Financial Modeling Courses for Investment Banking Careers

Financial Modeling Courses for Investment Banking Careers

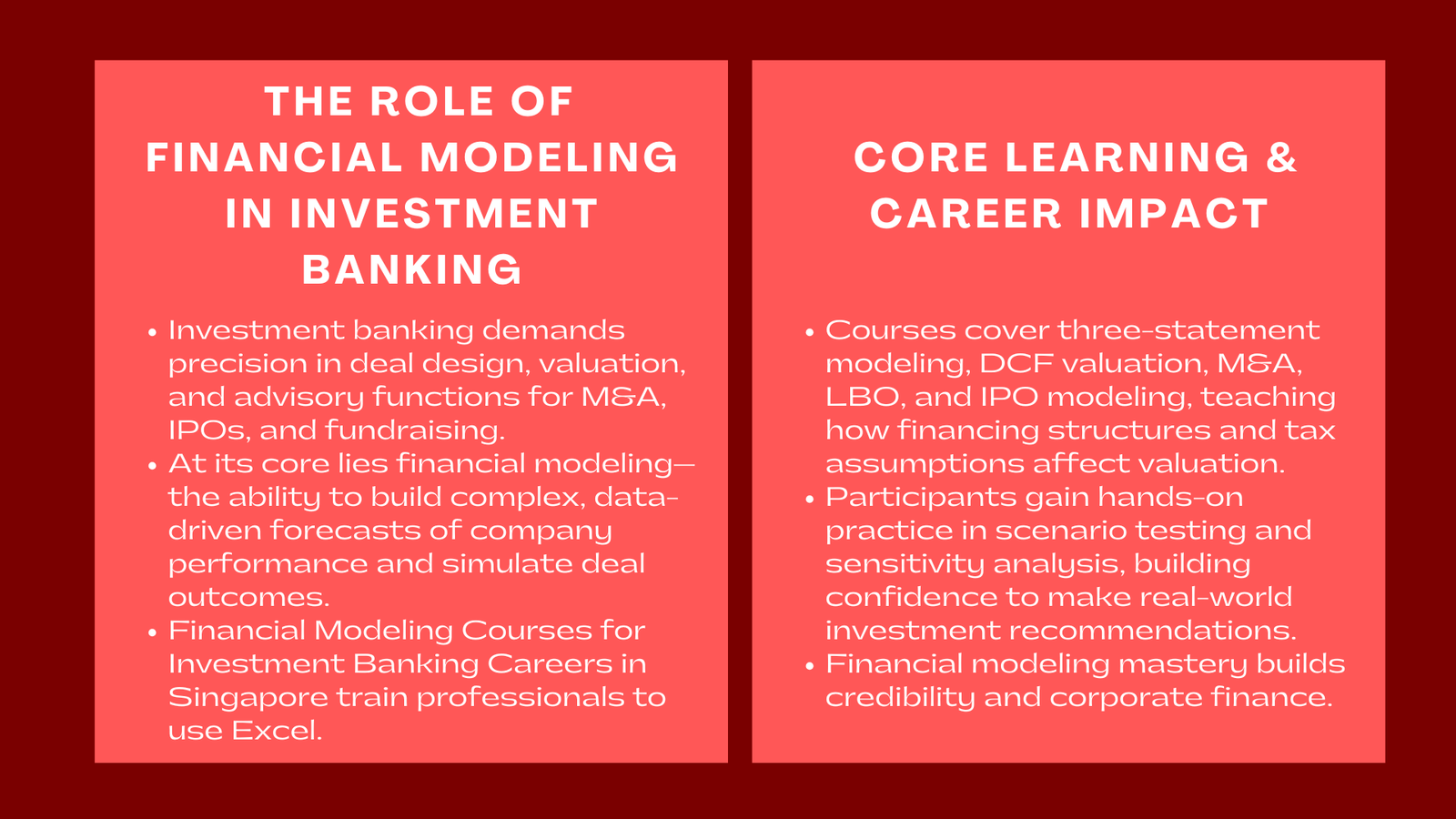

Investment Banking is one of the most competitive and intellectually challenging fields of finance. Deal doctors design deals, value companies and advise clients on deals, mergers, acquisitions and fund raising. At the heart of these responsibilities is financial modeling – the ability to design complex and dynamic pictures of the company’s financial performance and predict the future based on the past. At the core of these activities lies financial modeling — the technical skill of building complex, data-driven models that project a company’s performance and simulate potential financial outcomes.

