Financial Risk Management FRM Preparation Courses

Financial Risk Management (FRM) Preparation Courses

Introduction

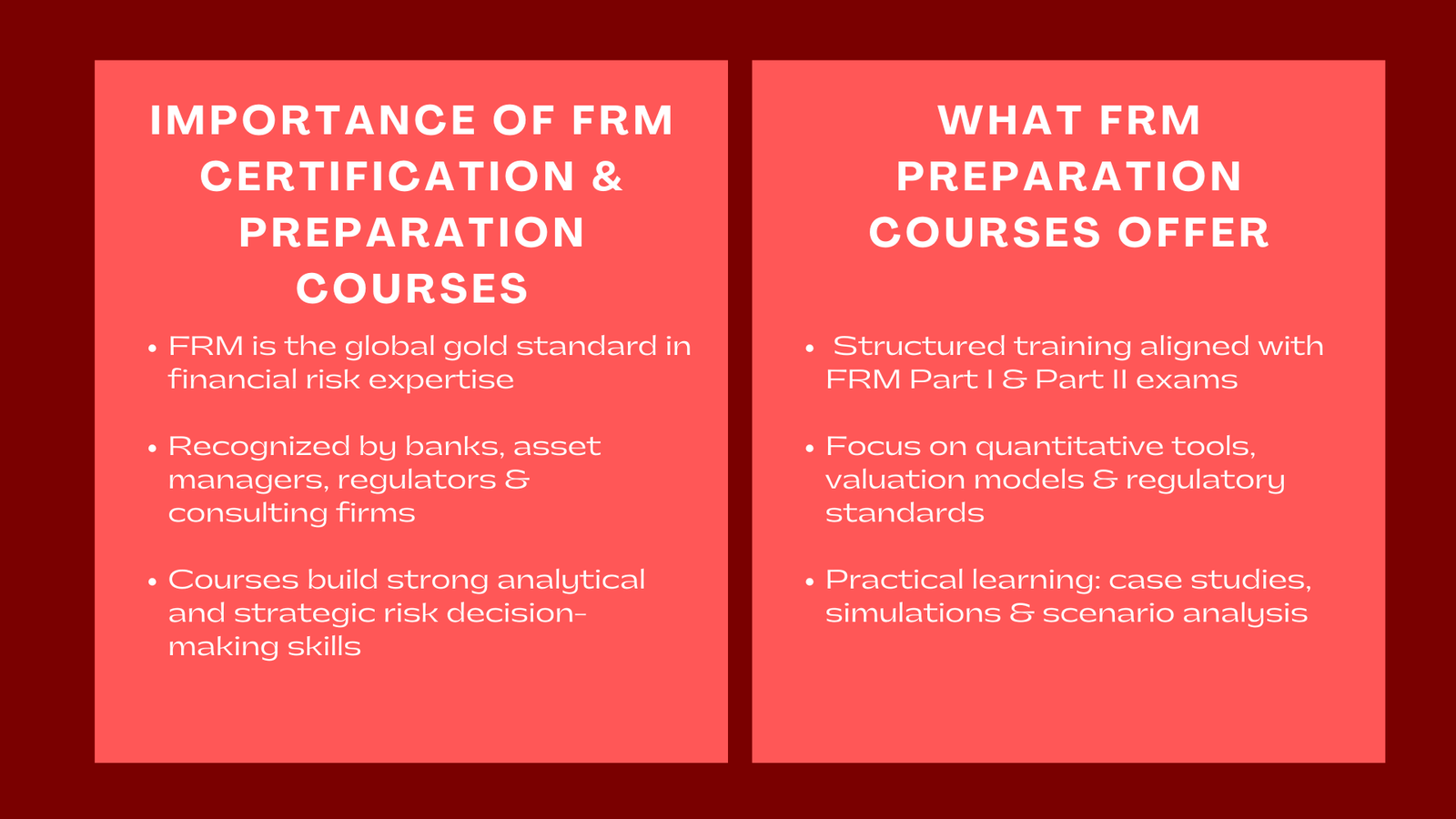

Risk is an inalienable aspect of any decision in the dynamic nature of the finance world. Risk has an effect on the protection of assets and profitability of institutions, whether it comes in form of market changes and credit exposure, or operational uncertainty. In order to successfully navigate this terrain, financial specialists are moving towards the Financial Risk Manager (FRM) qualification – a globally accepted qualification that indicates expertise in risk assessment, quantitative modelling as well as regulatory compliance.

The Preparation Courses under the Financed Risk Management (FRM) has thus become a mandatory doorway to the career advancement of any given finance professional. Such programs are not only equipping candidates with the tough FRM examinations but also build analytical, strategic and decision making skills invaluable in the unstable financial markets today, especially through finance risk management training Singapore for large companies.

The importance of FRM Certification.

The Global Association of Risk Professionals (GARP) has created the FRM certification which is perceived to be the gold standard of financial risk knowledge. It is an indicator of profound knowledge on market risk, credit risk, operational risk and investment management-all vital in dealing with uncertainty in financial systems.

Bank and asset management, consulting and regulatory employers are interested in FRM-certified professionals who can develop strong risk regimes and predict the disruption possibilities. The need to have qualified risk managers is ever on the increase as financial systems are becoming more complex and interdependent.

The candidates are not only provided with technical knowledge necessary to become certified after completing an FRM preparation program but also with a strategic mindset of how to identify, measure, and alleviate financial risks.

Introduction to FRM Preparation Courses.

Financial Risk Management preparation courses are extensive training programs, which are structured based on the two part of FRM exam. These training sessions aim at enhancing the knowledge of the candidates on the financial theory, quantitative tools, and practical applications in risk management.

