Mergers and Acquisitions M&A Finance Courses Navigating Cross Border Transactions and Regulatory Challenges

Mergers and Acquisitions (M&A) Finance Courses: Navigating Cross-Border Transactions and Regulatory Challenges

Introduction to Mergers and Acquisitions M&A Finance Courses Navigating Cross Border Transactions and Regulatory Challenges

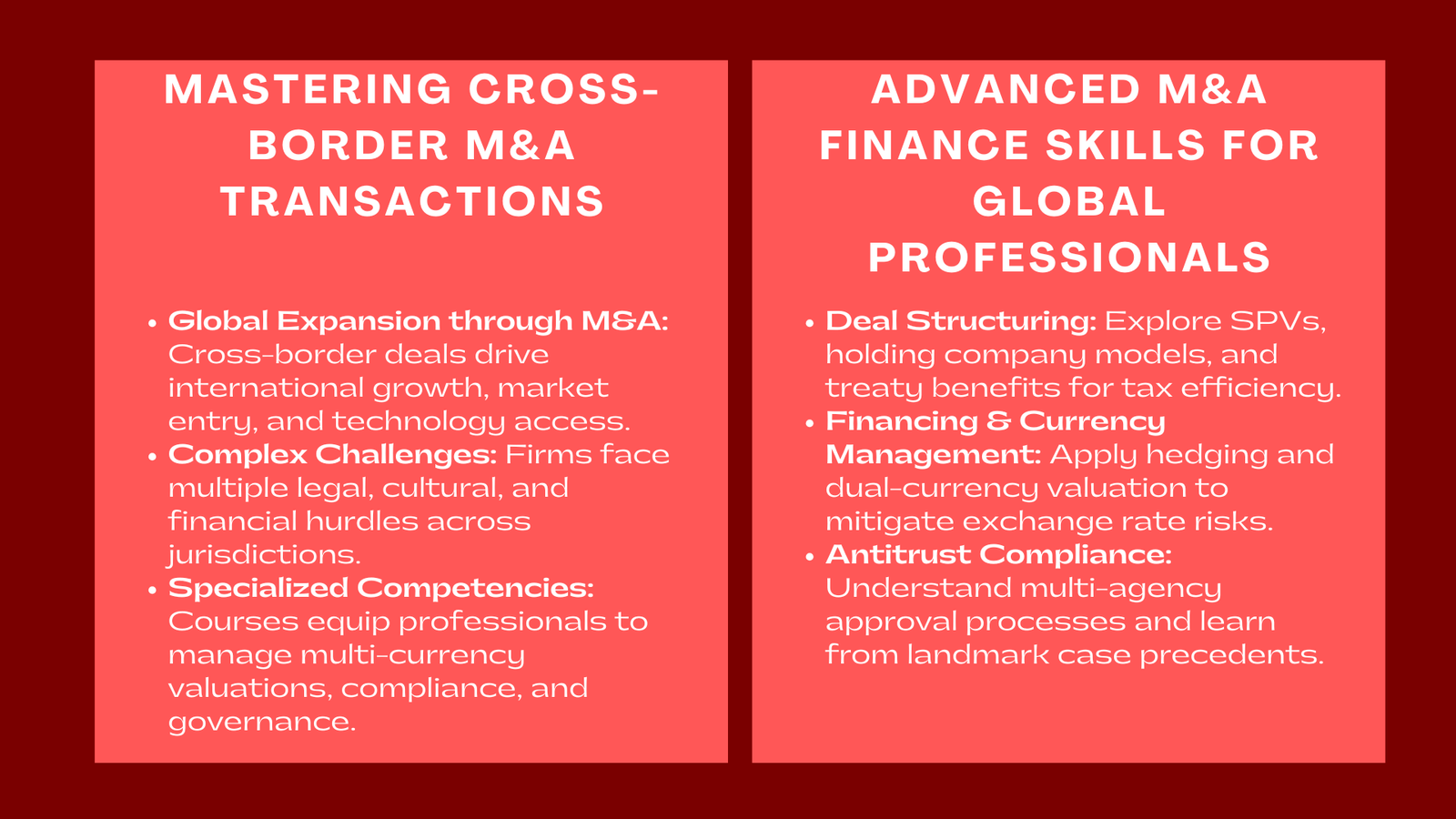

Cross-border mergers and acquisitions (M&A) have become an unavoidable way in the contemporary global economy where firms aspiring to international growth, market penetration and technological development desire to venture ventures. Nonetheless, international deals are also associated with a plethora of regulatory, cultural and financial challenges that require expert knowledge. Dealers operating in cross-border transactions have to maneuvers through a variety of legal systems, international investment systems, antitrust systems and taxation- sometimes across more than one jurisdiction at a time.

Progressive M&A finance programs, which emphasize cross-border deals, are set up to furnish the knowledge and strategic sense of the leadership team in the field of finance, legal counsel, and corporate planning to deal with such issues. This paper discusses the role of such programs, along with advanced financial management courses Singapore corporate finance, in equipping the professionals to deal with multi-jurisdictional compliance, regulatory risk, and deal execution in cross-country settings.

1. The Rise of Cross-Border M&A

1.1 The process of globalization and market expansion has been facilitated by the internet.

Through the agent of globalization, M&A activity has evolved as a domestic growth tool to cross borders as a strategic requirement. Acquisitions in foreign markets are done by companies in order to venture in new and promising markets, acquire supply chain benefits and domesticate revenue streams. However, every overseas venture has to be adjusted to different regulations, legislation and financial systems.

