Best Leading with Finance training Singapore: From Financial Reports to Strategic Impact

Best Leading with Finance training Singapore: From Financial Reports to Strategic Impact

Introduction: Beyond the Numbers

Finance has been viewed as the science of numbers records, that is,balance sheet , income statements, and cash flow records. Although these documents are essential in the transparency and accountability, it is equal in the insights that are provided. Finance to leaders is not just a checking box audit and the compliance with the auditors and regulators. Rather, it is a strategic window, through which the unknown opportunities could be identified, the potential threats could be recognized, and smarter and evidence-based decision-making could be made. Getting leaders to think in a larger scale when interpreting numbers will enable the leaders to figure out patterns and signs that lead to competitive positioning and future development.

Going beyond financial reports would have enabled the leaders to transform lifeless figures into living plans. Numbers, with context and vision, can show whether the resources are being used with efficiency, whether or not the business model represents a sustainable underlying approach, and whether the business company is ready to survive uncertainty. In this regard, a new element transforms finance into more than an office activity; it manages to be the source of change. Incorporating the values of finance in the core of the organization would help a company to be more than whoever keeps performances, and would allow a company to fashion their course to be resilient, innovative, and successful in the long term.

Financial Reports as a Foundation

Financial documents are not just a routine paperwork but forms the basis on which the choice has to be made by the leadership. Balance sheets indicate the company assets, liabilities and structuring of equity indicating how the company was managing its resources. The income statements monitor profitability, efficiency, whereas cash flow statements give the leaders an idea of liquidity and sustainability of the operations.

Nevertheless, it is not the numbers that are the driving force of these reports but the interpretation. An experienced leader is able to read between the lines of high profitability in order to determine trends, e.g. it may increase costs that guarantee inefficient performance or decreased margins that point towards a situation of competition. Financial reports, in this regard, serve as a direction: they do not give the destination, but set the head of the leaders in the right direction to survive and continue to develop sustainably.

