Treasury and Cash Management Courses for Finance Teams

Treasury and Cash Management Courses for Finance Teams

Introduction

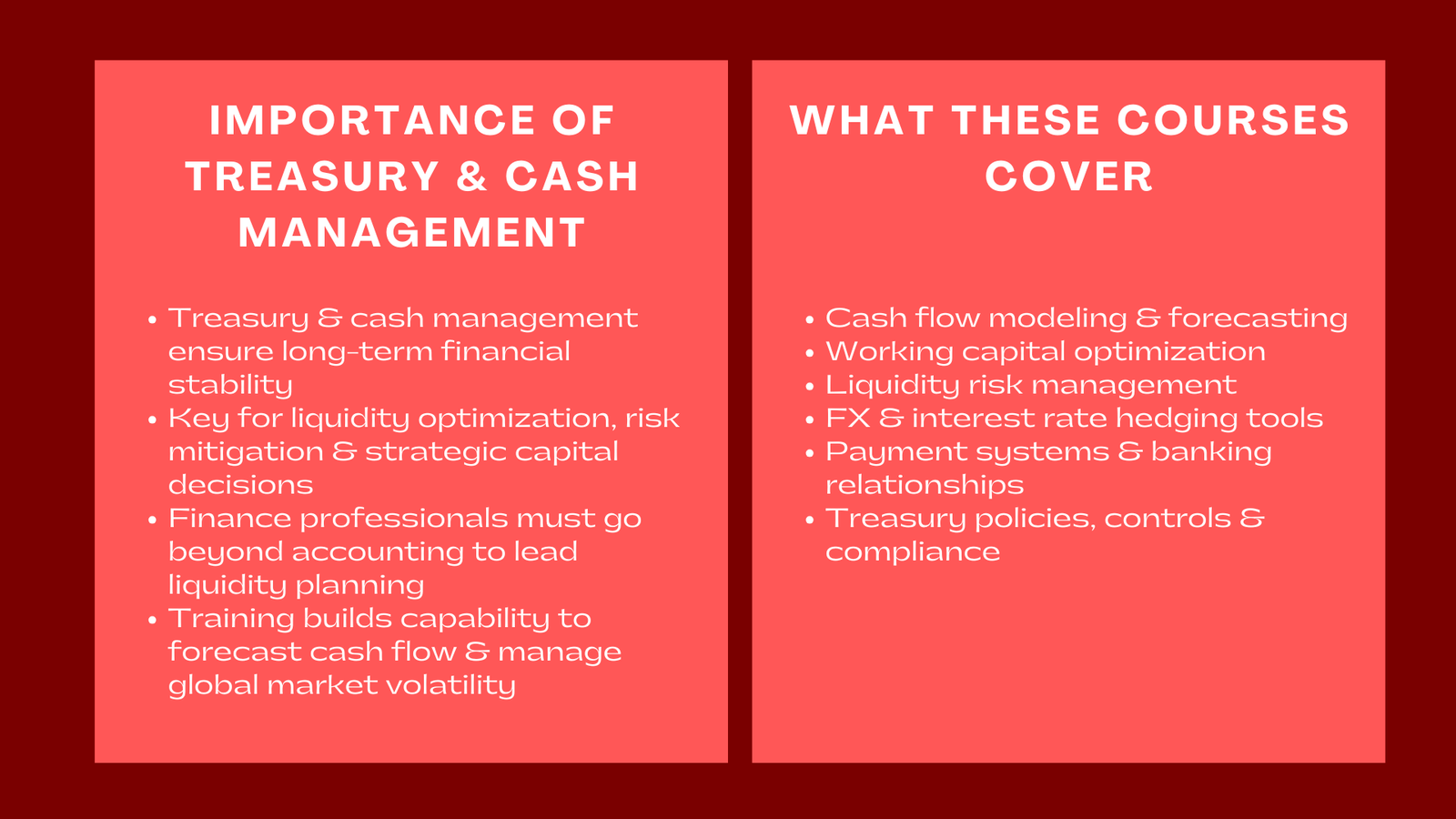

Financial stability of any successful organization is based on treasury and cash management. Liquidity management, cash flow management, and financial risk management are important tasks that determine the efficiency and success of an organization in the long-run. With the increasing dynamism of global markets, accountants need to delve deeper than mere accounting in order to emerge as leaders in managing liquidity, cash optimization and cash forecasting. This is why many treasury departments choose a professional finance course Singapore for treasury teams to enhance their expertise and stay competitive.