Investment banking and real-life deal making Financial modeling courses for investment banking careers Singapore are designed to facilitate real world application of the knowledge acquired through financial modelling courses for investment banking. They understand how to use Excel and other analytical tools in order to perform valuation, scenario analysis, and transaction modeling in an accurate and confident manner. By mastering these tools and frameworks, aspiring investment bankers not only gain technical expertise but also develop the strategic mindset required to evaluate opportunities, mitigate risks, and drive value creation in global financial markets.

What Investment Banking Financial Modeling Covers

These courses start with reviewing the basics of accounting, finance and valuation, and then move on to the specific modeling techniques linked to a transaction. Participants learn how to build models of three financial statements (income statement, balance sheet and cash flow), how it binds in a dynamic way and how to build a forecast that reflects market conditions. Participants learn to build fully integrated three-statement models—linking the income statement, balance sheet, and cash flow statement—to ensure that all financial data flows dynamically and accurately across the model. This process teaches how to construct realistic forecasts that reflect market trends, operational drivers, and economic conditions.

More advanced modules include merger models (M&A), leveraged buyout (LBO) models and initial public offering (IPO) valuation models. Each type of model has its own assumptions, drivers and outputs that demand detailed knowledge of corporate finance principles, each requiring a deep understanding of deal structures, financing assumptions, and valuation mechanics. Students learn to interpret the implications of financing choices, tax structures, and how to learn financial modeling for mergers and acquisitions and valuation analysis of capital costs on valuation outcomes.

Learners also get practical exposure to using sensitivity analysis, scenario testing and DCF valuation to assess deal viability and risk. These skills are essential in order to create client-ready financial materials and investment recommendations.

Why Financial Modeling Skills Are Essential in Investment Banking

Investment bankers use financial models to assist them make multi-million dollar decisions. Whether advising on a merger, structuring debt or valuing equity, accuracy is of paramount importance. A single slip of the modeling pen can make a deal look all wrong and undo it. In such high-stakes environments, even a small modeling error can distort valuation outcomes, misrepresent deal feasibility, and potentially derail entire transactions.

By learning financial modeling, analysts and associates develop credibility and trust with clients and upper-level bankers. In addition, working proficiently makes people rise faster as they can contribute effectively on their first day of work. This proficiency often accelerates career progression, as professionals who can deliver meaningful insights from day one are invaluable assets to their teams, especially those who have completed finance modelling and valuation training Singapore, which equips them with the technical and analytical expertise required to excel in demanding investment banking environments.

These courses also enhance problem-solving and analytical thinking, skills that are highly prized not only in banking, but throughout the entire finance-related sphere such as private equity and venture capital as well as corporate strategy. In essence, mastering financial modeling equips finance professionals with the analytical precision and strategic foresight necessary to excel across the broader financial industry.

Conclusion

Financial modeling courses for investment banking careers are a must for anyone looking to go into or advance in the investment banking industry. They transpire practical skills from an abstract theoretical finance subject to day-to-day action in major financial places. These programs bridge the gap between theoretical finance concepts and their practical application in real-world deal-making, equipping learners with the tools and confidence to perform under the demanding pace of global financial markets.

By learning to organize, analyze, and translate intricate fiscal information, specialists determine the advantage to excel in an industry that is characterized by precision and performance. For ambitious people looking to create their career within investment banking, financial modeling is not something that one learns just for fun – it is the cornerstone of professional success. Mastery of this skill demonstrates not only technical proficiency but also the discipline, logic, and strategic mindset that define successful bankers. In essence, financial modeling is the language of investment banking—a language every aspiring finance leader must speak fluently to thrive in this fast-paced and high-stakes industry.