses, their core learning themes, and how they empower professionals to drive corporate responsibility through informed financial leadership.

The Rise of Sustainable Finance and ESG Integration

Redefining the Purpose of Finance

Traditional finance focused on maximizing shareholder returns through quantitative metrics such as profitability, earnings growth, and market value. However, global challenges like climate change, inequality, and resource scarcity have broadened the definition of financial success. Investors, regulators, and consumers now expect organizations to create sustainable economic, social, and environmental value.

Sustainable finance integrates ESG training and certification for finance careers considerations into investment and capital allocation decisions. It seeks to ensure that financial growth supports a more resilient and equitable economy. This integration reflects a profound shift from short-term profit maximization to long-term value creation that accounts for risk, responsibility, and reputation.

Courses in sustainable finance prepare professionals to analyze investments through this multidimensional lens — teaching them to evaluate not only financial returns but also environmental and social impact.

Investor Demand and Regulatory Transformation

Investor behavior is one of the primary forces driving ESG adoption. Institutional investors, sovereign funds, and asset managers increasingly incorporate ESG metrics into portfolio decisions. Simultaneously, global regulators have introduced disclosure standards — such as the EU Sustainable Finance Disclosure Regulation (SFDR) and the Task Force on Climate-related Financial Disclosures (TCFD) — requiring organizations to report on sustainability performance.

These developments have made ESG literacy essential for finance professionals. Understanding regulatory frameworks, data metrics, and sustainability reporting enables organizations to maintain compliance while accessing capital from ESG-focused investors.

As sustainable finance becomes embedded in global markets, professionals trained in this discipline are better positioned to lead organizations through regulatory complexity and stakeholder scrutiny.

Core Learning Themes in Sustainable Finance and ESG Courses

Foundations of ESG and Sustainable Finance

Foundational courses introduce the key principles of ESG integration and sustainable finance. They cover the evolution of responsible investing, sustainability taxonomies, and frameworks such as the United Nations Principles for Responsible Investment (UN PRI) and the Sustainable Development Goals (SDGs), which are also emphasized in sustainable finance courses Singapore to equip professionals with globally relevant ESG knowledge.

Students learn how financial systems influence — and are influenced by — environmental and social dynamics. The goal is to develop a holistic understanding of finance as an enabler of sustainable development. These courses establish the ethical and strategic rationale for embedding sustainability in corporate decision-making, helping professionals reframe financial objectives within a broader societal context.

Environmental Finance and Climate Risk

Climate change represents one of the greatest systemic risks to global finance. Courses in environmental finance explore how carbon emissions, renewable energy investments, and resource efficiency affect corporate and investment performance.

Professionals learn to quantify and manage climate-related risks, using tools such as carbon pricing, green bond analysis, and scenario modeling based on the Network for Greening the Financial System (NGFS) framework.

Understanding climate finance also includes evaluating opportunities in renewable energy projects, sustainability-linked loans, and transition finance. Mastery of these topics prepares professionals to align financial innovation with environmental objectives.

Social and Governance Factors in Corporate Strategy

While environmental factors often receive the most attention, social and governance dimensions are equally vital to corporate sustainability. ESG courses teach professionals how labor practices, diversity, stakeholder relations, and governance structures influence corporate resilience and investor confidence.

Governance, in particular, serves as the foundation of sustainability. Courses emphasize topics such as board oversight, ethical leadership, executive compensation, and shareholder engagement. By understanding these dynamics, professionals can design governance systems that promote transparency, accountability, and trust — essential qualities in responsible organizations.

Sustainable Investment and Portfolio Management

Specialized courses focus on integrating ESG principles into investment strategy and asset management. Learners explore how to construct sustainable portfolios, apply ESG screening methodologies, and evaluate impact investments.

Techniques such as positive and negative screening, best-in-class selection, and thematic investing are discussed in detail. Additionally, participants learn to measure ESG performance through metrics like ESG scores, carbon intensity, and social impact indicators.

For investment professionals, these courses enhance the ability to align portfolio construction with ethical values and client sustainability goals without sacrificing financial returns.

ESG Reporting, Metrics, and Data Analytics

The credibility of sustainable finance depends on accurate measurement and transparent reporting. Courses in ESG analytics and disclosure standards provide professionals with the tools to interpret sustainability data and communicate performance effectively.

Participants examine major reporting frameworks such as the Global Reporting Initiative (GRI), Sustainability Accounting Standards Board (SASB), and Integrated Reporting (IR) frameworks. They also learn to analyze ESG data using modern technologies, including machine learning and natural language processing.

As data quality and standardization continue to evolve, ESG reporting literacy has become a defining competency for finance and sustainability professionals alike.

Educational Pathways and Global Certifications

University Programs in Sustainable Finance

Leading universities worldwide now offer specialized programs dedicated to sustainable finance. Institutions such as Oxford University, Cambridge University, Harvard Kennedy School, and the National University of Singapore (NUS) have developed executive education tracks focusing on ESG integration, climate finance, and sustainability reporting.

