Comprehensive Finance Mastery Program for Risk Reporting in Singapore

Comprehensive Finance Mastery Program for Risk Reporting in Singapore

Understanding Finance Mastery Program Reporting Risk

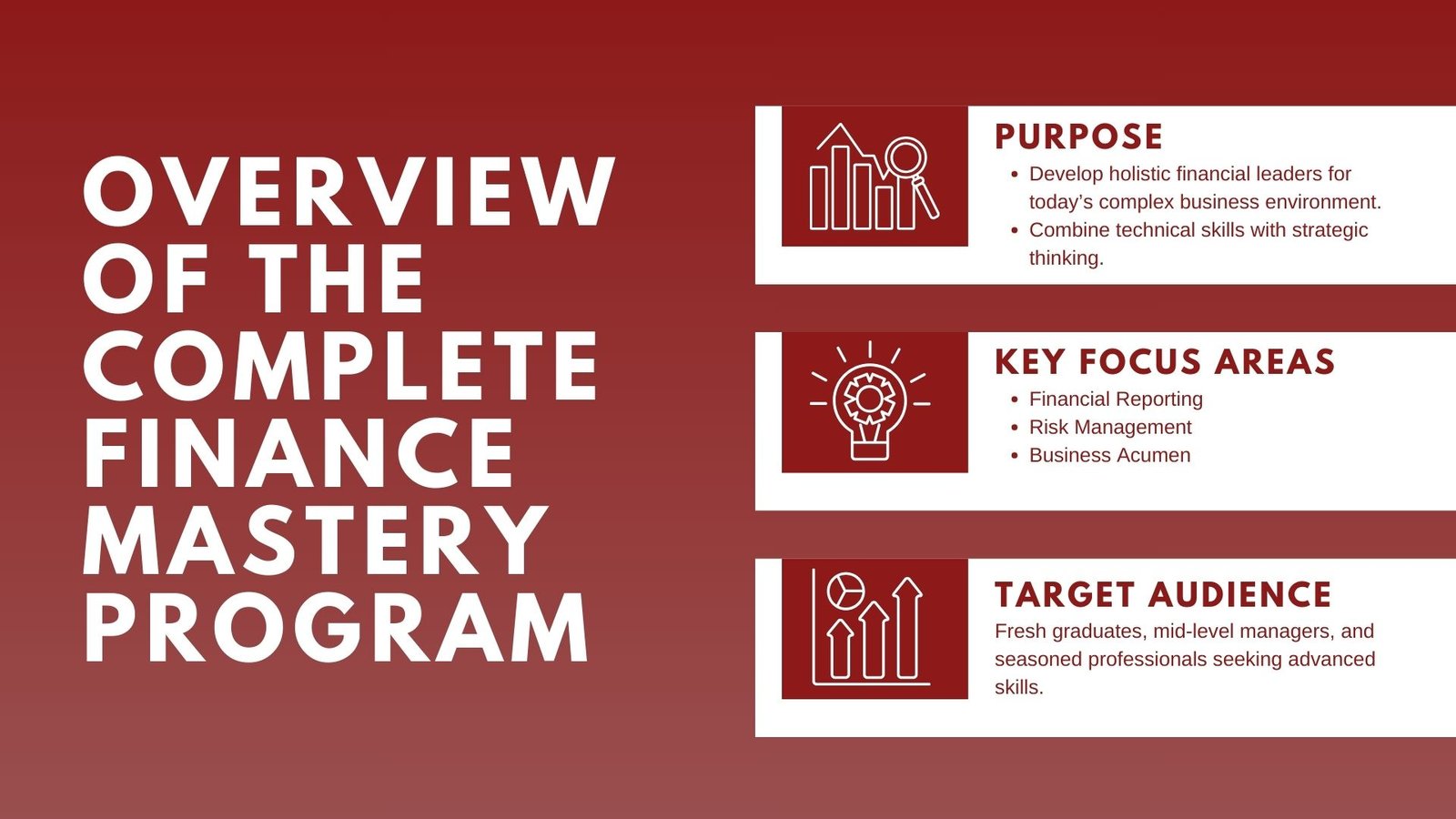

Number crunchers are not the only expectations of the finance professionals in the current competitive business environment. They are managers of risk, business performance storytellers and strategic advisors. Complete Finance Mastery Program is a program that is structured to develop holistic financial leaders that are able to face the intricacy of contemporary corporate finance with a great deal of confidence.