Here comes in Treasury and Cash Management Courses Finance Team. Such programs offer systematic education which helps increase technical expertise as well as strategic acumen. Learning how to operate treasuries, finance professionals are the key drivers of decision enhancement, liquidity management, and financial stability.

The Value of Treasury and Cash Management.

Treasury management forms the nerve of financial system of an organization. It makes sure that the company has always enough liquidity to service the obligations of the company as well as optimize on excess cash returns. Effective management of treasury assists in aligning short term cash requirements with long term investment objectives in sustaining and growing the business.

Cash management, on the other hand, is concerned with the day-to-day operations to ensure there is a smooth flow of money in the business- receivables collection, payable management, and optimal cash positions. A bad cash management may result in the absence of opportunities, insufficient liquidity, and unnecessary borrowing expenses.

Combined, treasury and cash management protect the economic wellbeing of a firm. Education in this field will enable the professionals in the field of finance to comprehend the manner of how to utilize capital effectively, how to reduce foreign exchange risk, and how to coordinate the schemes of finance with the company goals.

Treasury and Cash Management Courses What they cover.

Treasury and cash management courses are definite training programs aimed at developing the skills of liquidity management, financial planning, and investment strategy. These courses suit best finance departments in corporate and banking set ups.

The participants get a profound insight on how to deal with the cycles of cash flow, predicting the liquidity requirements, and the use of financial instruments efficiently. Topics typically include:

- Cash flow modelling and forecasting.

- Optimization of working capital.

- Liquidity risk management

- Interest rate and foreign exchange hedging.

- Payment system and banking relationships.

- Policy and internal controls in the treasury.

These courses, through a combination of lectures, simulations, and case studies, bridge the theory and practice- helping professionals to make informed decisions related to the treasury in dynamic markets.

The rationale of why corporates invest in treasury training.

The corporate treasury has had increased duties in the past years. It no longer entails cash balance management, but financial risk control, debt management and strategic funding decisions. Businesses are realizing that treasury professionals have a primary role to play in making sure that the business is financially stable particularly when the market is unsure.

For this reason, many organizations are implementing treasury operations training programs for corporate finance departments. Such programs assist teams to simplify liquidity management procedures, improve internal controls and meet changing regulatory frameworks.

By training their finance teams, companies will benefit by obtaining:

Better liquidity forecasting Professionals are able to predict funding requirements and avoid liquidity deficits.

- Less risk of financial risks: Employees are able to develop efficient hedging in relation to currency and interest rates.

- Better governance: A competent treasury team will help to adhere to the corporate finance policies and regulations.

- Increased efficiency: The smoother work of the treasury saves on transaction cost and is more efficient in capital.

Training also encourages cooperation among treasury, accounting and operations team- coordination between financial strategy and the overall business objectives.

Important Modules of Treasury and cash management training.

Cash Flow Forecasting and Analysis.

The module is devoted to developing proper cash flow models. The participants get to understand how to project inflows and outflows according to the data about operations itself, seasonal trends, and the market conditions. Proper forecasting facilitates superior investment and funding.

Optimization of Working Capital.

In this case, learners get a chance to learn how to handle the receivables, payables, and inventory effectively. There are such techniques as dynamic discounting, supplier financing, and credit management which are discussed in order to enhance the liquidity and lower the financing costs.

Internal Controls and Treasury Policy.

The participants are trained on how to formulate and execute treasury policies that set clear boundaries of authorization, duties separation, and monitoring policies. This minimizes the operational risk and increases compliance.

Interest Rate and Foreign Exchange Risk Management.