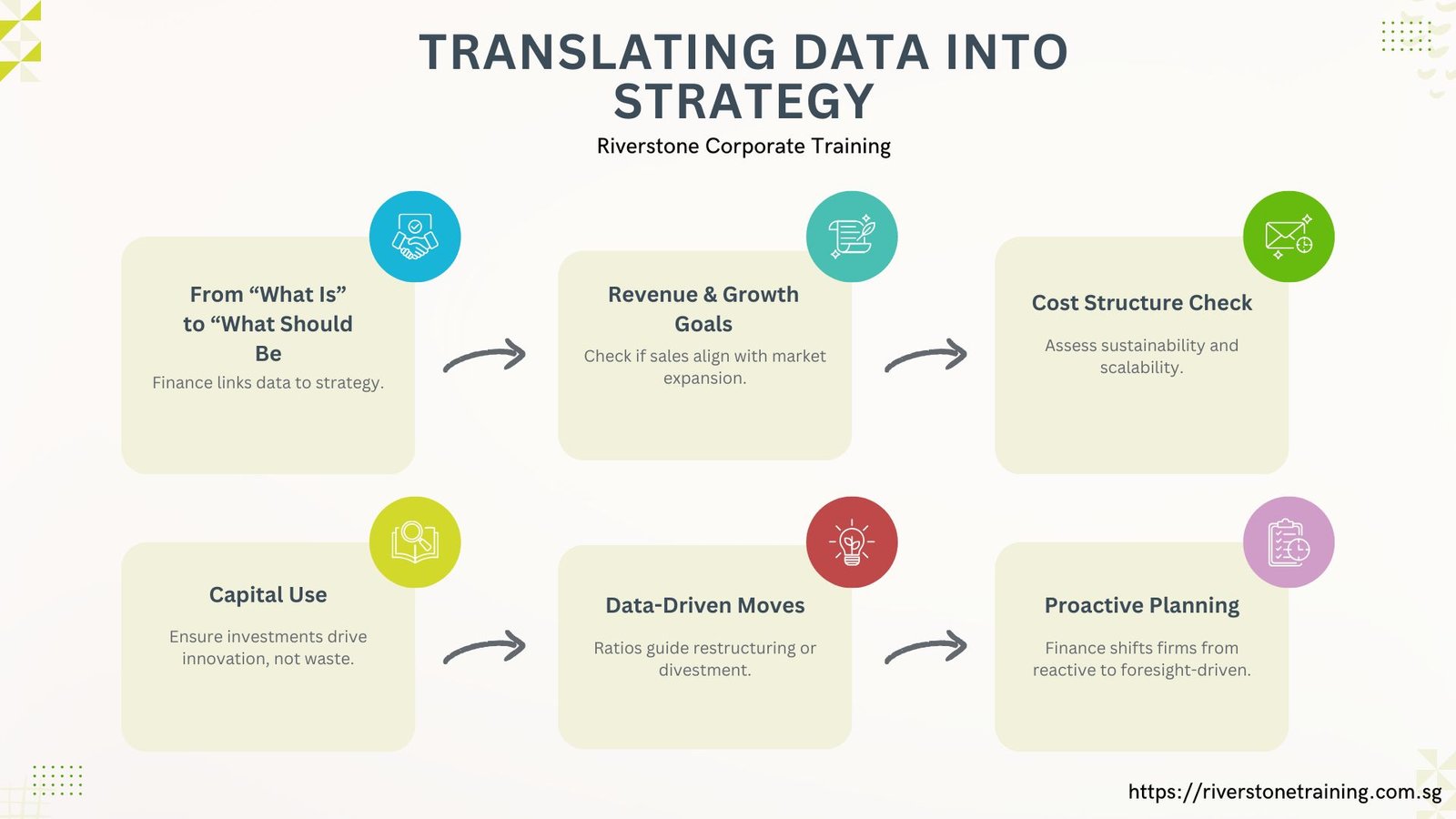

Translating Data into Strategy

Whereas financial reports give us clarity on what is, strategic impact calls to align such information with what should be. Leaders should connect financial data and corporate goals posing the following questions:

Is the increasing revenue in tandem with the long-term expansion rate in the market?

Are existing cost structures scalable, or do cost structures place a constraint on scalability?

Are capital investments important in the process of innovation or are they assets that deprive you of resources without sufficient payoff?

It is a process of translation that transforms the fixed figures into dynamic plans. As an example, comparing the financial ratios with non-performing business units might lead to the investigations of divesting or reorganizing these areas, releasing financial resources to be allocated to other sectors of higher growth value. Likewise, customer acquisition cost analysis as related to lifetime value assists leaders to optimize customer pricing, marketing and other retention strategies.

Once finance is a part of the strategic planning process, businesses no longer act in reaction to the financial performances but instead act proactively in how they make plans in regard to their futures, done so with foresight and creativity.

Finance training Singapore as a Strategic Partner

Finance in a modern organization has become more than what is at the back office in terms of functions. It has become an important strategic partner who dictates the business path in the modern world. The CFO and financial personnel co-operate with CEOs, board and operational leaders in making sure that all decisions making, such as expansion to new market, new product development, and acquisitions, are supported by sufficient financial analysis.

This role of partnership does not just limit to number crunching. Finance executives also assist in risk assessment, 50/50 assessment, and give stress-tests. Indicatively, the financial modeling would indicate before penetrating a new market whether the forecasted revenues should encourage the risks of penetration or collaboration and joint ventures would be a better way out.

Finance is a competitive source when the relationship is viewed as a strategic partner. It ensures that the mitigation of capital is not merely existence, but is actually put into practical use which brings about innovation, resilience and creation of long-run value.

