Best Navigating Financial Capital Management Singapore : Key Levers for Decision-Makers

Best Navigating Financial Capital Management Singapore: Key Levers for Decision-Makers

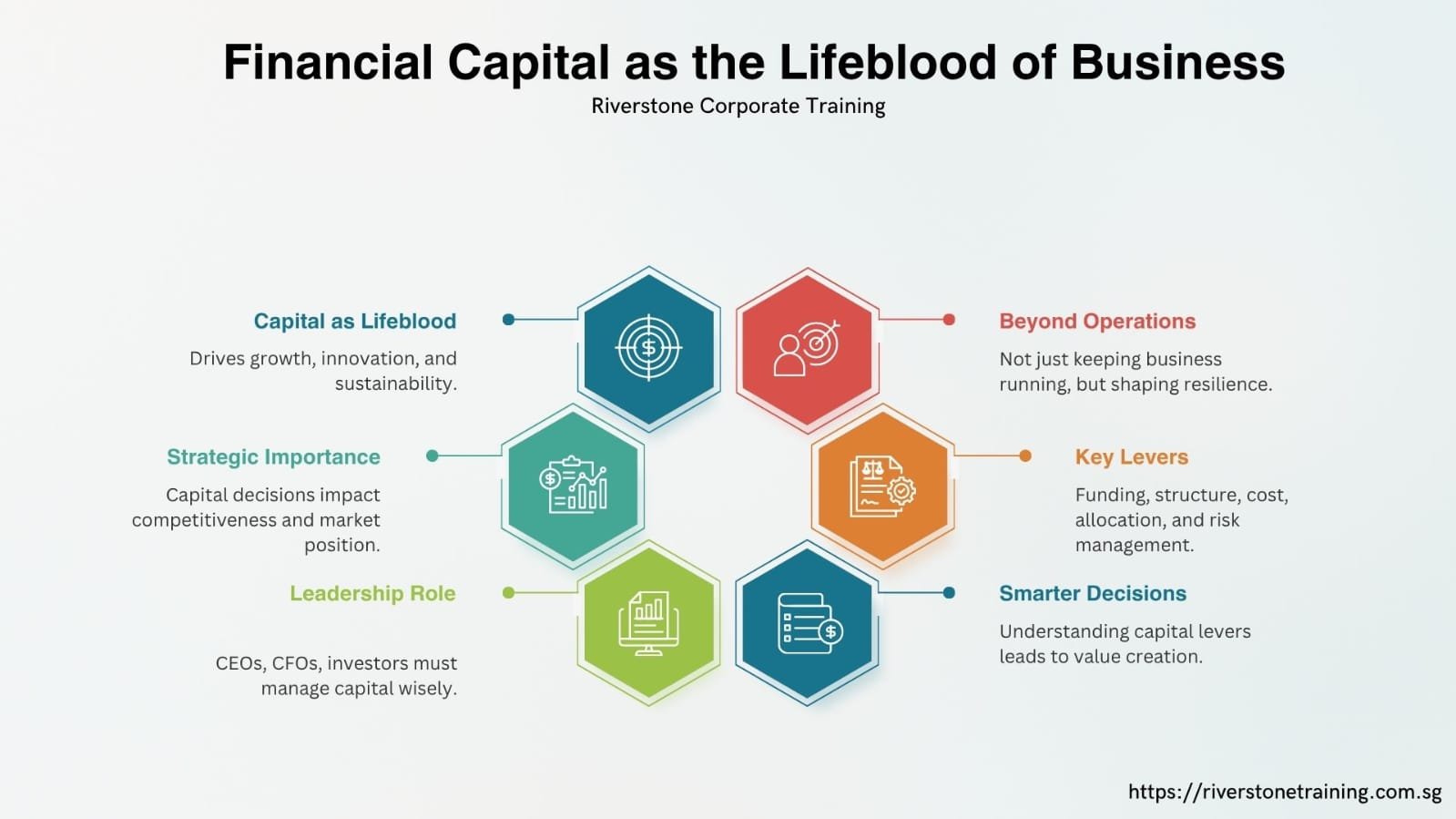

Introduction: Financial Capital as the Lifeblood of Business

Every business is sustained by business financial capital. It is used to finance the activities, provide innovation and sustainability over time. To the leaders of an organization, whether this is the CEOs of management or investors, the effectiveness at which they manage the capital can be a point of difference between upward and downward growth. The manner in which an organization acquires, organizes and distributes capital will determine how competitive it will become after resolving future opportunities and resilience.

Capital is also not just a monetary tool, but a strategic one. Good capital management will make a firm be able to embrace the opportunities and move swiftly, whereas poor capital management might expose even a profitable business.