These programs combine academic rigor with industry engagement, exposing learners to case studies and real-world challenges. Participants often include professionals from banking, corporate strategy, and government sectors who seek to understand how finance can drive positive environmental and social outcomes.

Graduates emerge with the strategic and analytical skills needed to implement sustainability principles within organizations and financial institutions.

Professional Certifications and Short Courses

For professionals seeking flexible, globally recognized credentials, certifications such as the CFA Institute Certificate in ESG Investing, Frankfurt School’s Certified Expert in Sustainable Finance, and UNEP FI’s Principles for Responsible Banking (PRB) Academy offer comprehensive ESG training.

These programs emphasize applied learning and global best practices. They cover ESG risk assessment, impact measurement, and stakeholder communication — equipping participants to implement sustainability strategies effectively.

Online platforms like Coursera, edX, and FutureLearn also partner with leading universities to provide modular courses accessible to professionals at all levels, making continuous learning in sustainable finance more inclusive than ever.

Corporate and Industry Training Programs

Many financial institutions and multinational corporations have launched in-house ESG academies to strengthen organizational capability. Programs developed by institutions such as the International Finance Corporation (IFC), World Bank, and regional development banks emphasize sustainable project finance, impact investing, and ESG risk management.

These internal programs align sustainability learning with corporate objectives, ensuring that teams across departments — from finance and operations to compliance and investor relations — understand the company’s ESG strategy and performance metrics.

Such initiatives reflect a broader recognition that sustainability is not a niche responsibility but a collective mandate across all business functions.

Career Impact and Professional Opportunities

Rising Demand for ESG Expertise

The demand for professionals skilled in sustainable finance and ESG integration has surged across industries. Roles such as ESG analyst, sustainability consultant, impact investment manager, and chief sustainability officer are now among the fastest-growing in finance.

Employers seek candidates who can quantify sustainability performance, engage with regulators, and communicate ESG strategy to investors. Possessing formal training in sustainable finance gives professionals a competitive advantage — signaling both technical expertise and values-driven leadership.

Bridging Finance and Corporate Responsibility

Sustainable finance education enables professionals to act as bridges between financial objectives and corporate responsibility. Those trained in ESG frameworks can align capital allocation with ethical goals, helping organizations meet stakeholder expectations while preserving profitability.

By understanding sustainability metrics and financial modeling simultaneously, professionals become strategic advisors capable of balancing short-term financial targets with long-term environmental and social outcomes. This balance defines the future of responsible business leadership.

Driving Organizational Transformation

Professionals equipped with ESG training play a central role in organizational transformation. They help design sustainability-linked financing structures, establish reporting systems, and guide decision-making processes that reflect both shareholder and stakeholder interests.

Moreover, they contribute to shaping corporate culture — embedding sustainability into performance metrics, risk management, and executive accountability. As organizations transition from compliance-driven ESG approaches to purpose-driven strategies, finance professionals with sustainability expertise become essential architects of this evolution.

Integrating ESG Learning into Corporate Strategy

From Education to Implementation

The value of ESG education lies in its practical application. Professionals who translate learning into measurable business outcomes drive the greatest impact. Applying sustainable finance concepts means incorporating ESG risk factors into credit analysis, investment screening, and budget allocation.

For example, a corporate treasurer trained in sustainable finance might structure a green bond to fund renewable energy initiatives. Similarly, an FP&A professional might include carbon cost assumptions in budgeting models. Each application transforms theory into tangible corporate responsibility.

Cross-Departmental Collaboration and Leadership

Sustainability cannot be confined to a single department. ESG-trained professionals foster collaboration across finance, operations, human resources, and compliance teams. They ensure that sustainability principles are embedded in the entire decision-making ecosystem.

Leadership in sustainable finance thus extends beyond technical knowledge — it requires communication, negotiation, and change management skills. Professionals who can align diverse stakeholders around sustainability objectives demonstrate the multidimensional leadership essential for modern corporate governance.

Continuous Learning and Adaptability

ESG standards and sustainability regulations continue to evolve, reflecting emerging global priorities such as biodiversity preservation, supply chain ethics, and circular economy models. Professionals must therefore engage in continuous learning to stay ahead of developments.

Regularly updating knowledge through new courses, certifications, and seminars ensures that sustainability expertise remains relevant and actionable. Lifelong learning in sustainable finance reinforces an organization’s capacity to innovate and maintain leadership in responsible business practices.

Conclusion

Sustainable finance and ESG education represent more than an academic trend — they are a foundation for the future of responsible capitalism. As investors, regulators, and consumers demand greater accountability, finance professionals must evolve into stewards of sustainable value creation.

Courses in sustainable finance and ESG empower professionals to integrate environmental, social, and governance considerations into every aspect of decision-making. They cultivate not only technical proficiency but also ethical judgment and strategic foresight.

For corporations, investing in ESG education builds internal capability and credibility. For individuals, it offers a pathway to meaningful, impactful careers that unite profitability with purpose.

Ultimately, sustainable finance education is about redefining success. It equips professionals to lead with integrity, manage complexity, and build financial systems that serve both people and the planet. In doing so, it transforms finance from a vehicle of short-term gain into a force for long-term resilience and shared prosperity.