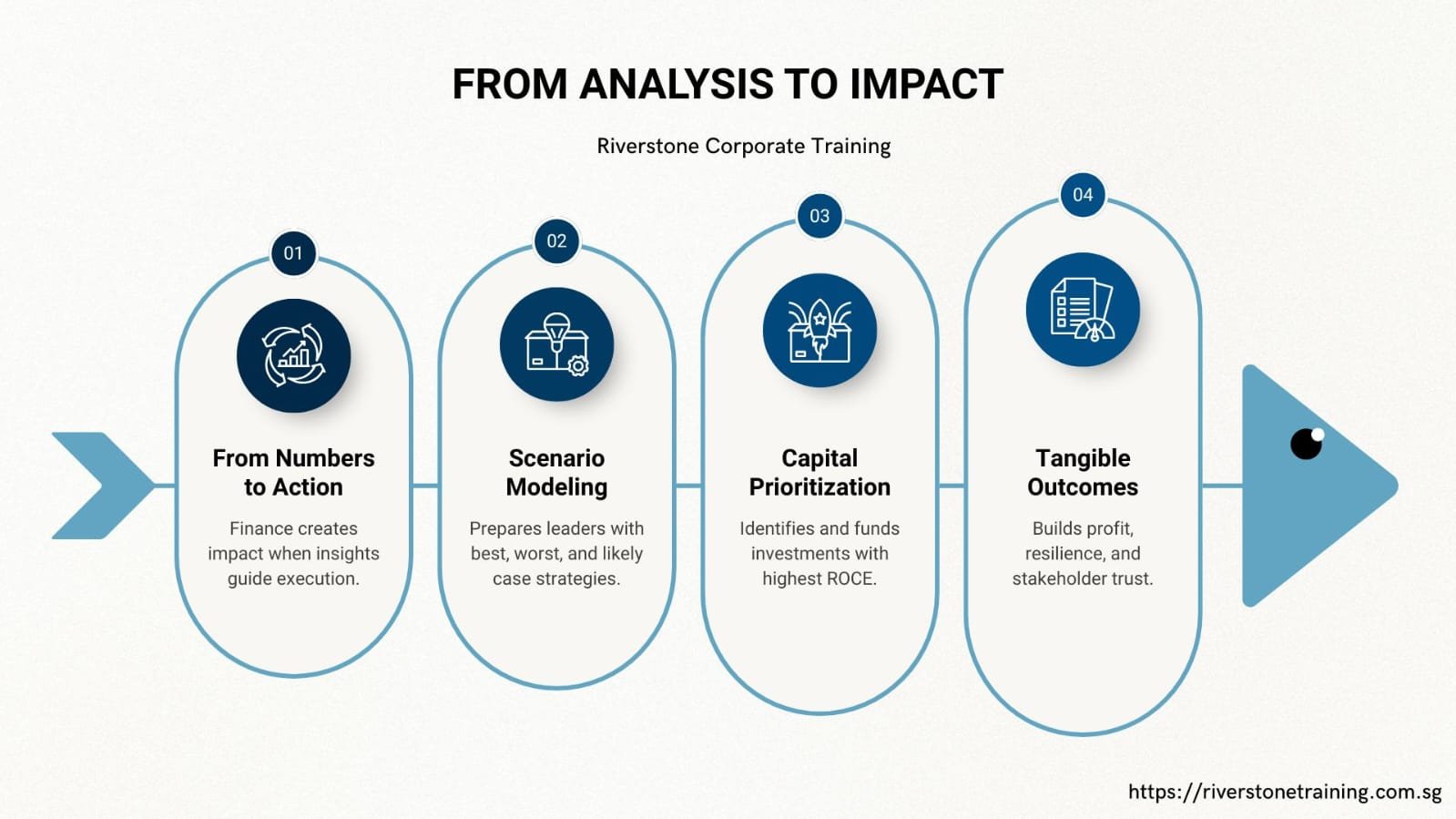

From Analysis to Impact

Take numbers alone and this is meaningless unless such numbers are worked over. Breaking the cycle of analysis and impacting reality is the final finance leadership test. Forecasting tools, scenario building, performance dash boards are the various tools that enable the leaders to bring in strategies to be tested prior to implementation and reduce risks and get maximum out of it which gives them the maximization of opportunities.

Taking a case in point, finance teams can simulate several scenarios – best case, worst case and the most probable to ensure that leaders are ready to utilize new ways of operation. During growth stages, they are able to recognize investments that have highest levels of returns on capital employed (ROCE) and decide which ones to execute.

It is proactive finance where decisions are not taken in vacuum, but instead tested on the real-life situation by stress-testing it. It uses financial intelligence to create physical measures of success more profits, increased vulnerability, and increased investor confidence. Leaders who excel this transition increase their influence making them multiple copies to believe that finance is not all about reporting performance, but creating the future.

Conclusion: Leading with Finance in the Modern Era

Being a financial leader is not about knowing finance reports, but it goes beyond that and goes on to create a strategy guide based on them. By extracting financial information, then matching it with the company priorities and integrating it in management decision-making, leaders generate clarity, agility and long-term influence.

In the current fast-changing business environment, finance leaders earn more than financial superiority about them, they earn strategy. They do not just measure valuation of trademark performance; they create it, and make the future of the finance one, which drives on permanent success and aggressive capabilities.