Accounting and Financial Reporting Courses for Finance Professionals

Accounting and Financial Reporting Courses for Finance Professionals

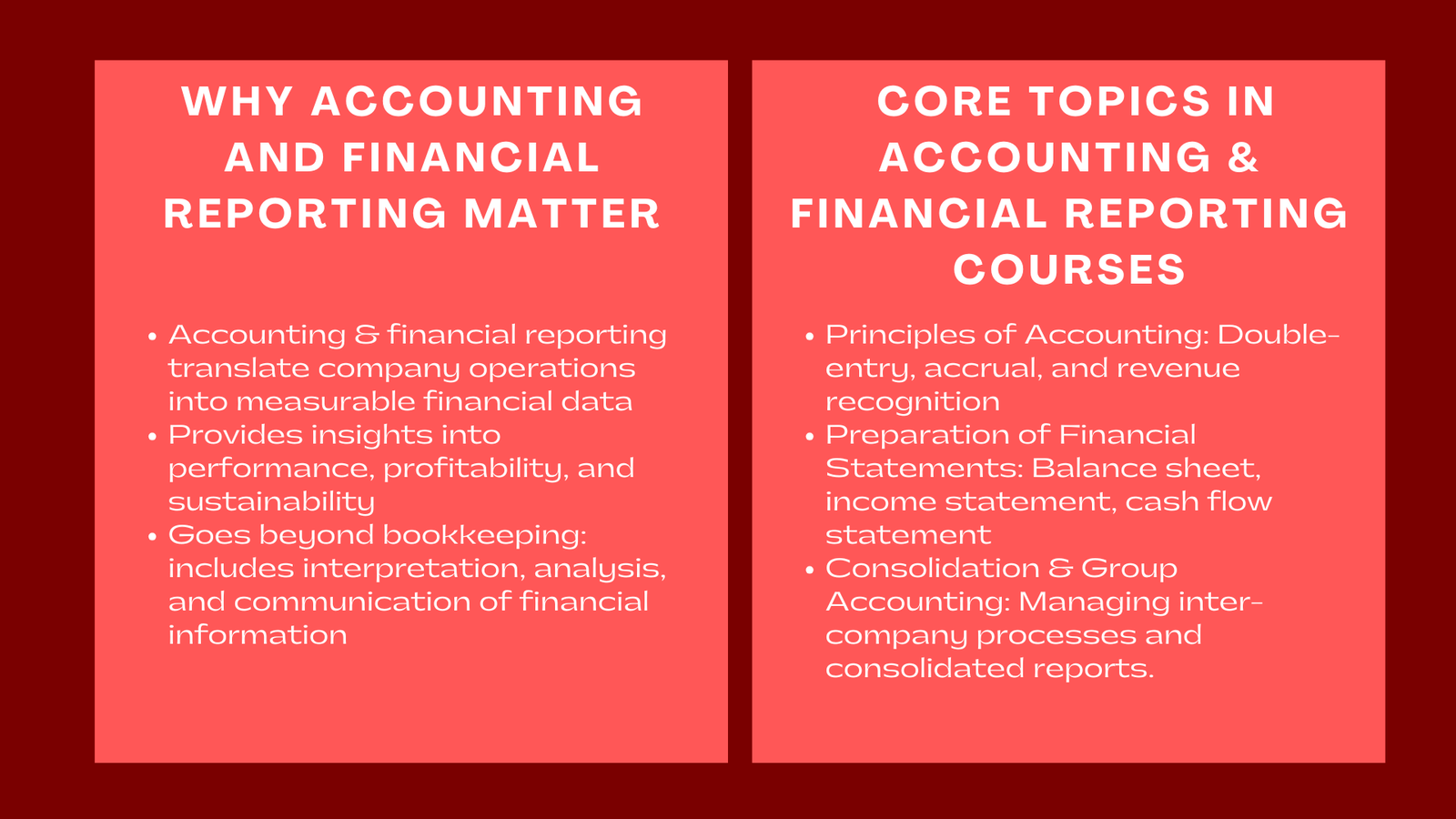

Business languages are accounting and financial reporting. They convert the operations of a company into quantifiable financial information giving insight into the company performance, profitability and sustainability. In the case of finance experts, it is important to master these skills. Accounting courses are not limited to bookkeeping but they educate on the interpretation, analysis, and communication of financial information.

In the current finance market, it is the duty of the employer to have employees who will not just be able to use numbers strategically, but also know them. The necessary ability is given by the accounting and financial reporting courses. They merge the technical knowledge and the analytical frameworks so that the professionals yield credible financial reports, confirming the compliance to the regulations, and assisting the management in planning and control.

The Importance of Accounting in Finance Careers

All significant financial choices in a firm are based on accounting. Financial statements form the foundation of investment analysis, performance evaluation, as well as the strategic planning. Financial model and valuation cannot be trusted in the absence of correct accounting information.

Accounting is important in the professional lives of people in the financial analysts, controllers, auditors, as well as investment bankers. The courses in the field assist the learner to know the technique of releasing transactions, revision of entries as well as the preparation of balance sheet, income statement and cash flow statement. They also train international accounting standards (IFRS) and local GAAP requirements such that they are compliant both inside of and outside of the country. This knowledge is a core component of financial compliance courses Singapore, equipping professionals to maintain regulatory adherence and accuracy in reporting.

Key Topics in Accounting and Financial Reporting Courses

An organized accounting program on finance practitioners is usually boarded with:

Principles of Accounting — Learn the basics of the accounting systems of doubles entry, the accrual and recognition of revenue.

Preparation of Financial Statements- Preparation of reliable and financially-compliant balance sheets, income statements, and the cash flow statements.

Consolidation and Group Accounting – Managing inter company processes and preparing consolidated financials of corporate groups.

Financial Analysis and Ratios — Are ratios that assess financial health with the help of liquidity, profitability, and solvency ratios.

Regulatory Compliance and Disclosure — Study the reporting standards i.e. IFRS, GAAP and the local accounting regimes.

In addition to the modules on sustainability reporting, integrated reporting, and digital finance systems (such as SAP or Oracle Financials), advanced programs can also have those.

Career Benefits and Applications

The accounting and reporting skills increase the credibility and flexibility in the finance careers. Analysts who are able to predict the financial information are in a better position to facilitate mergers and acquisitions as well as strategic planning. According to the accounting structures, the controllers and CFOs can implement transparency and accountability within the various departments.

Furthermore, with the age of automation and analytics, a professional who is knowledgeable in accounting and data systems are demanded. The solution to this gap is accounting courses which give the twin ability of analyzing and being accurate with the finances. After learning accounting and financial reporting, finance specialists can also advance to such senior positions as Financial Manager, Chief Accountant and CFO. Such roles involve a high level of knowledge of reporting requirements, detailing and potential conversion of financial information into business strategy, which is highly relevant for business valuation for accounting practices.

Conclusion

The courses in accounting and reporting cannot be done without by a person who wants to be an expert in the field of finance. They come up with technical basis on which any financial analysis and decision making relies. With the right balance of accuracy and strategy, such courses enable the professionals to manage complicated financial settings and create value to the players.

To the already like-minded in the field of finance, enhancement of the knowledge of the accounting department will guarantee a career expansion and flexibility in the long run. To the point, financial reporting is not only a matter of compliance, but it is about learning to build the language of analysis to advance financial leadership.