Addressing financial reporting, risk management and business insight, the program offers a comprehensive method to gaining skills that are both technically competent as well as strategic in nature. Irrespective of whether the subject is a fresh graduate, a middle level manager, or a developed professional person aiming to hone a powerful business skill set, the course provides the participant with an arsenal of tools that are not restricted to theoretical knowledge and could be utilized within the business world.

The central philosophy of the program is focused on the combination of three extremely crucial dimensions which are the capacity to create and understand a high quality of financial reporting, the capacity to see and manage risks that could complicate business activities and finally the capacity to use financial information in informing strategic business planning.

The combination of these three competencies guarantees that the graduates of the program are well skilled in finance and are also regarded as contributors to corporate strategic planning, communication with stakeholders, and long-term development. The contemporary financial practitioner will not be able to work in silos anymore, with the reasons being that recognizing the bigger picture in the world of business is needed in order to make a meaningful decision. This aligns closely with the Required financial information for Singapore Professional, ensuring the program remains practical and regionally relevant.

Building a Strong Foundation in Financial Reporting

Financial reporting processing is the core of corporate finance, which is the organized sharing of the financial position of different organizations with their internal and external stakeholders. The first pillar of this program is concerned with empowering the participants to command the rich principles, standards, and best practices of reporting both under the local and international standards including the IFRS and the GAAP. It is vital to become familiar with the peculiarities of these frameworks, particularly, such companies that can operate in several jurisdictions or intend to do the same, in the future.

The training goes into details regarding how to prepare correct financial statements; including Income statement, balance sheet, cash flow statements, notes to the accounts. More to the point, it educates on how to translate these reports into a form of decision-making rather than compliance. As an example, it could provide strategic advantage to businesses when they are able to read the signals of liquidity constraints based on cash flow trends, profitability drivers as expressed through the margin analysis and early warning signals of financial distress as reflected in changes in working capital requirements.

Participants also get to learn the importance of financial reporting on transparency and corporate governance. Improper or inaccurate reports may cause investor confidence and also attract regulatory fines as well as cause the company to collapse. Thus, the program focuses on ethical journalism and meeting the disclosures. Both successful and failing companies are reviewed as though carrying out some case studies to demonstrate that the good reporting ethics has a far-reaching effect on company names and its market value.

Mastering Risk Management as a Strategic Imperative

The business cannot be undertaken without taking risks. Economic fluctuation, market oscillations, operational instability, and regulatory conditions may all be dangers to business performance. Risk management is the second major pillar of the program not as an ex post role, but rather as an ex ante and strategic art. The participants are taught how to recognise, evaluate, and manage financial and business risks, which are implemented in organised systems.

In this part of the program, all the risks that business is exposed to have been discussed, including the credit and market risks, operational, strategic, and reputational risks. The connection of the Enterprise Risk Management (ERM) practices to the day to day decision making is specifically emphasised. This makes the consideration of risk part and parcel of budgeting, forecasting, investment decisions and strategic planning and it is not an afterthought. This is also aligned with the principles of Singapore operational risk management, where risk is embedded into strategic and financial planning.

Practical applications are provided in order to demonstrate that companies that do not foresee and deal with risks may incur harsh effects. To give an example, excess concentration of one source of revenue, or inability to hedge against currency fluctuations, inability to maintain sufficient cybersecurity levels may derail even successful businesses. Organizations that also actively monitor and adjust to risk factors, on the other hand, tend to be stronger in cases of deteriorated economy or industry turnover.

