Budgeting and Forecasting Courses for Finance Teams

Budgeting and Forecasting Courses for Finance Teams

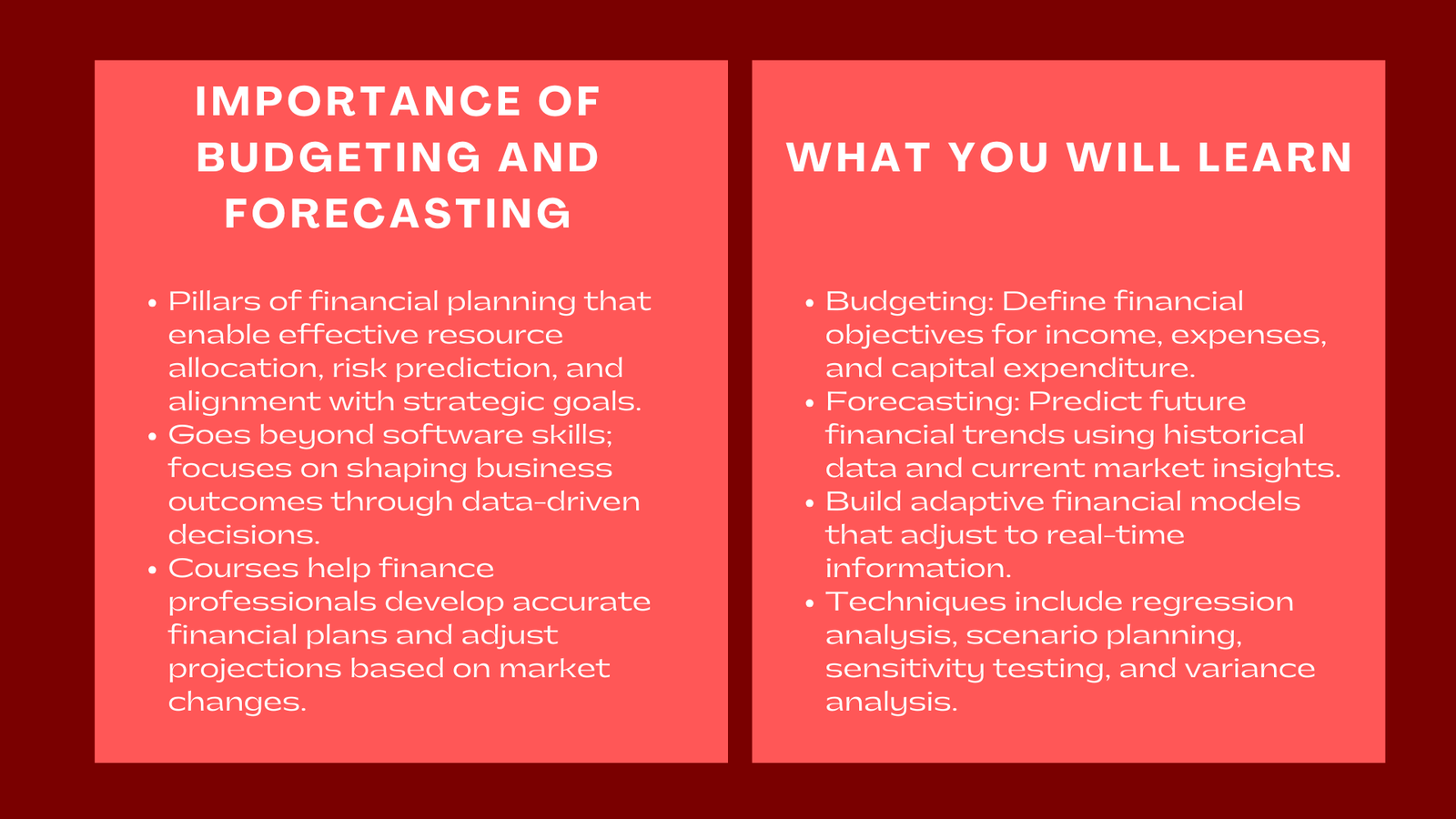

Budgeting and forecasting are the pillars of the financial planning process of any organization. They allow companies to allocate resources effectively, predict risks and realign operations to strategic objectives. For the finance professionals, it is not solely about knowing how to use software such as spreadsheets, but it is about shaping business outcomes through making data-informed decisions.

Budgeting and forecasting courses train professionals in finance to develop accurate financial plans, track performances and adjust financial projections based on changing market conditions. In a business world that is highly characterized by unpredictability, these abilities are invaluable. Companies rely on well-prepared finance professionals who are able to put numbers into context and how they impact the company’s strategy while maintaining financial stability.

The Role of Budgeting and Forecasting

Budgeting is the process of defining financial objectives in terms of income, expenses or capital expenditure, within a period of time. Forecasting, on the other hand, is a data-driven process that focuses on forecasting future financial trends based on historical data and current trends. Together, they create a feedback loop that will help organizations plan for success, and they won’t fall in a financial hole.

Budgeting and forecasting courses educate how to create adaptive financial models that adapt themselves to real-time information. Stakeholders get practical experience in budgeting from a zero-based or incremental manner and in using variance analysis to monitor performance against targets. Forecasting models examine qualitative and quantitative techniques, ranging from regression analysis, scenario analysis and sensitivity testing. The use of various tools such as Excel, Power Query and cloud-based planning platforms like Anaplan or Adaptive Insights, is also an important aspect of a lot of modern programmes. These technologies can help finance departments improve the accuracy, speed and collaboration across departments, making Financial Planning Courses Singapore highly valuable for professionals seeking practical and up-to-date skills.

Why These Skills Matter in Today’s Business Environment

Organizations nowadays are at the mercy of rapidly changing markets, inflationary winds, and an ever-changing consumer behavior. As a consequence of this, the ability to prepare agile and data-driven budgets has become a competitive edge. Those professionals that are able to anticipate trends and assess risk, as well as adjust their forecasts appropriately, are in high demand.

Budgeting and forecasting activities are also an integral part of the performance management activities. The above business transformation studies make it easier for the executives to allocate the resources strategically and find out ways to save on costs, while at the same time not hampering growth opportunities. For finance teams, this means better communication with leadership and having more impact in strategic decision-making. From a career perspective, a background in budgeting and forecasting can lead to the opportunity of high-level positions like FP&A Manager, Finance Business Partner or Chief Financial Officer (CFO), as well as a deeper understanding of how to value a business using multiples approach to enhance strategic financial decisions.

Conclusion

Budgeting and forecasting classes help the finance departments shift away from historical record keeping of figures and into informative financial management. They help bridge gaps between performance data of the operations and strategic goals, making the performance more efficient and profitable. Participants also gain the ability to anticipate market changes, model different financial scenarios, and provide actionable insights that guide executive decisions.

For those in a professional role, developing the skills in these techniques does not require managing a budget — it requires helping direct the future for their organizations through insight and foresight. By mastering budgeting and forecasting, finance professionals can influence strategic planning, resource allocation, and risk management more effectively. As long as businesses face uncertainty, accountants and finance specialists with strong financial analysis skills and budgeting and forecasting expertise will always be in high demand, positioning them for leadership roles such as FP&A Manager, Finance Business Partner, or Chief Financial Officer (CFO). These courses not only enhance technical competence but also foster strategic thinking, problem-solving, and communication skills essential for career growth in a competitive corporate environment.