This paper discusses the major financial capital levers, sources of finance, capital structure, the cost of capital, allocation strategy, and managing risks and how drisk ecision making financial management can leverage such to create sustained value.

Understanding Sources of Financial Capital Management Singapore

Regardless of the business, any company is subject to two major sources of funds which are equity and debt. They both have advantages and disadvantages, which should be weighed.

In equity funding, the funds are raised without the need to be recouped but with the drawback of watering down the ownership and decision-making authority. Quite frequently, it is appealing to younger firms that should be flexible to re-invest into the business development. The disadvantage is that it entails distribution of the future earnings to new shareholders.

Debt financing does not change ownership except to introduce the element of repayment and interest payments. Debt can be an effective tool of growth and used in prudent ways like when the rate of interest is profitable and cash flows are predictable. Nevertheless, excessive dependence on the debt may overstretch the liquidity and expose itself to failure during recessions.

As in the case of most companies the mix is a combination of equity and debt. The balance will be determined by the stage of business model inovation of financial, the state of industry and the environment of the markets. Early funding with the use of equity can not only relieve a startup of financial strain in the initial stages but it can also allow a more established company with consistent incomes to move towards a more debt-heavy approach. Diversification gives elasticity and reduction of risk.

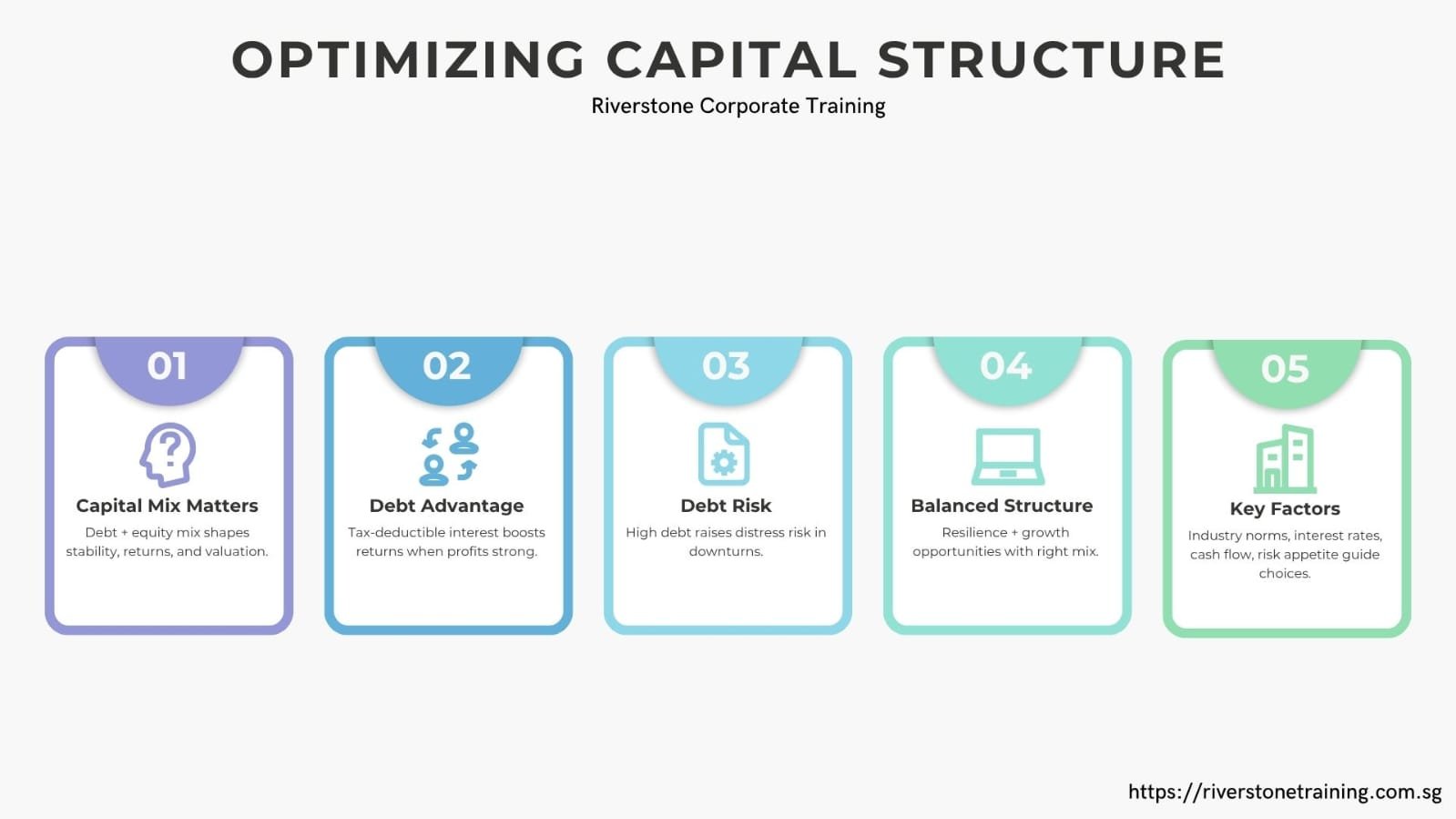

Optimizing Financial Capital Management Singapore Structure

Capital structure is an amount of debt that is taken with an amount of equity. It has a direct impact on stability, returns and valuation.

Debt costs can be used to increase returns since leverages boost the profits and interest charged is tax deductible. However, debt is a liability during the times of recession, meaning a greater risk of financial stress.

A shareholder friendly structure is less risky in terms of financial risk, and can act to dilute shareholder value. Equity does not face a pressure to repay, yet it tends to be costly as compared to debt in terms of returns that are anticipated.

Proper structure is determined by the industry standards, interest rates as well as the accuracy of cash flows that are obtained. Industries with substantial capital-intensive activity, such as real estate or utilities, can be holding higher levels of debt and technology companies frequently use equity because of unstable income.

The capital structure is well elaborated, which gives it resilience and flexibility to the company, such that it does not subsidize it to an economic crisis, but rather the company continues to take the opportunity.

Managing Cost of Financial Capital Management Singapore

The cost of capital is the lowest rate of creation the firm needs in order to please the investors as well as lenders. It is one of the obstacle rates in investment decision.

A combination of cost of equity and debt known by the proportion they occupy in the capital structure is the Weighted Average Cost of Capital (WACC). Reduction in the WACC would lead to cheaper access to funds and therefore increase growth projects by the businesses. So the increase in the WACC decreases growth and hazards a strategy to work harder or remove risk.