Generally, the preparation programs of FRM include:

- Quantitative analysis and financial mathematics.

- Valuation and risk models

- Measuring and dealing with credit risk.

- Liquidity risk and operational risk.

- Financial market problems at present.

- Investment management and risk management models.

Courses can be delivered in the form of online modules, face to face workshops or a hybrid program depending on the institution. The relevance of FRM courses to organizational goals is also taken by many corporate training providers whereby courses are tailored to meet the needs of a team of workers in a financial, treasury, or audit department.

The Increasing Managerialists Demand of FRM Skills.

The ability of corporations to enhance their risk governance structures is put under extreme pressure by the changing nature of regulatory demands and the global financial unpredictability. The recent market disruptions and the 2008 financial crisis highlighted the need to have competent professionals who can identify and deal with sophisticated risks.

The companies that value FRM-certified talent are in better positions to help them stay afloat and not lose investor confidence. Structured programs help risk practitioners to develop analytic rigor and regulatory acumen that amplify corporate decision-making.

This has made financial risk management training for banking professionals a critical investment area. Such training is not only considered by institutions as the preparation of exams but also as the development of internal capacity in risk analytics, stress testing, and compliance oversight.

Organization and Learning Outcomes.

FRM Part I – Risk Management Basics.

Part I provides the background by paying attention to the basic principles of risk, quantitative analysis, financial markets, and products. Applicants are taught mathematical services to evaluate market volatility, investment exposures, and pricing models.

FRM Part II – Applications of risk management.

Part II uses these foundations to practical risk management situations. Some of the topics covered are credit risk modeling, measurement of market risk, liquidity management, and operational risk frameworks. It also addresses the current topics like FinTech, cybersecurity, and environmental risk.

Students who have graduated through such programs develop:

- Capacity to analyze complicated financial information to make decisions.

- Knowledge of the international regulatory standards (Basel III, IFRS 9, etc.).

- Enterprise risk frameworks skills to be developed.

- Skill in quantitative instruments of prediction and analysis.

- The major advantages of the FRM Preparation Programs.

- Increased Professional Credibility.

The FRM credential is an indication of high competency being awarded internationally in the world of finance. It separates skilled individuals in a competitive labor market particularly in positions in risk management, treasury and regulatory compliance.

Applied Knowledge and Reality Learning.

FRM courses are not just textbook-based quality. They teach risk assessment skills that are practical by use of case studies, data-driven simulations and the analysis of a scenario. This methodology makes sure that the participants can implement the concepts in the workplace issues.

International Answers and Professional Movement.

The credential has over 60,000 certified FRMs across the globe, and this aspect opens up global career prospects. The asset management firms and consulting agencies have a smooth transition between the roles of the professionals at the banks.

Corporate Risk Strategy Alignment.

Investing in FRM preparation is not only a question of employee development to the companies, but risk resilience. Formally trained employees in FRM are able to make contributions to the stress testing models, capital adequacy analysis, and regulatory reporting more accurately.

Preparations by Professionals to the FRM Exam.

To succeed in the FRM exams, one has to study in a systematic manner and schedule his/her time. The training providers that are reputable, provide guided study plans, mock exams and progress checks so that the candidates are kept on track.

Other programs provide flexible learning paradigms which are a combination of instructor based training with self-pacified online courses. This hybrid model will suit the busy schedules of working professionals who have to juggle between the preparation of exams and their work.

Collaboration is also the key feature of the best programs–students have an opportunity to interact with each other in online communities, discussion boards and in group problem-solving tasks, which helps to make their learning process more interesting.

The Implication of Technology in the Contemporary FRM Training.

Online learning tools have transformed the way of preparation that candidates do to the FRM exams. Adaptive quizzes, interactive dashboards, and performance analytics enable the learners to assess progress and focus on the weak areas effectively.

Sophisticated platforms also have risk simulation software, which helps participants to test quantitative models and stress situations in real time. This practical method is a reflection of the difficulties encountered by professionals in contemporary risk management jobs.

In addition, AI-based tutoring systems provide customized guidance to each learner, and course content is tailored to his or her strengths and weaknesses.These innovations make advanced FRM online preparation programs increasingly popular among busy finance professionals.

Who is to study Preparation Courses of the FRM.

FRM courses are intended to be taken by people who should develop their knowledge in risk management more, and these are:

- Risk analysts and managers

- Portfolio managers Investment bankers.

- Finance and treasury experts.

- Internal compliance officers and auditors.

- Students taking higher degrees in finance.

Team training is also beneficial to the corporate teams when several employees take up FRM training, since enhanced knowledge base on risk management in the enterprise is enhanced.

The Strategic Value to Organizations.

The organizations sponsoring FRM preparation programs show that they are interested in professional excellence and regulatory compliance. Certified employees introduce quantifiable benefits in corporate governance, internal control system, and accuracy of financial forecast.

With the introduction of FRM-qualified professionals to the risk committees and strategic planning units, the companies will be able to predict the probable disruption in advance, match the allocation of capital with risk tolerance, and retain the trust by stakeholders.

In other industries where FRM-certified employees are required like banking, insurance and asset management, the FRM certification of their employees may also be used as a differentiator when interacting with regulators and institutional clients.

Conclusion to Financial Risk Management FRM Preparation Courses

The demand of skilled risk professionals has never been so high as the financial systems are becoming more and more complex. FRM preparation courses provide the individuals and the organizations with the tools and strategic expertise to detect, analyze and cope with financial risks efficiently.

Through quality training, professionals can have an advantage in the international financial landscape, whereas corporations develop strong teams that are able to withstand uncertainty with confidence. Finally, the Financial Risk Management (FRM) Preparation Courses are the key to the gap between theory and practice of financial stability- preparing the future generation of the global risk management leaders.