1.2. The Need of Specialized Competencies.

The more cross-border activity one has, the more professionals with international finance and compliance training are required. An international mergers and acquisitions course bridges this gap by teaching participants how to evaluate foreign market risks, manage deal structures across currencies, and ensure compliance with both domestic and international authorities.

2. Understanding Multi-Jurisdictional Complexity

2.1 Divergent Legal Frameworks

The various jurisdictions have their corporate, antitrust, and securities regulations. Indicatively, a merger that is in accordance with the United States law might be subject to antitrust investigation in the European Union or restrictions to foreign investment in China. M&A finance courses educate the participants on how to perform jurisdictional mapping, which involves analysing all systems of law involved to determine the points of conflict, overlap, and compliance requirements at the beginning of the deal.

2.2 Barriers to Culture and Governance.

On top of regulation, cultural disparities in negotiation style, governance expectation and disclosure standards can kill deals. Transformative training aids the professionals to realize how to close such gaps by using effective communication, cross-cultural management and alignment strategies with the stakeholders.

3. Regulatory Due Diligence in Cross-Border Deals

3.1 Identifying Regulatory Risks

Regulatory due diligence is a cornerstone of cross-border transactions. It involves evaluating government approval processes, national security reviews, and compliance with anti-bribery or anti-money-laundering laws. Participants in cross-border M&A finance training programs learn how to assess exposure to regulatory delays or prohibitions and incorporate mitigation plans into deal timelines.

3.2.1 Managing International Legal Teams.

It can be very difficult to handle a cross-border transaction, which requires more than one legal and financial advisory firm to be involved. Standardization of coordination patterns is highlighted in training modules, where all teams are to be operated within a single goal, and the specifics of the region are to be taken into account. Students get to exercise trying to draft global regulatory checklists and aligning transaction documents across jurisdictions.

4. Organizing Cross-border Transactions.

The jurisdiction and entity are determined by the jurisdiction of the host country along with the form of company that is incorporated therein.

4.1 Jurisdiction and Form of Company.

The location of a deal may have a great effect on its tax efficiency, regulatory regulation, and enforceability. The professionals should learn about the holding company structures, offshore special purpose vehicles (SPVs), and treaty benefits. Courses are used to offer practical simulation in the design of structures that would maximize tax exposure and yet remain within the local law.

4.2 Financing and Currency Issues.

The deal financing is also complicated by exchange rate volatility, financing constraints, and divergent capital market regulations. The participants are taught to use hedging techniques, dual-currency model of valuation and financing which helps in minimising foreign exchange risk. These technical modules train the finance workers to assist the CFOs and treasurers to organize robust multi-currency deals.

5. Finding Your way in the Antitrust and Competition Law.

5.1 International Review Process on antitrust.

Antitrust laws discourage monopoly in the market and ensure healthy competition. Large cross-border mergers have to seek the consent of various competition bodies such as the U.S. Department of Justice, the European Commission, national regulators in the target markets, and so on. The training programs will explain to the participants how to follow multi agency approval schedules, filing specifications, and pre-merger notification regulations.

5.2 Case Studies and Precedents

Case-based learning enables professionals to study high profile mergers that experienced regulatory backlash- e.g. blocked telecommunications mergers or blocked airline mergers. These cases help people to better appreciate the way regulatory agencies perceive market concentration, consumer injury, and pricing power.

6. Accounting and Taxation Problems.

6.1 Transfer Pricing and Withholding Taxes.

International transactions cause complicated tax consequences, both in the form of transfer pricing and withholding taxes on interest and dividends. The courses educate on how to model after tax cash flows and how to find tax efficient structures. Through a synthesis between accounting and the tax consideration, the professionals are taught how to achieve the maximum value at all levels of compliance.

6.2 International M&A Accounting.

The various accounting standards of IFRS, US GAAP, and local GAAP have an impact on the reporting of acquisitions. The participants study the varying purchase price allocation, goodwill recognition and currency translation existing in the various regimes. Knowledge of such differences will guarantee proper financial reporting in the event of an acquisition.

7. Integrating Post-Merger Cross Border.

7.1 The seventh principle concerns the balancing between policies and reporting.

After a deal is made, actual problem starts- merge financial systems, reporting systems and governance policies. The cross-border integration should involve harmonizing the internal control with international standards of compliance. The training programs provide the participants with the mechanism to harmonize integration in various regulatory environments.

7.2 Human and Cultural Integration Management.

Cultural integration may be even more important than financial consolidation. The case discussions demonstrate the impact of the misalignment of leadership or the lack of communication to the realization of synergy across borders. Participants get to learn structures of change management, culture compatibility, and post-merger performance maintenance.

Conclusion

International M&A transactions are a challenge and a chance. They enable organizations to explore a new market as well as a new technology but also require strict adherence, cultural acumen, and technical expertise. The professional will also be equipped with the ability to dominate the global environment by taking advanced courses in M&A finance, which is all about international deal-making, where the professional integrates legal, financial, and strategic understanding in order to handle international dealings.

The participants develop the skills to be able to foresee problems before they emerge through an exhaustive module on valuation, structure, regulation and integration. In a globalized capital and competition environment, the cross-border M&A finance is no longer a matter of choice, but a characteristic of international finance practitioners.