One way that companies can manage WACC is by ensuring that their credit rating remains excellent, their debt level is kept down as well as promoting investor confidence via transparency and performance consistency. Financing costs are kept to a minimum by reducing financing costs, increasing companies to create value.

Practically, the returns of any project yielding revenues in excess of WACC increase the wealth of shareholders. The ones that do not nullify value regardless of how attractive they might appear to the eye.

Strategic Financial Capital Management Singapore Allocation

Raising finances is not everything. The more important effort has to be made on capital allocation. Haphazard allocation may squander resources and planned allocation may lead to sustainable growth.

Leaders should not waste time in the area that will achieve maximum returns over a long period. Growth investment that could be a new set of business market value financial management Singapore Allocation, buying, or product development can turn the path of a company when done properly. Better operational advancements, such as technology or efficiency transformations, enhance competitiveness and margins.

Shareholder returns are other decisions which involve capital allocation. The companies can distribute profitability in the form of dividends or share buyback depending on the situation or even plow it back into further development. The balancing position is pegged on the growth opportunities, industry maturity, and shareholders expectations.

There must be clear governance and measures of performance. Allocation is strategically aligned; hence the businesses will not waste money, and all dollars will enhance their future competitiveness.

Risk Management and Flexibility Financial Capital Management Singapore

Risk also needs to be taken into consideration by strong capital management. Even economic changes, regulatory changes or world crises disrupt the most well-planned strategies.

Liquidity buffers safeguard institutions when there is a downturn in order to maintain them till the business needs can be met. It removes dependence on any particular source of funding or investor giving less exposure to shock. Stress testing and scenario planning are measures to aid leaders to be ready to adverse conditions in place when they arise.

They also need flexibility. The ability of companies to react fast when chances arise has been determined by agile capital structures which benefits business organizations by allowing prompt reaction either by means of acquiring a rival company, venturing into a new market or investing in innovation. Flexibility makes sure that capital would not be conserved after all but would be placed in a strategic location that would generate future value.

Conclusion: The Role of Financial Capital Management Singapore Decisions in Strategy

Financial capital does not just stand alone in the balance sheet but it is also a competitive resource, whereby there is the capability to compete, grow and survive. This has given decision-makers the ability to attain stability and long-term benefits as the organisation has learned to use its main levers, which are its sources of funds, its capital structure, its cost of capital, its allocation sources and risk management.

Whenever a leader manages financial capital in an intelligent manner, the leader does not just manage money but they become value industrialists. They also make sure that the resources are maintained, used strategically and are used to meet long run objectives.

The modern unstable environment, where funding may turn and fall in the relative short term is another area of capital management that is decisive. Companies that master such levers are more resilient and in a better position to leverage opportunities and have sustainable success.