The show likewise examines where risk management and regulatory compliance and corporate governance meet. As an example, how appropriate are the boards in risk strategy, significance of internal audits in ensuring controls, and the requirement of transparent disclosure of risk to investors are scrutinized in detail.

Developing Strong Business Acumen for Strategic Impact

Being a great finance leader does not only require you to be financially qualified. Business acumen is the third and the most crucial pillar of the Complete Finance Mastery Program as the businesses rely on its help to convert the numbers into the business-enhancing ideas. Business acumen would include an awareness of relationships between various functions within a business, the market dynamic effects on strategy and how financial choices impact long-term building of value.

The participants are taught to evaluate investment opportunities not only on financial basis but also on the basis of functionality and within the market. This entails cross knowing the customer behavior, positioning in the market, business considerations in the supply chain and trends in technology that might affect the business model. Mental functioning that extends beyond the ledger means that the finance people can communicate with the executives, department heads and other interest groups and facilitate that the financial strategies that are designed are in-built with the larger business goals.

It also builds communication skills in this part of the program to help the participants organize financial findings in a convincing and coherent way. The optimal financial plans may go wrong when they are not supported or not comprehended by the decision-making parties. The training is thus aimed at teaching to develop interesting stories with financial data to back them up, how to apply data visualization tools, and how to adjust the style of communication to different groups of people, including members of the board of directors and operational personnel.

Integrating Reporting, Risk, and Business Acumen into a Unified Skillset

Although the individual pillars of the program -reporting, risk management and business acumen- are all good on their own, the power of the Complete Finance Mastery Program is in uniting all those competencies into a highly effective unit. The current business world needs professionals in finance who would be able to navigate effortlessly among the micro-level analysis, strategic orientation, and risk-based decisions.

Its program learning involves practical simulations, business learning in the real world, and capstone projects to guide the participants to apply the knowledge learned in the real world. To illustrate, one simulation can ask participants to examine the financial report of an enterprise, point out the dangers of its operations, and design a strategic plan of its development that takes into consideration the opportunities and weaknesses of the company. This integrated course of action is a guaranteed readiness of graduates to accept the real world, where the interplay of the financial information, business strategy, and risk management have become real in the decision-making sphere of a corporation.

Integration of this nature is particularly useful in industries that are changing rather fast. In corporations such as technology, green energy, or businesses conducting international transportation, financial reporting has to be on the same level as the evolving business model, the risk management has to be focused on the emerging threats, and the business intelligence has to adjust to the new market environment. The art of seeing the set challenges as a related segment of one and the same strategic dimension is what makes the best in the line of finance enigmatically admirable.

Why the Complete Finance Mastery Program Matters in Today’s Market

The pace of change in the business world presents a challenge of speed, vision and the ability to engage the best expertise regardless of field of study. Accountants who have developed only technical accounting know-how run the danger of being sidelined as companies need advisors capable of helping them deal with uncertainty and seize emerging chances. It is based on this need that the Complete Finance Mastery Program was created to provide a curriculum that is as technical in its foundation as it is strategic in terms of applying thought and leadership skills to it.

Not only do employers want the finance professional who can bring more than the finance department to the table-people who can be involved in strategy sessions, evaluate the financial feasibility of new initiatives, handle risk exposures, and communicate effectively with everyone (financial and non-financial alike), they are also willing to pay a premium price. Graduates of this program will be in a good position to assume such roles as financial managers, business analysts or business executives such as CFO and also become entrepreneurs.

During job application, professional development usually relies more on the capacity to add greater value than others in the market. Leadership requires strong communication skills and in the context of risk management, achieved through combining financial reporting, risk management and core business skills in the same program, participants not only build their technical competence, but also their ability to become influencers in their organizations. The Complete Finance Mastery Program is thus not just a course per se , it is an investment into a future finance professional that not only thrives to the complexities of the modern business environment but the one that sets the lead under confidence to drive business in a rapidly changing world.