The ability to deal with exposure to FX and interest rate risk is crucial to international organizations. Such derivatives modules as forwards, swaps, and options are presented in this module-they learn to use these instruments to hedge against.

Banking and Payment Systems

Knowledge of banking relations structure and payment technologies can assist professionals to deal with bank fees, simplify operations, and provide payments security on the global level.

The Technology and Automation of the treasury.

Automation and analytics is an essential part of the modern treasury. Some of the treasury management systems (TMS), digital banking platforms, and real-time liquidity visibility data-driven tools are often covered in courses.

The benefit of Treasury and Cash Management Courses.

Enhancement of Financial Decision-Making.

Professionally developed finance departments are capable of examining cash positions correctly to enhance both the short term liquidity planning and long term capital structure decisions.

Improving Risk Minimizing Abilities.

Knowledge of hedging techniques and financial risk exposure can help treasury professionals to insure their organizations against currency volatility and market shocks.

Enhancing Operational Effectiveness.

The teams minimize the number of manual errors, enhance the accuracy of reconciliation, and speed up the financial reporting life cycle by optimizing processes and automating them.

Supporting Business Growth

Good cash management will see to it that there is money to be used in expansion, acquisition or new investments without having to borrow money without good reason.

Increasing Staff Knowledge and Keenness.

Treasury training would help to improve professional growth of the finance professionals and create better and more capable teams.

Developing a Strategic Treasury Function.

The development of corporate finance has seen the treasury being changed into a strategic business partner rather than a transactional unit. Treasury professionals are now required to deliver insights that inform business strategy, maximize the allocation of capital, and maximize shareholder value.

By enrolling in advanced cash management and liquidity training for finance professionals, participants gain the expertise to integrate treasury functions into corporate strategy. They are taught to work with the senior management, predict the need of funding and control the financial risks according to the strategic goals.

This strategic positioning takes the treasury as a value-making function and no longer a cost center. Organisations developing such treasury competencies are in a stronger position to deal with uncertainty, reinforced innovation and financial performance.

The technology role in the Treasury and Cash Management.

The fast rate of development of technology has revolutionized treasury business. The use of digital environments, like treasury management systems (TMS), data analytics and robotic process automation (RPA) is simplifying cash management processes.

Incorporating training sessions on digital treasury transformation has become the norm in modern training programs, where it is possible to learn how to use automation to ensure visibility of cash in real time, predictive forecasting and safe payment processing.

The capability of data driven treasury management does not only improve accuracy but also gives actionable insight into liquidity trends and investment performances. With the adoption of digital transformation in organizations, qualified treasury practitioners will be instrumental in the financial innovation management.

Who Attends Treasury and Cash Management Training.

The courses in treasury and cash management are recommended to:

- Managers and treasury analysts.

- Finance and accounting practitioners.

- Financial controllers and CFOs.

- Corporate relationship managers and corporate bankers.

- Risk management and corporate finance departments.

The involvement of different departments in training is also beneficial to organizations because it fosters the integration of decision-making in financial planning, operations as well as strategic management.

What the Future of Treasury Education Will Be.

With the growing interconnection of global markets, liquidity and funding is not the only way that treasury management is growing. The next stage of treasury operations is being determined by sustainability, ESG finance, and digital assets. The following training programs will be focused on the environment and risk assessment, green finance tools, and payment solutions based on blockchain technology.

The modern finance teams will be successful based on the capacity to adjust to these transformations. The constant development through specialized courses makes the treasury professionals always agile, informed and able to transform their organizations through the use of finance.

Conclusion to Treasury and Cash Management Courses for Finance Teams

One of the financial health and corporate stability pillars is treasury and cash management. By organizing training, the finance teams will be able to reinforce their liquidity, risk, and strategic capital allocation knowledge.

When investing in Treasury and Cash Management Courses of Finance Teams, organizations not only increase the efficiency of its operations and the efficiency of decision-making and governance. Due to the changes in the business environment, talented treasury officials will continue playing a crucial role in ensuring financial stability, sustainability, and prosperity.